In technical analysis, chart patterns are essential tools used by traders to predict market behaviour. One of the more unusual and less frequently discussed patterns is the megaphone pattern, also known as a broadening formation or expanding triangle.

Characterised by increasingly volatile price swings and a widening range, the megaphone pattern can signal significant uncertainty in the market. Despite its intimidating shape, understanding how to identify and trade this pattern can offer high-reward opportunities.

This guide will explain all you need to understand about the megaphone pattern, including its definition, composition, psychological aspects, and trading strategies.

What Is Megaphone Pattern?

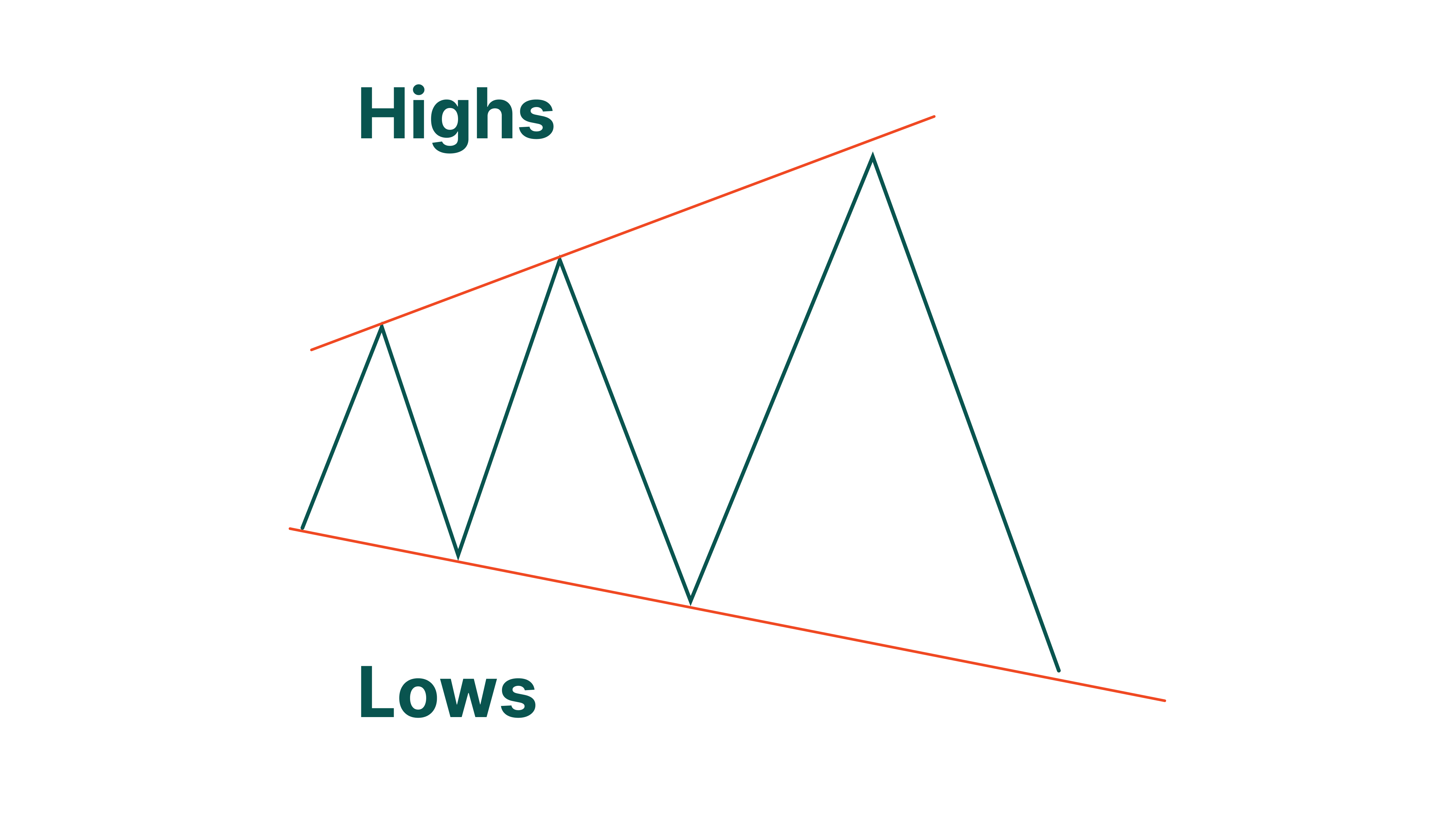

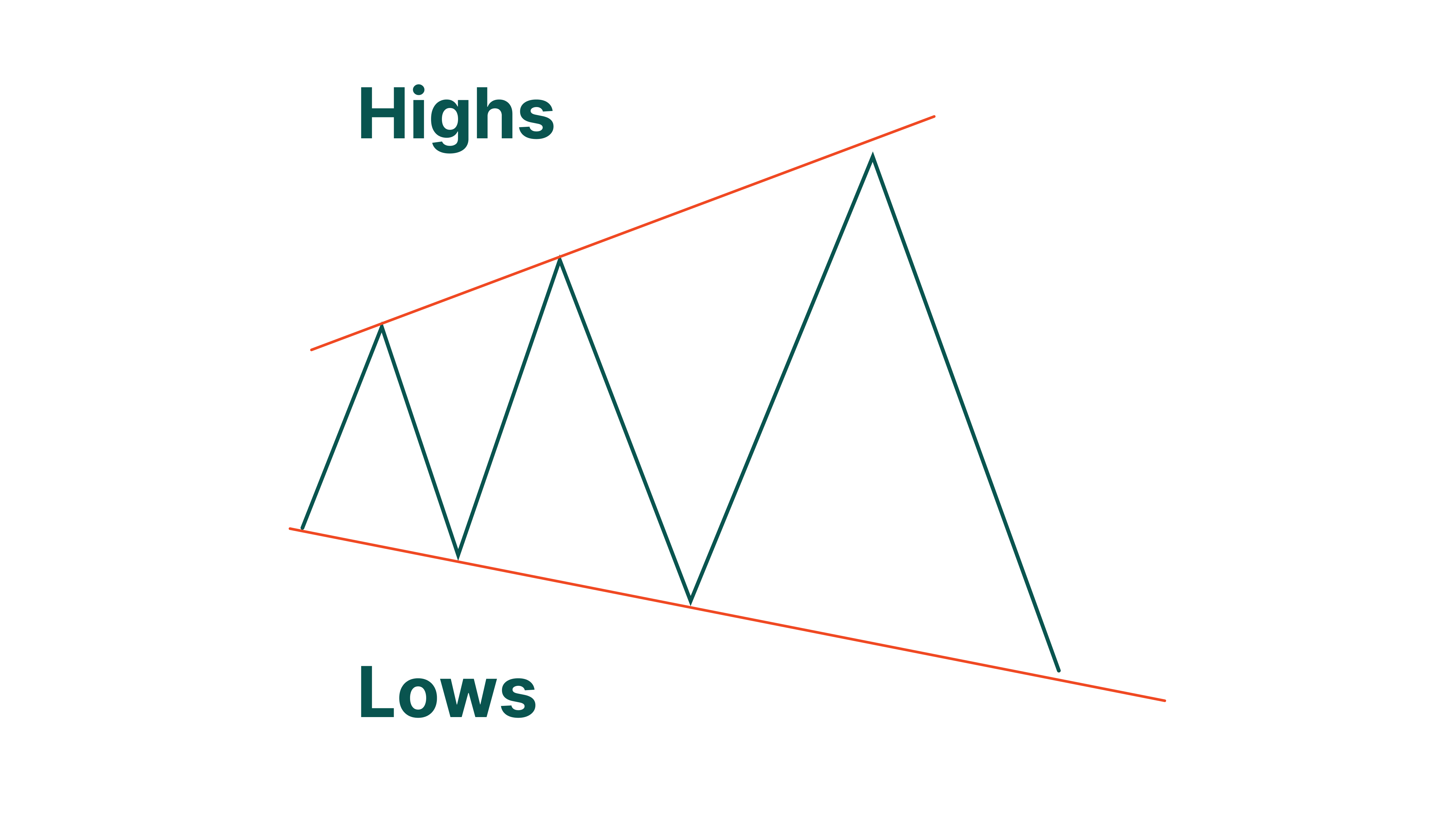

A megaphone pattern is a broadening chart pattern where the price action forms higher highs and lower lows, creating a shape that resembles a loudspeaker or megaphone. This pattern typically appears during periods of high market volatility and investor indecision.

Key Characteristics:

Formed by two diverging trendlines.

