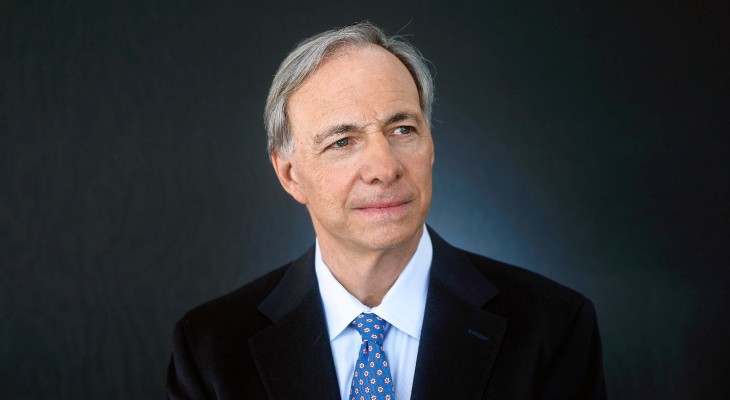

成为巨头中的巨头本身就是一项非常罕见的成就,雷·达利奥(Ray Dalio)就是这样一位被成为神一般的人物。

He is the founder of Bridgewater Associates, the world's largest hedge fund, which he founded in 1957 in his apartment in New York.

Dalio New York Apartments

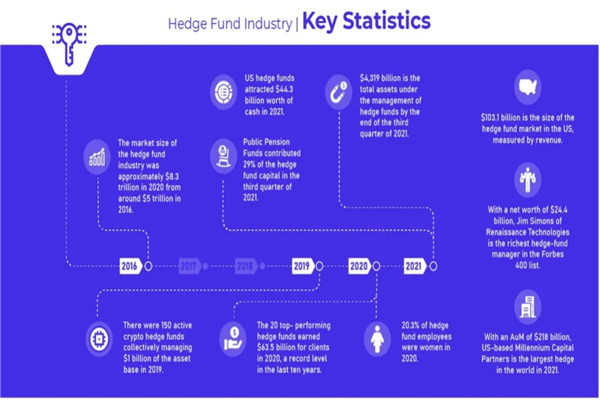

Currently, the company manages over $160 billion in assets and over 1700 employees. Under Dalio's leadership and influence, Bridgewater Fund has maintained exceptional performance, even during some of the worst recessions in financial history.

Dalio is committed to continuous innovation and development, ensuring that Qiaoshui Company always adapts to the constantly changing environment, rather than gradually losing competitiveness like many competitors in decades.

