With the establishment of the State Financial Supervisory Authority and the further deepening of the financial market, more and more people will join the forex market.

Although there are already a group of quite mature forex traders in China, the impact of the new trading model is also evident to some investors who have not been exposed to forex, such as leveraged trading, margin trading, t+0 trading, 24-hour trading, and two-way trading.

So, if the domestic forex market is opened up, what should we pay attention to?

Firstly, the Timing of The Trade

For domestic investors, the stock market only trades for 4 hours a day.

Even if there is a night market for domestic futures investment, the trading time per day is less than 10 hours, and the trading time for different trading varieties is also different. For example, the night market for gold and silver lasts until 2:30 am, but the trading of natural rubber, rebar, and other products only lasts until 23:00.

And forex trading is 24 hours, and one account can trade global varieties, with trading opportunities every moment. If you are unsure of the market situation, be sure to clear your position and leave, or at least take measures to stop profits and losses.

The Second Point is that the Target of Forex Investment is the National Economy

When doing forex trading, the perspective must be macro. From a country's economy to a global economy.

Compared to the domestic stock market, forex does not need to select the most suitable one from thousands of stocks, nor does it need to focus on sectors and concepts. You only need to focus on a few varieties and accurately judge their trends. So there are some differences in the trading ideas between trading in the stock market and trading in forex.

In addition, the influencing factors of forex are global, especially gold and Crude Oil. For example, raising interest rates by the Federal Reserve will affect gold, the geopolitical situation in Russia and Ukraine will affect gold, and physical demand from India and China will also affect gold.

So, when doing trading, one must have a global perspective, be able to quickly gather global economic information, and then make judgments.

Thirdly, Forex Trading has Relatively High Leverage

At present, although domestic futures trading also has leverage, it is generally 10-20 times. In contrast, forex trading leverage can range from 100 to 500, and some non compliant platforms can even provide leverage of 1000 to 2000 times.

The advantage of high leverage is that it can leverage the maximum returns with the smallest amount of funds, maximizing the utilization of funds. But the downside is that if encountering a reverse market trend, losses will also be multiplied.

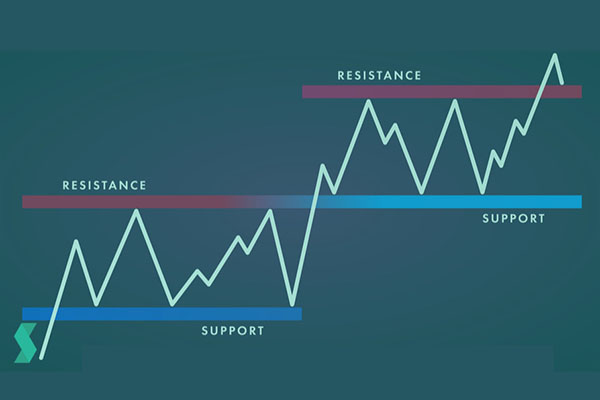

So when doing forex, it is necessary to balance the relationship between returns and risks. For example, if you do a good job of stopping losses and profits, and reach the stop loss and profit level in your heart, you must leave the market decisively and never have a lucky mentality.

In addition, it is important to understand the impact of a single point fluctuation in each variety on your position, which may allow you to understand the price fluctuations you can tolerate. For example, 1 standard hand gold is priced at $10 per point fluctuation; One point of fluctuation in Europe and America is also $10; But currently, every point of fluctuation between the US dollar and the Japanese yen is $7.54. Only by understanding this can you calculate your target price.

Of course, some high-quality platforms also provide specialized tools to assist you with calculations, such as EBC, which has a specialized trading tool website https://www.ebctec.com/forex-tools/ A total of 9 trading tools are provided, which can basically meet daily trading needs.

Fourth Point, Platform Selection

It should be noted that forex is a global trading market. We obtain trading data from liquidity suppliers around the world, such as major banks, hedge funds, and exchanges.