Price swings become progressively wider.

Indicates uncertainty, high volatility, and lack of consensus.

Can precede major breakouts or breakdowns.

This pattern appears on various timeframes, ranging from 15-minute charts to weekly ones, and forex, stocks, commodities, and indices markets.

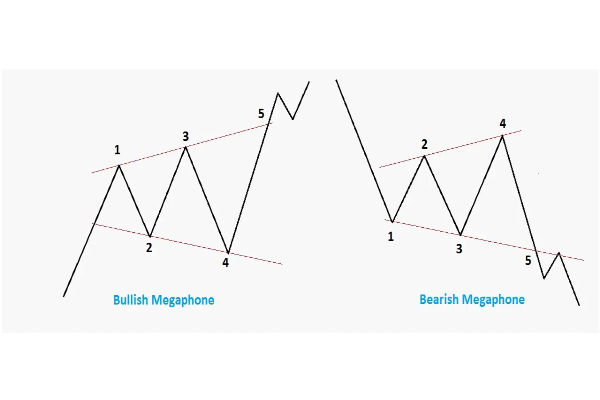

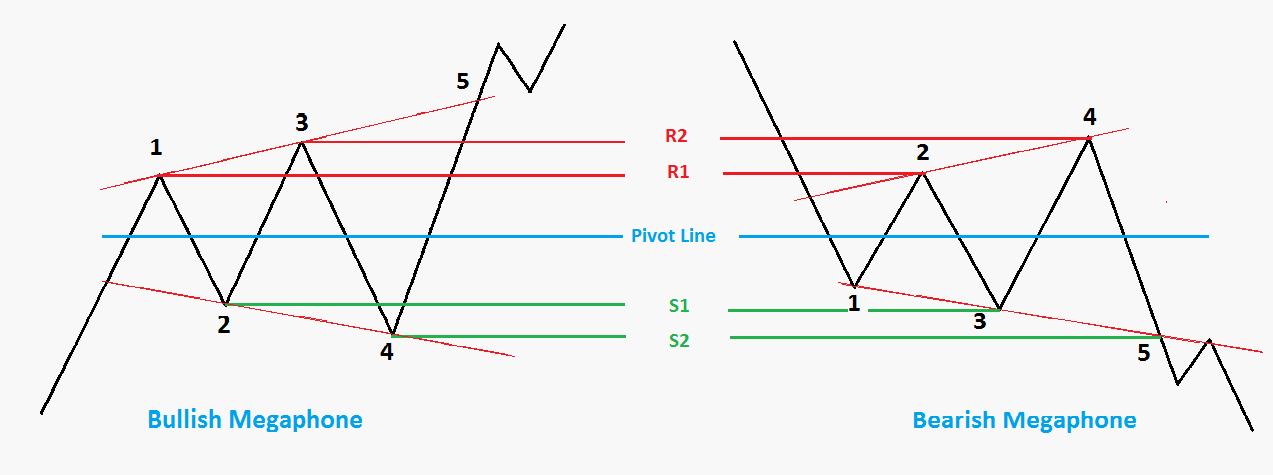

Types of Megaphone Patterns

The megaphone formation can appear in two primary variations:

