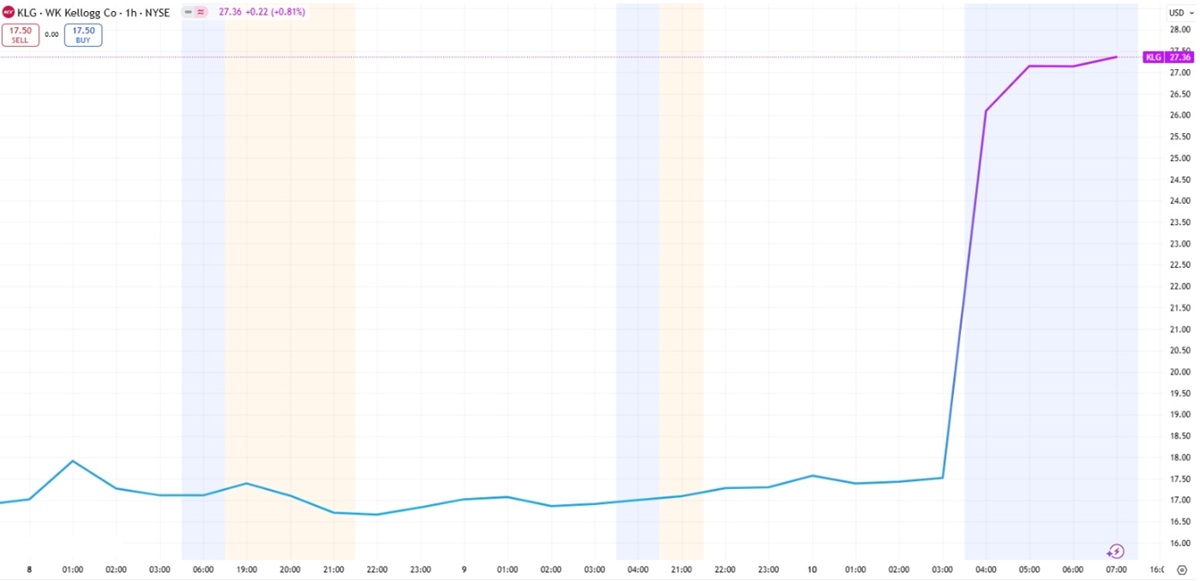

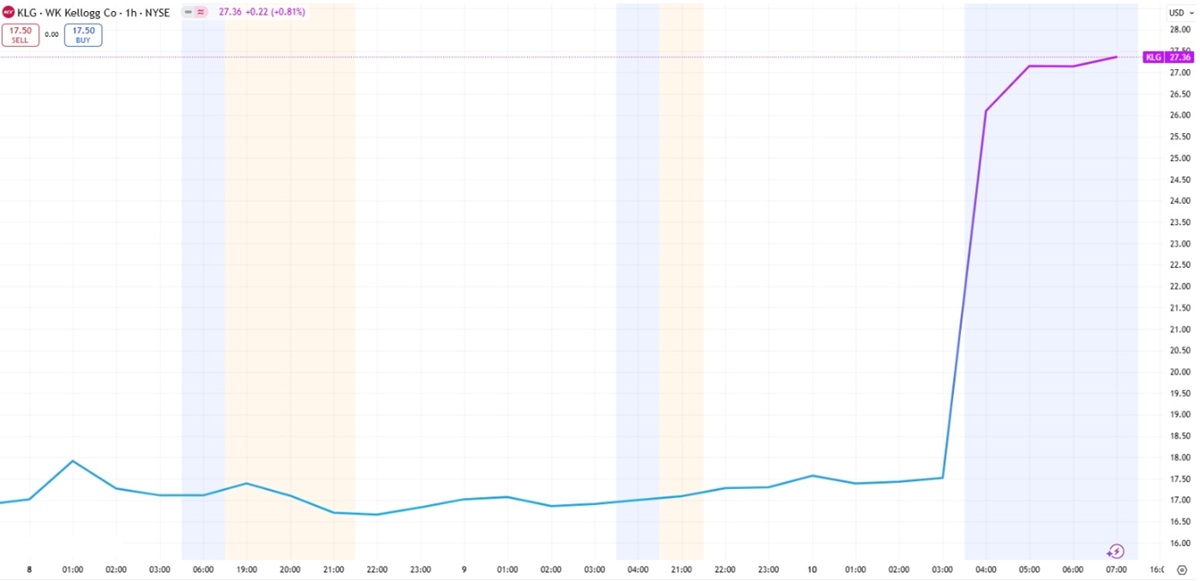

The WK Kellogg stock price surged by over 60% in after-hours trading on 9 July, following reports that Italian confectionery giant Ferrero is nearing a deal to acquire the U.S. cereal maker for approximately $3 billion. According to The Wall Street Journal, the acquisition could be announced within days and would value WK Kellogg at roughly twice its current market capitalisation of $1.5 billion.