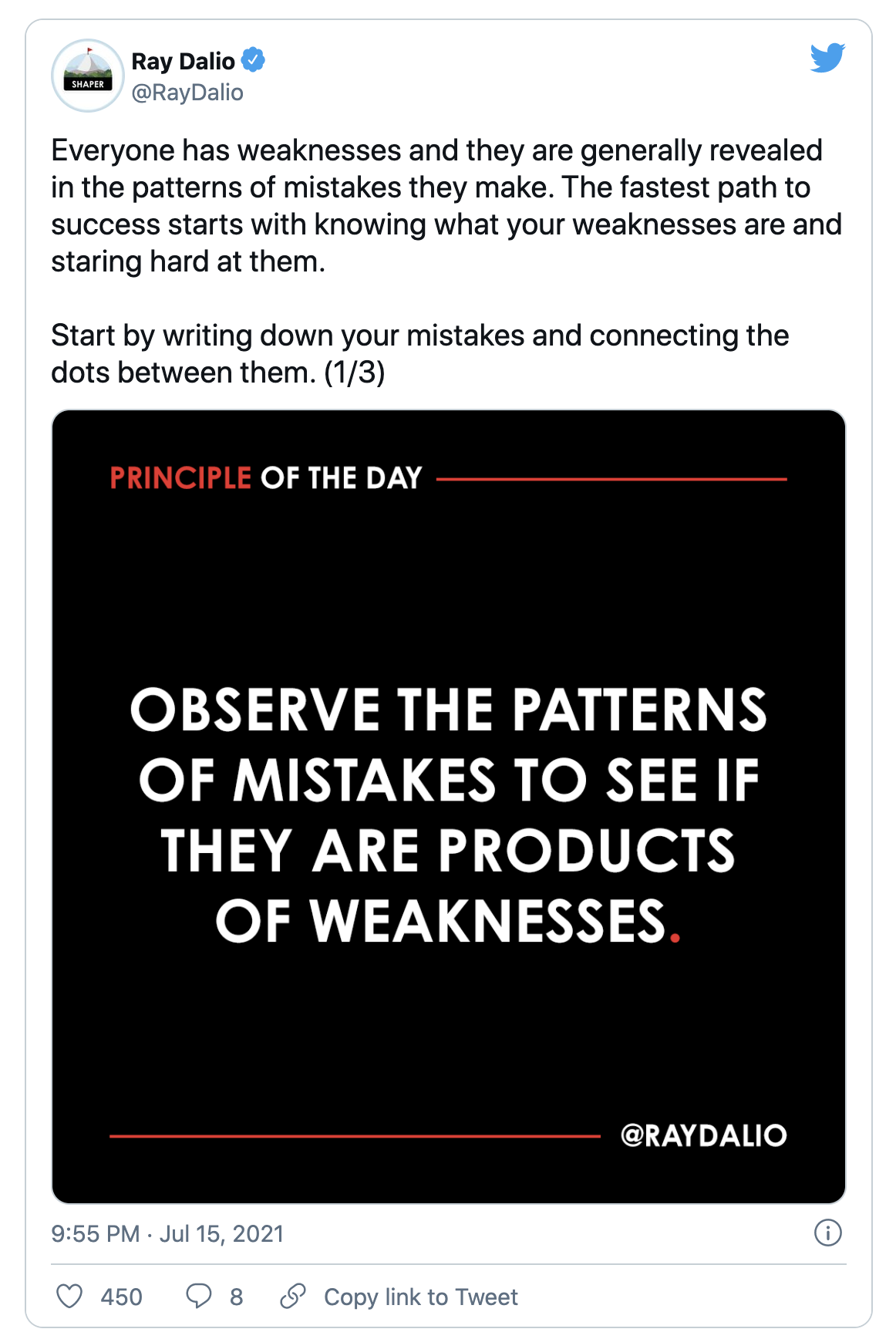

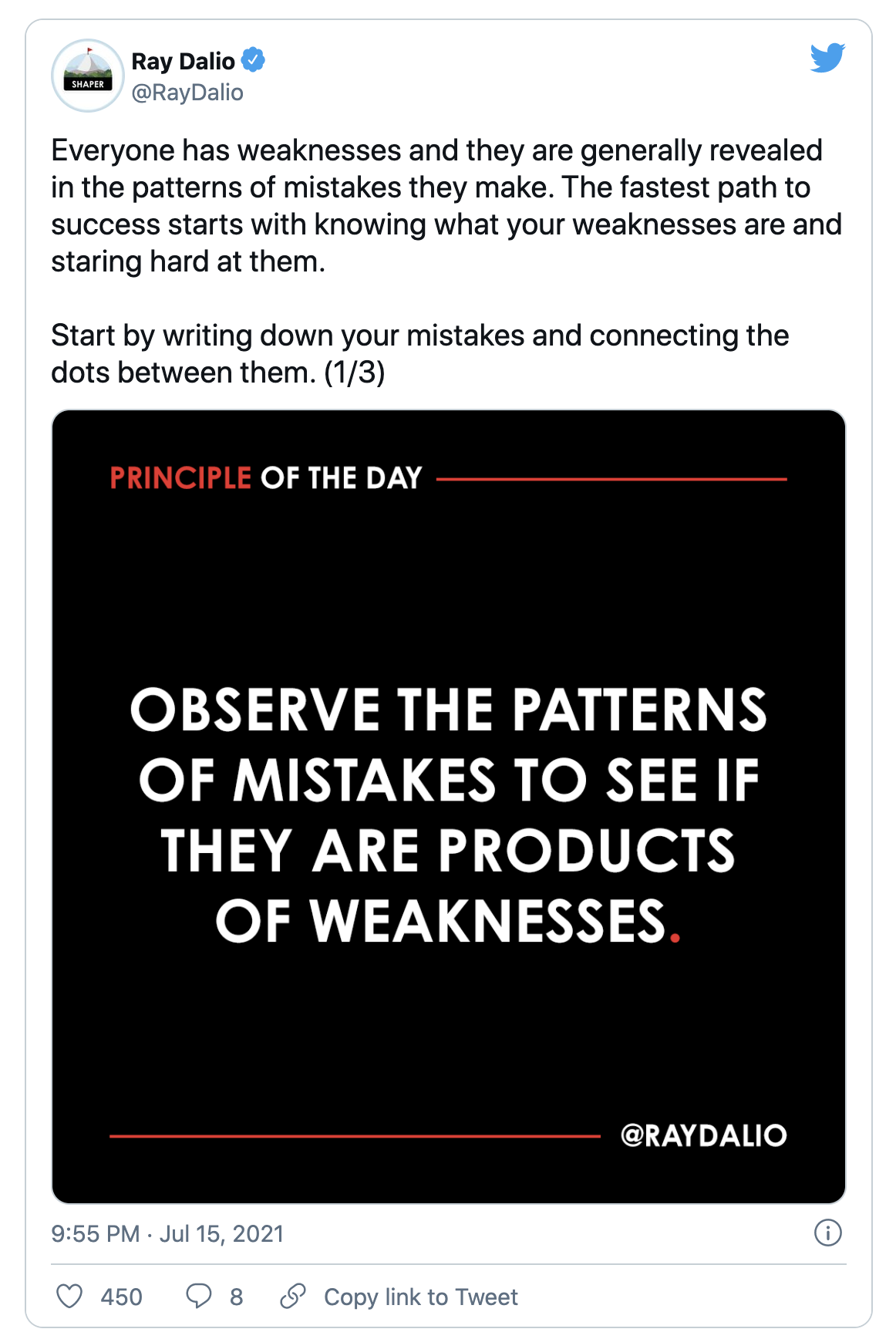

In 2018, he also published a world-renowned book called "PRINCIPLES" in Chinese, which referred to the primary principle of success, including how people learn from their mistakes.

Everyone has weaknesses, and they often reveal themselves through repeated mistakes. Dario recently wrote on twitter: "The fastest path to success begins with understanding your weaknesses and striving to correct them."

Dario has a refreshing view on the role and value of errors, seeing them as a "natural component of the evolutionary process." He emphasizes the importance of recognizing mistakes and learning from them. Dario distinguishes between those who make mistakes, reflect on them, and are willing to learn, and those who cannot accept or learn from their mistakes.

This billionaire is also very candid about some of his past mistakes, including what he referred to as a "major failure" in 1982. Dario said that he had "bet all his money on an unprecedented economic depression," and as a result, he almost lost everything during the bull market in the stock market, which forced him to lay off all his employees at Bridgewater Associates at that time.

"I went bankrupt and had to borrow $4,000 from my father to pay my family bills," Dario wrote in his book.

However, Dario said that failure ultimately became "one of the best things that happened to me" because it forced him to confront some of his weaknesses, leading to significant personal and professional growth.

As we head into the weekend, let's take a moment to reflect on the growth experiences of this global investment giant and consider how we can learn from our own mistakes.

Early Life

Dalio was born in New York City and is the son of a jazz musician and housewife. During his growth, he had little interest in rote memorization at school, but he had tried many jobs, including working as a caddy at a famous golf course.

It was on this golf course that he first tasted the taste of the investment world, listening to the conversation between his investment experts as a caddy. He used the $300 he saved as a caddy to invest in a large airline, which quickly merged, and Dalio received an astonishing 200% return on his first investment.

