Copy trading has become an increasingly popular strategy for both new and experienced traders. By allowing investors to automatically replicate the trades of more seasoned market participants, copy trading offers a shortcut to market exposure and the chance to profit from others' expertise.

But is copy trading truly profitable-and what are the main advantages and drawbacks to consider? Here, we break down the top pros and cons to help you decide if copy trading is right for you.

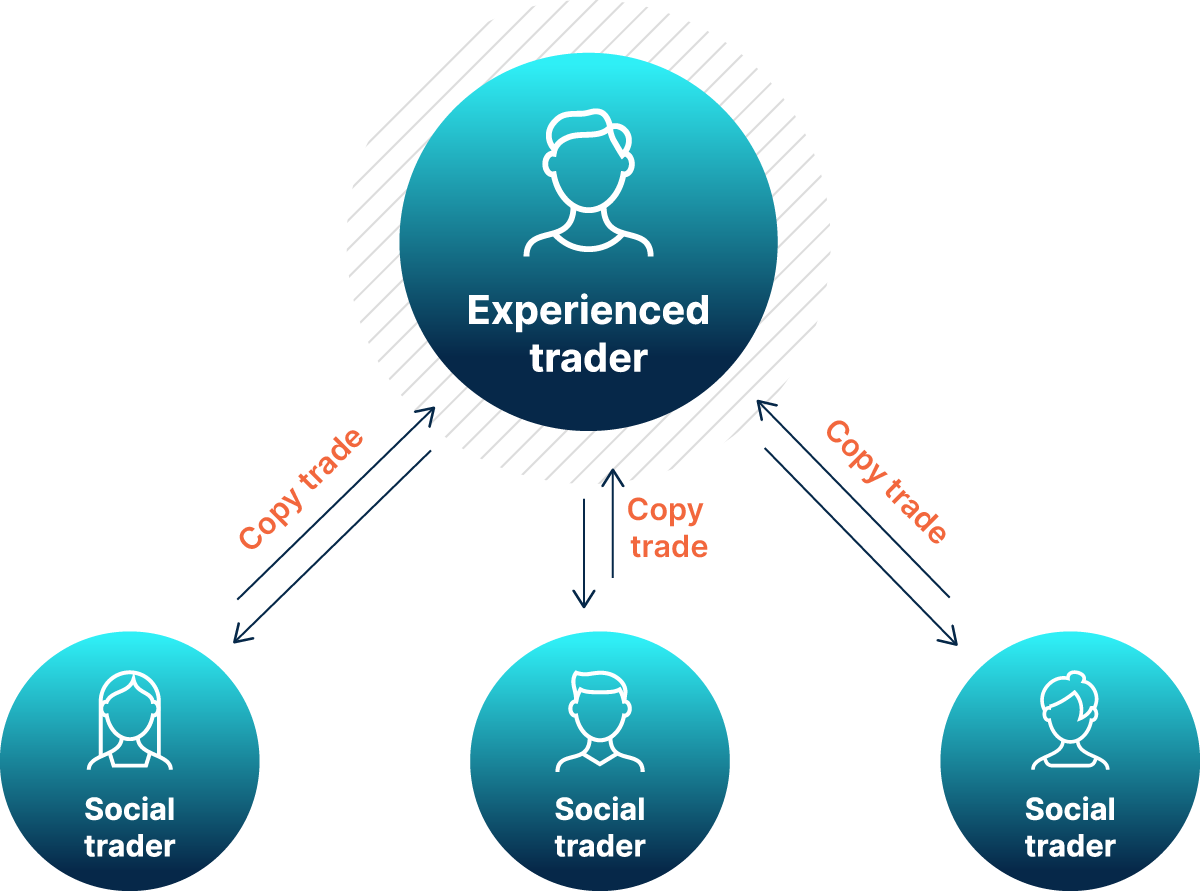