This dramatic spike in the WK Kellogg stock price has drawn intense interest from traders and analysts alike, highlighting a significant moment in the packaged food sector. The deal, if confirmed, marks a major move by Ferrero as it continues its expansion into the American breakfast market.

A Legacy Brand in Financial Trouble

WK Kellogg is one of two companies created when the original Kellogg Company split in 2023. While Kellannova took over the snacking business, WK Kellogg retained the breakfast cereal portfolio—including classic brands like Frosted Flakes and Froot Loops.

WK Kellogg is one of two companies created when the original Kellogg Company split in 2023. While Kellannova took over the snacking business, WK Kellogg retained the breakfast cereal portfolio—including classic brands like Frosted Flakes and Froot Loops.

However, the post-split performance has been rocky. The company has struggled with soft demand and shifting consumer preferences, especially amid growing health consciousness and reduced interest in sugary cereals. In the first quarter of 2024. WK Kellogg reported an 8.6% decline in sales and lowered its full-year sales forecast to a drop of 2–3%, from the previous –1% guidance.

Adding to the pressure is the company's significant debt load, with over $500 million in liabilities—a burden that has weighed heavily on investor confidence and likely contributed to the brand's depressed valuation.

Ferrero's U.S. Ambitions

Ferrero, the maker of Nutella, Ferrero Rocher, and Kinder, has steadily built a formidable presence in the United States. Over the past few years, it has acquired Nestlé's U.S. confectionery division, ice cream company Wells Enterprises, and several other brands in a bid to diversify its product portfolio.

Ferrero, the maker of Nutella, Ferrero Rocher, and Kinder, has steadily built a formidable presence in the United States. Over the past few years, it has acquired Nestlé's U.S. confectionery division, ice cream company Wells Enterprises, and several other brands in a bid to diversify its product portfolio.

The acquisition of WK Kellogg would represent Ferrero's boldest move yet into the breakfast segment. With more than 30 brands sold across 170 countries and a 9% year-on-year revenue increase in its most recent fiscal year, Ferrero is well-positioned to absorb and revitalise legacy brands that have struggled under new market dynamics.

Analysts believe the move is not just a rescue deal for WK Kellogg, but a calculated step by Ferrero to secure further U.S. shelf space and deepen its market penetration beyond confectionery.

Market Reaction and Trader Takeaways

The surge in the WK Kellogg stock price reflects strong market optimism about the deal—and the possibility of more consolidation within the food and beverage sector. The reaction also mirrors the broader M&A activity in the space, notably Mars Inc.'s $30 billion acquisition of Kellannova earlier this year.

For traders, the key takeaway is that underperforming legacy food brands with strong distribution channels and consumer recognition remain prime acquisition targets, especially in a market that is increasingly dominated by health-focused innovation and scale-driven strategies.

If the Ferrero-WK Kellogg deal finalises at the expected price, WK Kellogg shares could see limited further upside, but short-term volatility and speculative flows are likely to continue as the market digests the news and prices in potential next moves.

Conclusion

The sharp jump in the WK Kellogg stock price signals more than just investor enthusiasm—it reflects Ferrero's expanding influence and a shifting landscape in consumer food products. As traditional cereal brands face mounting pressure, strategic takeovers like this show that legacy names may still hold long-term value in the right hands.

For market participants, WK Kellogg's sudden revival offers a reminder: in sectors ripe for consolidation, price action can change quickly—and dramatically—on the back of well-timed M&A news.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

WK Kellogg is one of two companies created when the original Kellogg Company split in 2023. While Kellannova took over the snacking business, WK Kellogg retained the breakfast cereal portfolio—including classic brands like Frosted Flakes and Froot Loops.

WK Kellogg is one of two companies created when the original Kellogg Company split in 2023. While Kellannova took over the snacking business, WK Kellogg retained the breakfast cereal portfolio—including classic brands like Frosted Flakes and Froot Loops. Ferrero, the maker of Nutella, Ferrero Rocher, and Kinder, has steadily built a formidable presence in the United States. Over the past few years, it has acquired Nestlé's U.S. confectionery division, ice cream company Wells Enterprises, and several other brands in a bid to diversify its product portfolio.

Ferrero, the maker of Nutella, Ferrero Rocher, and Kinder, has steadily built a formidable presence in the United States. Over the past few years, it has acquired Nestlé's U.S. confectionery division, ice cream company Wells Enterprises, and several other brands in a bid to diversify its product portfolio.