A month ago, the banking crisis in the United States and Europe caused a series of chain reactions worldwide.

During the 17 trading days from March 10th to present, the liquidity of the foreign exchange market was mostly only 20% -30% of the base period of March 10th; Fortunately, it has now rebounded to around 48% of the base period.

Does the rebound in market liquidity represent a resolution of the banking crisis in the US and Europe? What is the impact on ordinary investors?

1、 Enlightenment from the 'Swiss Franc Crisis'

In 2015, the "Swiss franc crisis" erupted - the Swiss central bank announced the Swiss franc's decoupling from the euro without prior warning.

In just three minutes, the Swiss franc suddenly collapsed, causing most liquidity suppliers to choose to completely withdraw their liquidity provided to foreign exchange brokers in the Swiss franc related currency pairs. Due to the depletion of market liquidity, a large number of traders' account balances have been cleared and even overdrawn.

This event has exposed the market to the destructive power of the lack of liquidity in the foreign exchange market.

Compared to the Swiss franc incident, the banking crisis in the US and Europe seems to be being resolved in a more moderate way.

Previously, Credit Suisse and Deutsche Bank, both in the eye of the storm, were globally systemically important banks, especially Deutsche Bank, which was in the second tier and one of the 12 most important banks in the world. But in the end, Credit Suisse was acquired by UBS, and the Deutsche Bank crisis did not spread like Credit Suisse, which also allowed the market to emerge from a sense of narrowing concerns.

Perhaps this incident will eventually be resolved peacefully in a flat tone. But it also constantly reminds the market that liquidity crises always exist, and creating a liquid environment is crucial.

How Individual Investors Avoid the "Swiss Franc Crisis"

For ordinary investors, it is rare to encounter a black swan event that is rare in decades. However, if one accidentally chooses a platform without liquidity, the impact on their own funds is no less than encountering a "Swiss franc crisis". So, choosing to collaborate with a liquid trading brokerage has become the first stop for most investors.

To find a liquid trading broker, it is necessary to understand the operating mechanism of the foreign exchange market.

According to the BIS Bank for International Settlements, about 70% of the liquidity in the foreign exchange market comes from international banking giants such as Barclays Bank, Swiss Bank, and JPMorgan Chase. However, as ordinary investors cannot directly participate in the interbank foreign exchange market, they can only obtain quotes from liquidity suppliers through major trading Securities firms to participate in trading.

There are two types of trading securities firms:

① One type is primary trading securities firms, which generally access the interbank foreign exchange market directly through primary liquidity suppliers to obtain the most direct liquidity.

For example, EBC Group connects to the liquidity fund pools of over 20 top banks through the fix interface, providing customers with direct market access to primary liquidity venues.

② The vast majority are general securities firms, as they cannot directly access primary liquidity suppliers and can only obtain liquidity from primary trading securities firms.

So in the foreign exchange market, liquidity suppliers not only refer to primary liquidity suppliers, but also include primary trading securities firms closely related to them. Of course, in order to become a first-class trading brokerage, the conditions are extremely strict. In addition to having strong credit endorsements, a minimum deposit of $1 million is also required.

For general investors, the safest choice is naturally a primary trading brokerage. In addition to having high-quality qualifications, direct access to the interbank foreign exchange market can help them obtain better liquidity, thereby enabling orders to be traded at a better price.

2、 How to find high-quality primary trading securities firms

Check the connected bank

The more important an international bank is, the stronger the liquidity it has access to.

For example, EBC's partner banks include top international banks such as Barclays, UBS, JPMorgan Chase, and Goldman Sachs, all of which are listed among global systemically important banks, so there are few slip points during EBC trading.

Check bank accounts and supervision

After the "Swiss franc incident", global first tier commercial banks have reduced the number of enterprise account openings and further raised the threshold for account opening in order to facilitate regulation. So, the ability to open corporate accounts with top commercial banks after 2015 precisely demonstrates the strength of this trading brokerage firm.