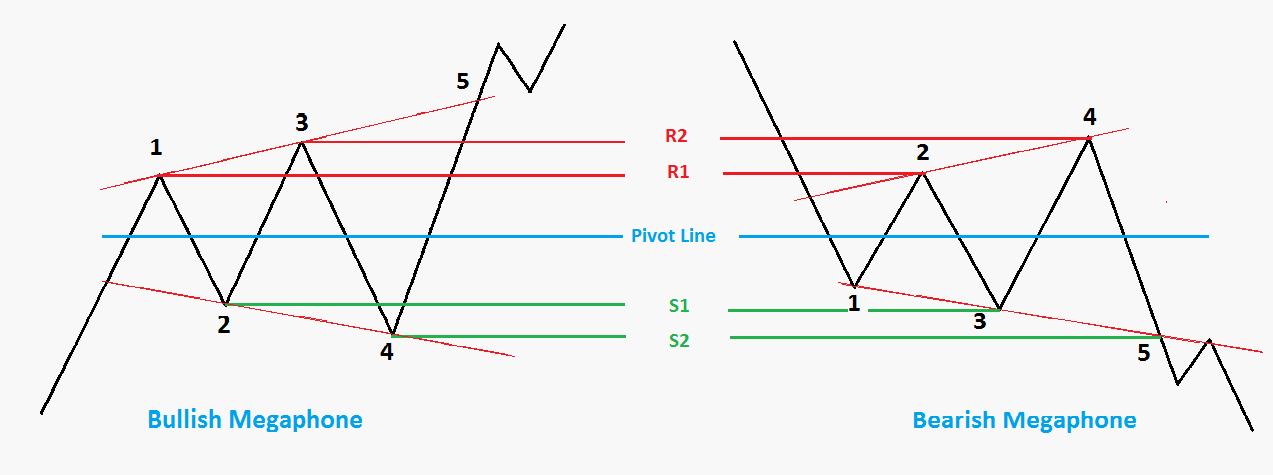

1. Megaphone Top (Bearish)

Appears at the end of an uptrend and signals a possible reversal. The market experiences extreme bullish momentum followed by volatility, suggesting the trend may be running out of steam.

2. Megaphone Bottom (Bullish)

Forms at the end of a downtrend, indicating buyer interest is returning, but still under heavy resistance. Increasing lows are signs that the market may be preparing for a reversal upward.

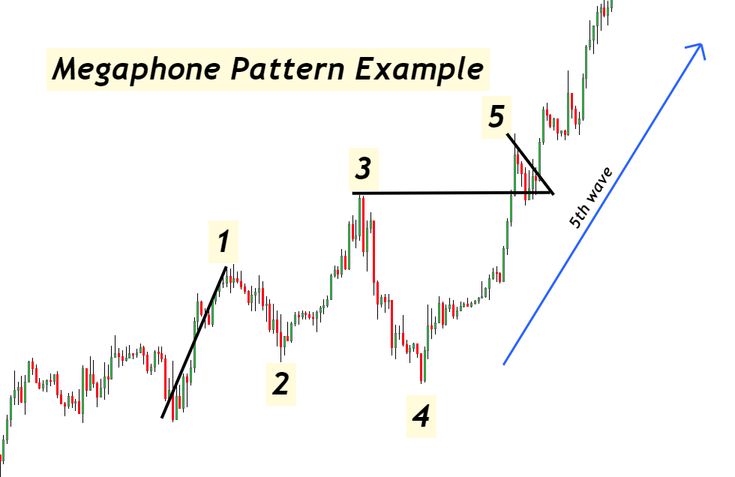

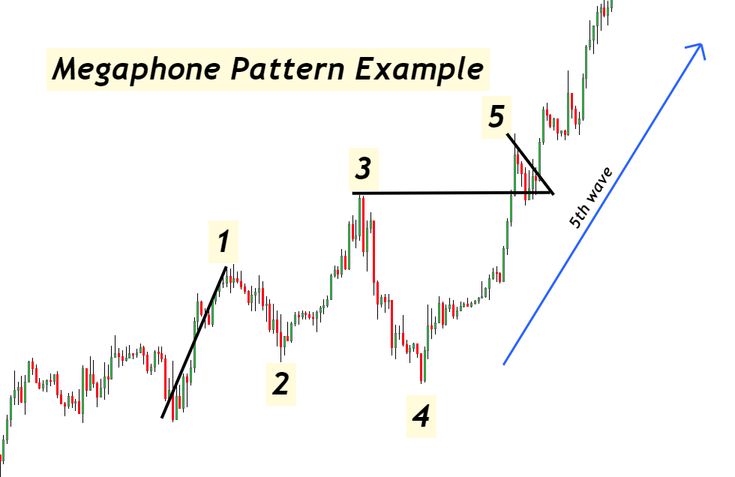

Megaphone Pattern Formation

The formation process of the megaphone pattern typically consists of five points or more that connect the pattern's expanding support and resistance lines.

The sequence looks like this:

Initial High – First peak marks resistance.

First Low – Establishes initial support.

Second High – Higher than the previous, extending the resistance line.

Second Low – Lower than the first low, extending the support line.

Additional Swings – More exaggerated highs and lows within the broadening channel.

Over time, the form morphs into the shape of a megaphone.

How to Identify a Megaphone Pattern on the Chart

Identifying the megaphone pattern early offers traders a chance to prepare for high-volatility setups. Here's what to look for:

Diverging trendlines: Draw a line across higher highs and another across lower lows.