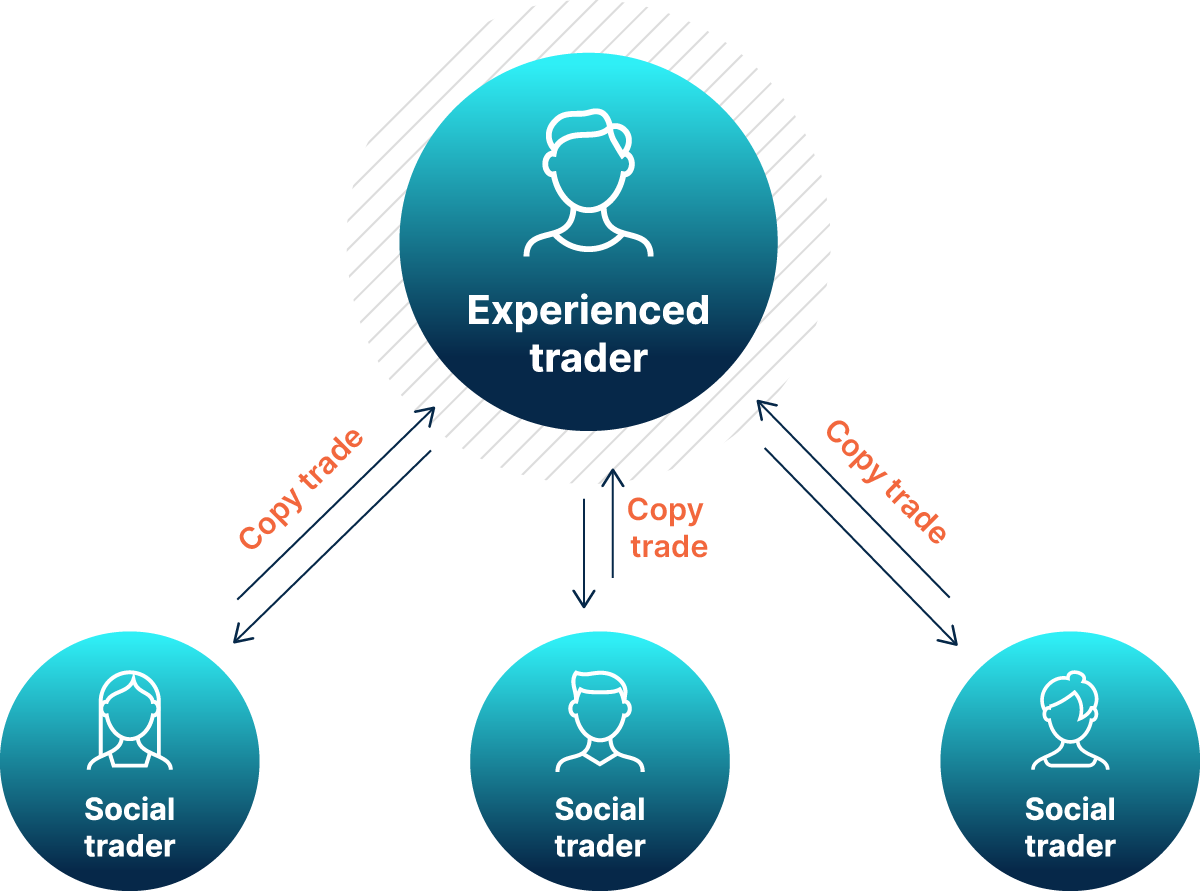

Copy trading is a form of online trading where you select experienced traders (often called "leaders" or "signal providers") and automatically mirror their trading activity in your own account.

When the trader you follow opens, modifies, or closes a position, the same action is executed for you, usually in proportion to your investment. This hands-off approach is designed to make trading accessible, even for those with limited experience or time.