So, while opening up the domestic forex market, we still need to connect with the world and obtain liquidity quotes. Therefore, when choosing a platform in the future, the execution speed and liquidity of transactions remain the first factors we need to pay attention to.

The first is the execution speed of the transaction. This determines whether we can capture the trend.

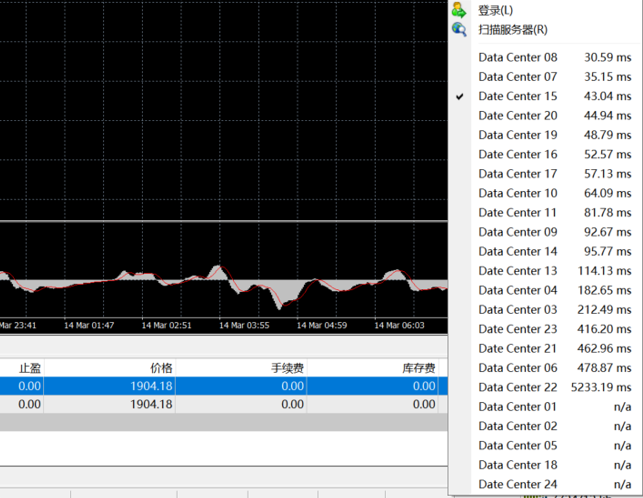

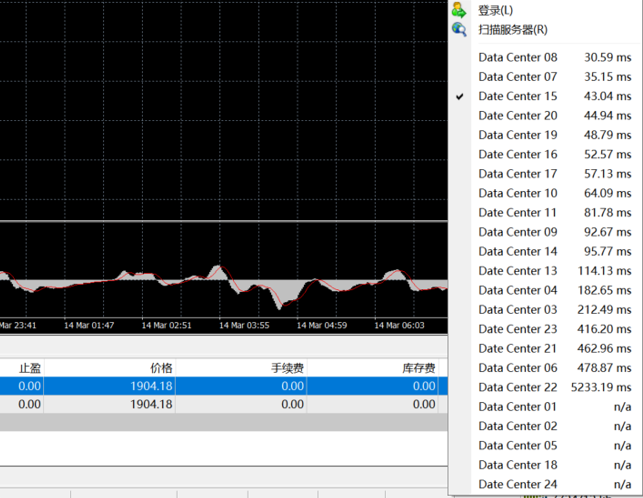

Generally, a legitimate platform requires at least 3 or more servers. If there are more than 10 servers, it is a relatively high-quality platform. On MT4 software on major platforms, servers that can be switched are usually displayed in the lower right corner.

Taking EBC's MT4 trading software as an example, there are a total of 24 servers. We can also determine whether the platform has servers worldwide based on the IP address of the server.

The second factor is liquidity, which determines the sliding point situation and whether our order can be traded at the best price.

Because our orders are thrown from the platform to the market, the stronger the liquidity of the market, the easier it is for our orders to be traded, and the fewer slip points there will be. And among them, the liquidity of the market is mainly undertaken by banks.

So, when choosing a platform, we must pay attention to which banks it has collaborated with. If the partners are all important banks mentioned above, then at least their reliability in terms of liquidity will be relatively high.

For example, EBC's partner banks include top international banks such as Barclays, UBS, JPMorgan Chase, Goldman Sachs, etc., so there are very few slip points in actual transactions.

Previously, there was a ranking table of globally systemically important banks. From the first level to the fourth level, the higher the level, the greater the contribution of banks to market liquidity. China's four major banks are also among them, and it can be imagined that with the opening up of the forex market, they will play a more important role in liquidity supply.

Overall, with the strengthening of financial regulation, China's gradual opening up of the forex market is a necessary path.

Faced with a new trading model, we not only need to maintain awe to understand it, but also need to embrace the world's most liquid market with an open attitude.

More importantly, it is important to understand the operating mechanism of the forex market, find a high-quality platform, and learn diligently in trading in order to find one's own belonging in a more diverse investment world.