Oil price gains 2%, kiwi tumbles

2023-05-25

Summary:

Summary:

World stocks dropped on Wednesday as U.S. debt ceiling talks dragged on without resolution, stoking a general malaise in markets that saw the dollar hold around recent highs, dragging gold lower.

World stocks dropped on Wednesday as U.S. debt ceiling talks dragged on

without resolution, stoking a general malaise in markets that saw the dollar

hold around recent highs, dragging gold lower.

Europe's benchmark STOXX index fell 1.8% to a 1-1/2-month low as luxury

stocks fell 1.7% to a seven-week low as a sell-off in the sector continued.

But Crude Oil prices bucked the downtrend and kept rising, after a warning

from the Saudi energy minister to speculators that raised the prospect of

further OPEC+ output cuts.

Commodities

Oil prices rose 2% after the EIA said U.S. crude inventories posted a massive

surprise weekly drawdown of 12.5 million barrels to 455.2 million barrels, the

EIA said. Analysts had expected an 800,000-barrel rise.

The U.S. Memorial Day holiday on May 29 marks the beginning of the peak

summer travel season and higher fuel demand.

Meanwhile, saudi arabia's energy minister said short-sellers betting oil

prices will fall should "watch out" for pain.

Forex

The dollar hit a fresh two-month high against a basket of peers, bolstered by

recent signs of a resilient U.S. economy and debt ceiling jitters.

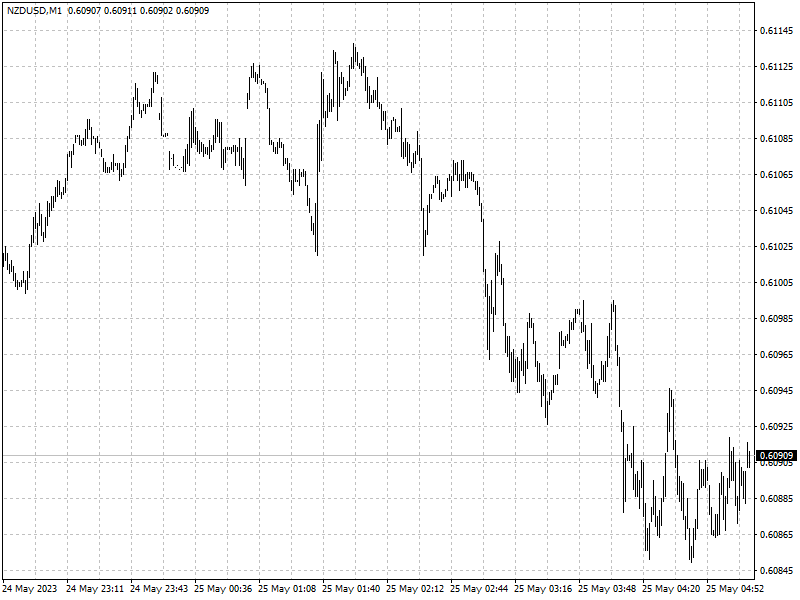

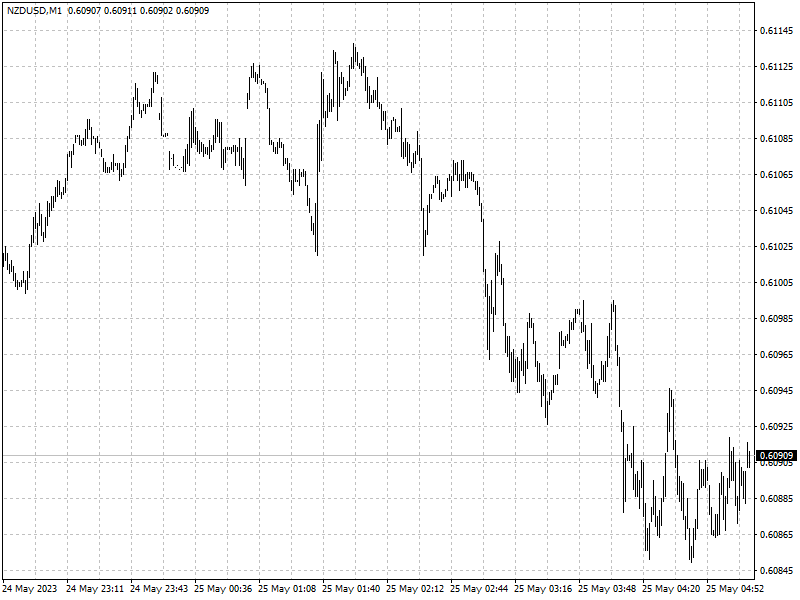

The New Zealand dollar dropped 2.3% after the Reserve Bank wrong-footed

markets by keeping its forecast for the terminal rate at 5.5%, having hiked by a

quarter point to that level.

The pound dropped to a five-week low against the dollar of $1.2358, after

data showed British inflation slowed by much less than markets had been

expecting.

Higher inflation, leading to higher-for-longer Bank of England rates, had

supported the pound in recent months but that relationship is now starting to

reverse.