Price structure: At least 3–5 swing highs and lows forming a broadening range.

Volume: Typically increases as the pattern progresses, especially near breakout points.

Lack of consolidation: Unlike other patterns, megaphone formations don't tighten; they expand.

Tools like trendline drawing, volume indicators, and volatility measures (like ATR) can aid in spotting and confirming the pattern.

Megaphone Pattern Trading Strategies

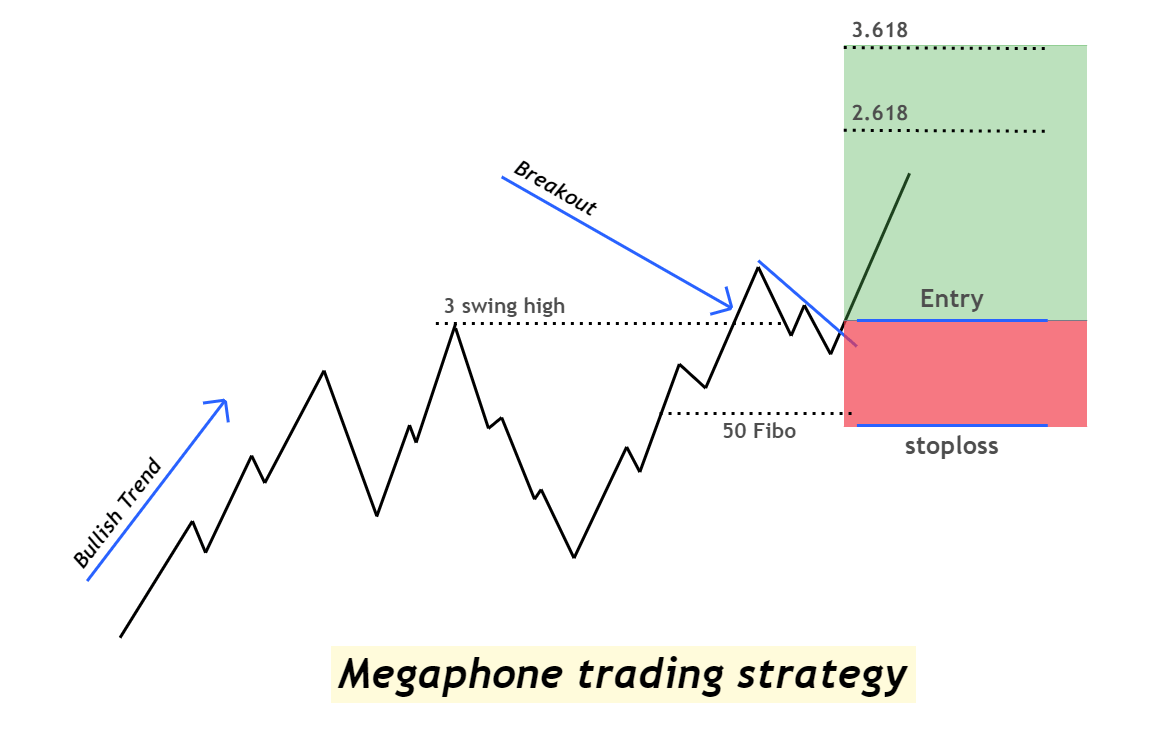

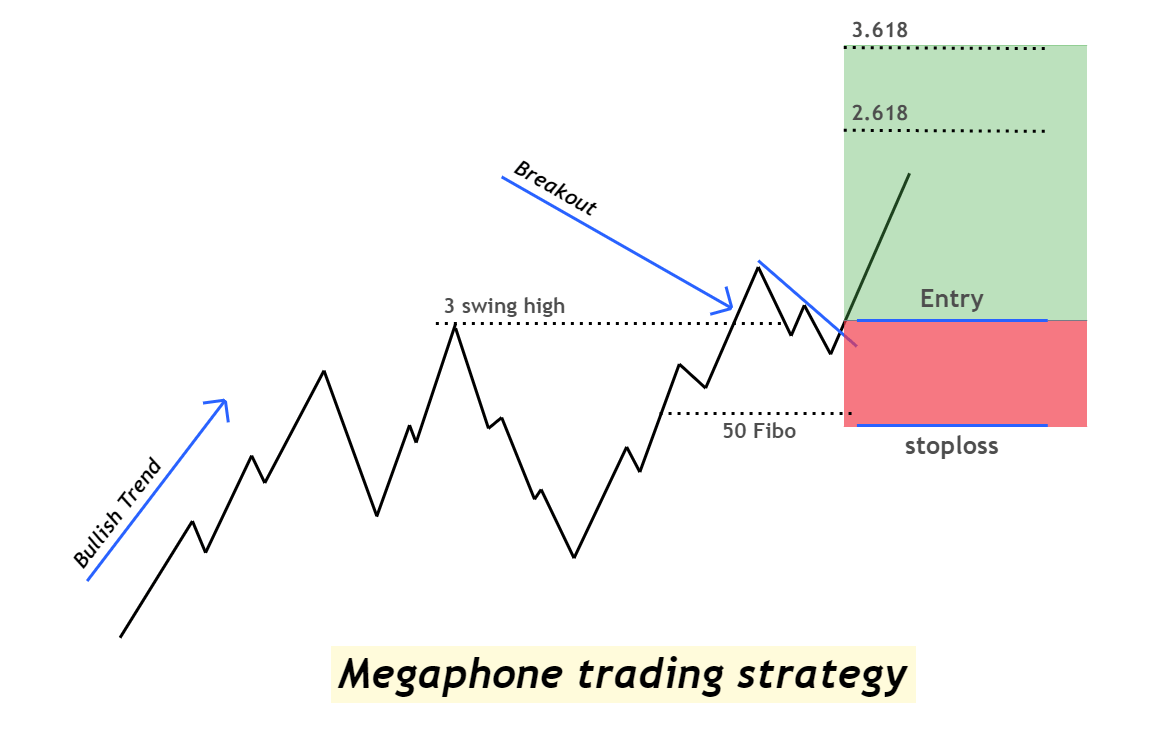

1. Breakout Strategy

Await a verified breakout from one of the trendlines with significant volume.

Enter a long or short trade depending on the breakout direction.

Use a stop-loss just inside the pattern boundary to manage risk.

Profit targets can be set using Fibonacci extensions or previous swing levels.

2. Mean Reversion Within the Pattern

During the pattern's development, consider trading the swings between support and resistance.

Buy at the lower boundary; sell at the upper boundary.

Works best in range-bound conditions or low-news environments.

Use short-term oscillators such as the RSI or Stochastic for entry timing.

3. Trend Continuation Strategy

If the megaphone appears mid-trend, it may act as a continuation pattern rather than a reversal.

Confirm continuation with breakout direction.

Use trend-following indicators such as moving averages for additional validation.

Ideal for swing traders and position traders riding larger trends.

Best Markets and Timeframes to Use

As mentioned above, the pattern isn't limited to one asset or trading style. However, it performs better under certain conditions:

Markets:

Forex pairs like EUR/USD and GBP/JPY