Top Pros of Copy Trading

1. Accessibility for Beginners

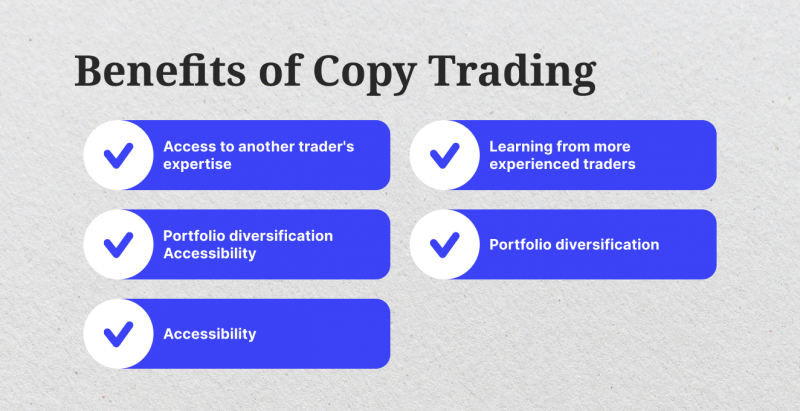

Copy trading opens the door for those new to the markets. You don't need years of experience or in-depth analysis skills-just the ability to choose a trader to follow. This makes it an attractive entry point for aspiring investors.

2. Time-Saving and Convenience

Because trades are executed automatically, copy trading can save hours of research and monitoring. It's ideal for those who want to participate in the markets but have other commitments.

3. Diversification Opportunities

By copying multiple traders with different styles and strategies, you can diversify your portfolio across various assets and markets. This can help spread risk and reduce the impact of a single trader's poor performance.

4. Learning Potential

Watching how experienced traders operate can provide valuable insights into market strategies, risk management, and trade execution. For some, copy trading is a stepping stone to building their own trading skills.

5. Potential for Profit

If you select consistently successful traders to follow, copy trading can be profitable. Some platforms even offer performance incentives and bonuses for profitable trading, further enhancing your returns.

Top Cons of Copy Trading

1. Market and Trader Risk

Copy trading is not risk-free. Even the best traders can have losing streaks, and past performance never guarantees future results. If the trader you copy makes poor decisions, your account will suffer the same losses.

2. Limited Control

When you copy another trader, you give up control over individual trade decisions. While some platforms let you adjust risk settings or stop copying at any time, you're still largely dependent on someone else's strategy.

3. Costs and Fees

Many copy trading platforms charge fees or commissions, which can eat into your profits. These may include performance fees, management fees, or spreads-and you'll owe some fees even if your copied trades lose money.

4. Overreliance on Others

Relying solely on other traders' expertise can limit your own learning and growth. If you don't understand the strategies being used, you may struggle to assess risk or make informed decisions if something goes wrong.

5. Platform and Trader Selection Risks

The success of copy trading depends heavily on the traders you choose and the transparency of the platform. Not all “top” traders have sustainable strategies, and some may take excessive risks to boost short-term results. Always review performance history and risk metrics before copying.

Is Copy Trading Profitable?

Copy trading can be profitable, especially if you carefully select skilled traders and manage your risk. However, it is not a guarantee of returns, and losses are always possible. The most successful copy traders are those who stay engaged, diversify across several leaders, and regularly review their performance and risk exposure.

Key Tips Before You Start

Research thoroughly: Don't just follow the most popular or highest-return trader. Look for consistent performance, transparent strategies, and responsible risk management.

Diversify: Spread your investment across multiple traders and asset classes to reduce the risk of heavy losses.

Understand the fees: Know how much you'll pay in commissions or performance fees and how these impact your potential returns.

Stay engaged: Monitor your account, review performance, and be ready to adjust your strategy if needed.

Conclusion

Copy trading offers an accessible, time-saving way to participate in financial markets and potentially profit from others' experience. However, it comes with real risks, costs, and the need for careful trader selection.

By weighing the top pros and cons, you can decide if copy trading fits your goals and risk tolerance in 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.