Growth as an Investor

From that moment on, he became obsessed with the market and began reading all the available information about the business and financial world. Starting from these small moments, he gradually developed his own investment life philosophy and realized that the only way to make money in the market is to always keep himself right when others are wrong.

By developing his investment philosophy and having financial professionals he knows critically evaluate it, he gradually developed his ideas and established an impressive stock portfolio at a very young age.

His academic performance is not ideal, but he continues to focus on his growth as an investor. He began researching the growing field of commodity futures, where extremely low Margin Requirements attracted young investors like him with only a small amount of starting capital.

Find Your Place

Gradually, he was able to combine his passion for investment with his university education, and Dalio began to excel in his studies.

With his excellent academic performance, he was admitted to the prestigious Harvard Business School and found a clerk's job on the New York Stock Exchange.

It was during this period that the financial world of the United States had undergone a major change. Because of the departure from the gold standard system, rapid inflation led to the subsequent prosperity of the stock market. Then, in order to control this inflation, the Federal Reserve began to raise interest rates, causing stocks to plummet and commodities to soar.

This means that Dalio has rare first-hand experience in the largest growth field in the financial industry when entering the professional investment field.

Establishing his Company

Dalio applies these experiences from his early life and college years to create an investment philosophy by continuously predicting the main trends of various assets, namely the "Global MacroThe deep insight of the world has enabled Qiaoshui Company to maintain its leading position and accurately predict the main turning points that will lead to the rise and fall of Securities prices.