Major stock indices such as the S&P 500, NASDAQ, and DAX

High-volatility equities during earnings season

Cryptocurrencies (BTC, ETH) during hype or correction phases

Timeframes:

4H and Daily charts for swing and position trades

15M to 1H for intraday scalping with caution

Avoid using the pattern on low-volume assets or micro timeframes where noise outweighs clarity.

Risk Management and Common Mistakes to Know

Given its volatile nature, the megaphone pattern comes with significant risk. Here's how to manage it effectively:

Use wide but logical stop-losses to accommodate volatility.

Scale into positions rather than committing all at once.

Avoid overleveraging, especially in forex or futures markets.

Stay informed on news catalysts that may amplify swings (e.g., earnings, CPI data, central bank decisions).

Limit your position size until the breakout is confirmed and stable.

Lastly, even experienced traders sometimes misread or misuse the pattern. Here's what to avoid:

Jumping in too early: Wait for confirmation before acting on a breakout.

Ignoring false breakouts: Use volume and price action for validation.

Confusing it with triangles: A megaphone expands; triangles typically contract.

Poor risk-to-reward setups: Wide ranges don't mean unlimited profits. Plan carefully.

Conclusion

In conclusion, the megaphone pattern, while less common than flags or triangles, is a powerful tool for traders who know how to interpret it. Its unique shape reflects market instability, and within that chaos lies opportunity.

By learning how to identify it, interpret price swings, and wait for breakout confirmation, traders can harness this pattern to capture explosive moves.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.