For example, the Barclays corporate account owned by EBC not only requires a business turnover and deposits of over £ 6.5 million, but also requires applicants to meet the account opening requirements through Barclays' series of strict financial audits and layer by layer background checks, naturally possessing the qualification to access the interbank fund pool.

In addition, many times, corporate bank accounts are also closely related to regulation. For example, the UK FCA has regulatory information for all UK banks and requires FCA licensed institutions to independently manage user funds. So EBCThe group must independently deposit funds in the custody account of Barclays Bank, comply with CASS regulations, and sign specific trust letters.

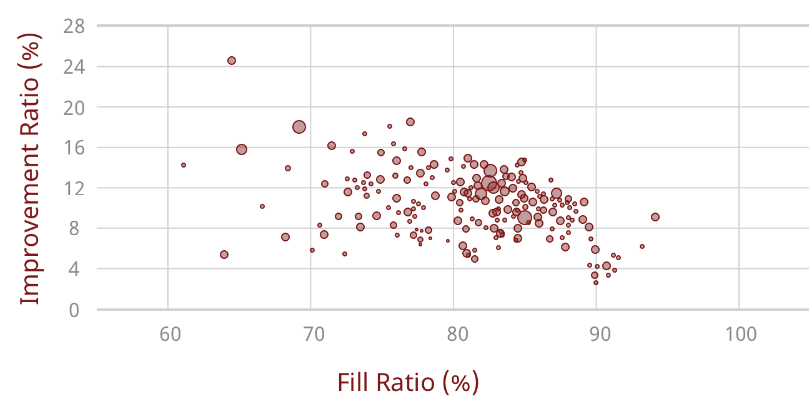

Looking at the sliding points of the data market

Whether it is the "Swiss franc incident" or the "US European banking crisis", the instantaneous market situation and the liquidity supply capacity of securities firms will directly affect the situation of sliding points.

The most representative is that in April 2017, when the United States released its non farm employment data report, the sliding point reached 38 points due to major market conditions and market liquidity issues. Of course, for this industry wide sliding point, the performance of different trading securities firms also varies, and some trading securities with sufficient liquidity have much smaller sliding points than other platforms.

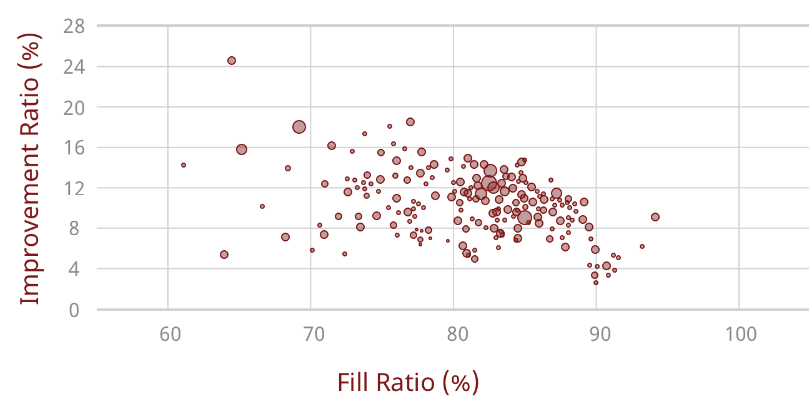

So, the instantaneous market situation is a great test of a trading brokerage's liquidity level, which can be directly felt in our daily trading. For example, if you place the same order on different platforms before, you will find that over 85% of EBC's orders will be sold at a better price. So in the face of some instantaneous large market trends, trading on EBC will achieve relatively better performance.

Overall, the impact of the banking crisis in the United States and Europe is precisely the impact of insufficient market liquidity.

Although the crisis is being resolved, the impact it has on the market is long-term and profound. In this context, for us traders, sufficient liquidity is particularly important.

Everyone is a glimmer of light in the sea, and only by following the flowing waves can we reach the distant shore.