This global perspective, coupled with a unique corporate culture and perseverance in developing the latest system investment strategies, has enabled Bridgewater Fund to continuously surpass its competitors year after year and gather the world's wealthiest and most prestigious clients.

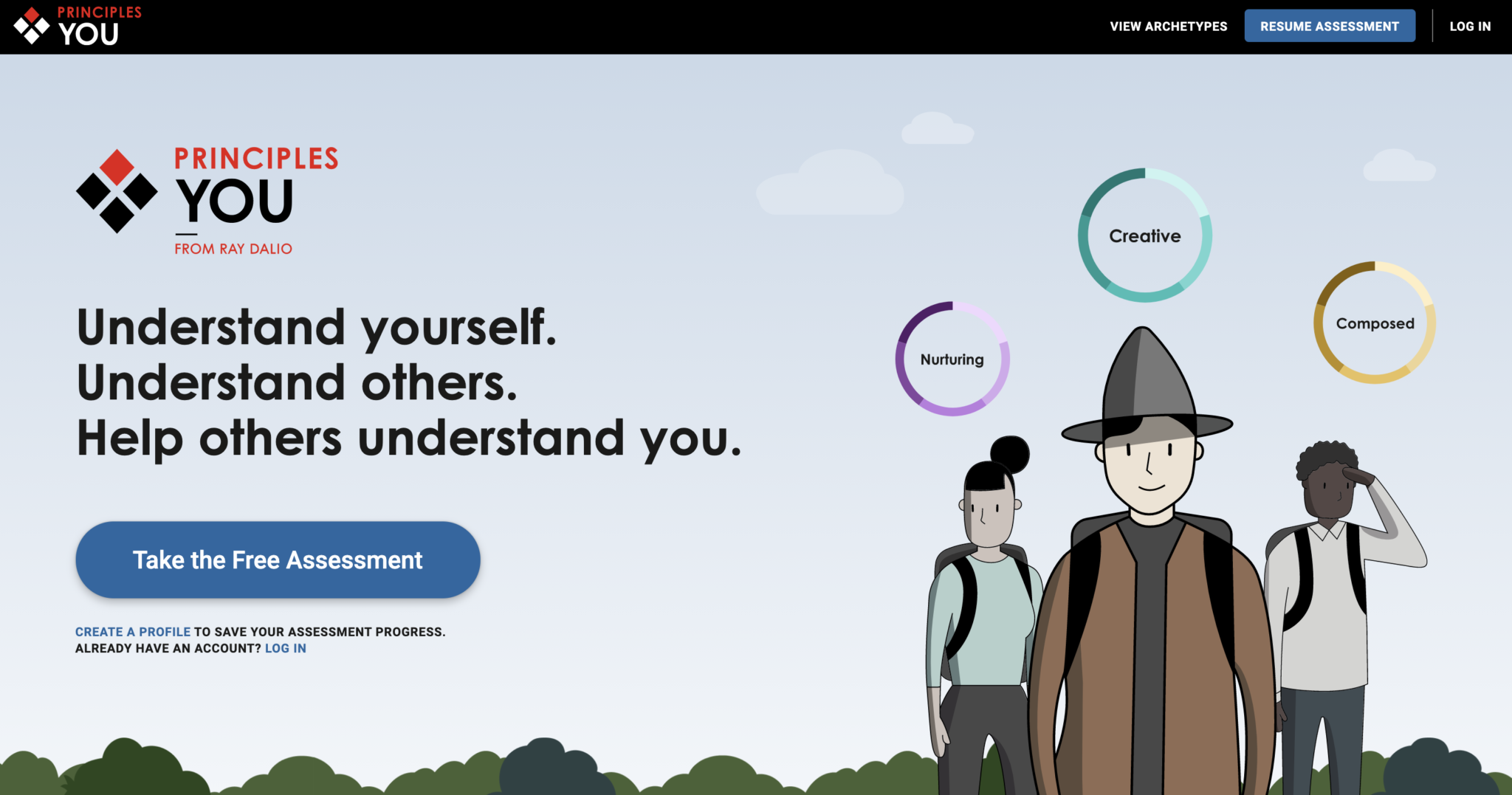

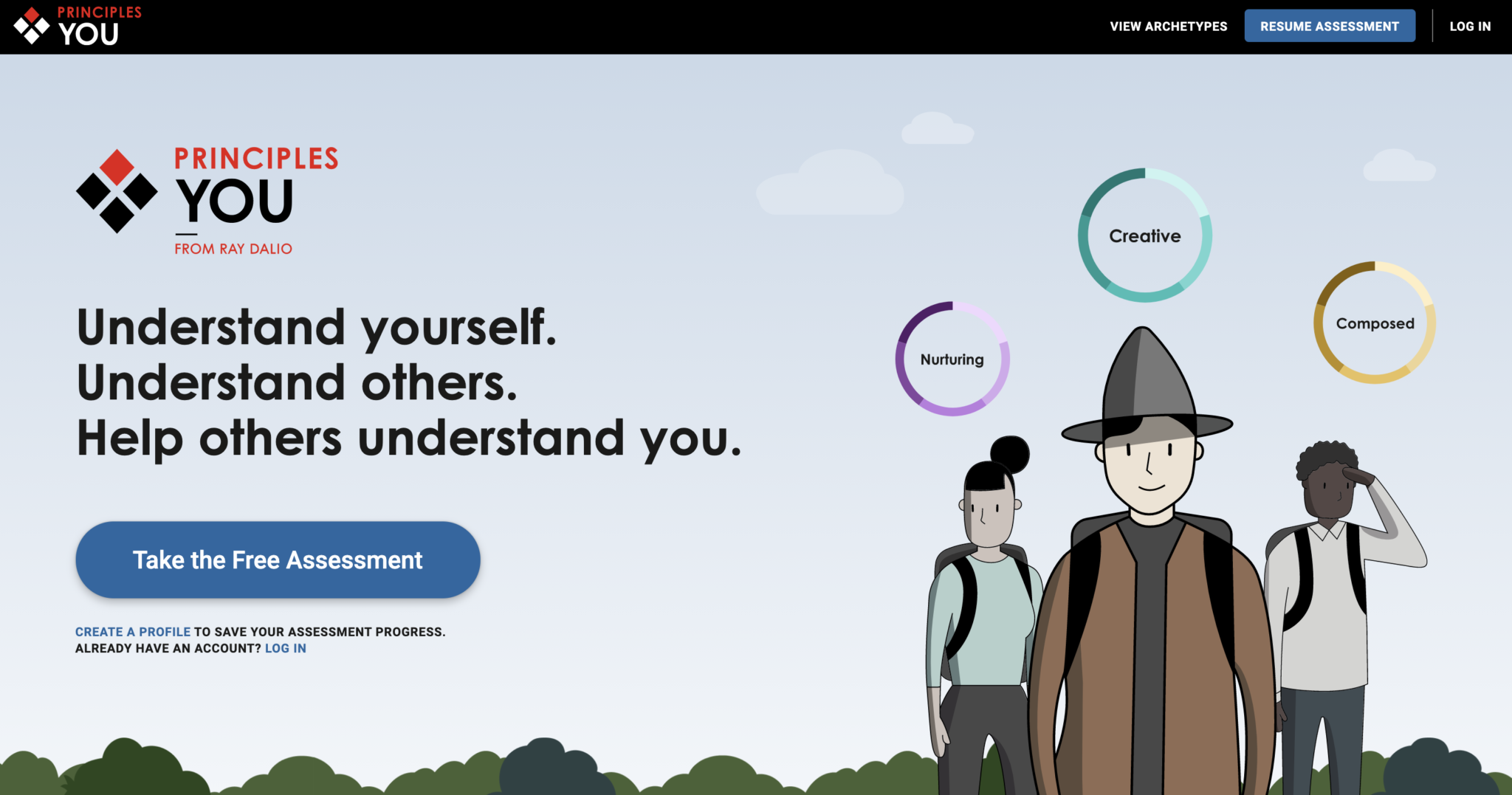

Dalio believes in the usefulness of personality assessment - he uses many different personality test for recruitment and management in his hedge fund company.

Now, with the help of expert psychologists including psychologists and best-selling author Adam Grant, Dario has developed a new online personality assessment that anyone can test for free, https://principlesyou.com/ .

I am doing this to enable people to understand themselves and others," Dario said. The new assessment, called PrinciplesYou, takes approximately 30 to 40 minutes to complete. The results provide a detailed evaluation of an individual's thinking patterns, including tendencies, talents, and growth opportunities. It also offers in-depth insights into core characteristics and their real-life performance.

EBC Financial Group adheres to the principle of "constantly staying with excellent people and aligning with excellent enterprises," striving to achieve industry benchmarks with the world's top thinking and high-level strategies.

Every serious trader deserves to be taken seriously.