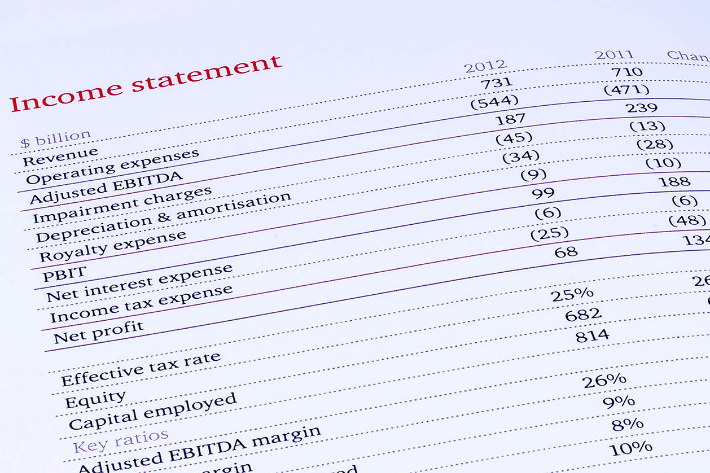

The opening price, also known as the opening price, refers to the first

transaction price of a certain currency after the opening of each trading day.

Most financial exchanges in the world adopt the principle of maximum transaction

volume to determine the opening price. The closing price refers to the

transaction price of the last transaction of a certain currency before the end

of a day's trading activity. If there is no transaction on the same day, the

latest transaction price shall be used as the closing price, as the closing

price is the standard of the current market situation and the basis for the

opening price of the next trading day, which can be used to predict future

market conditions. So when investors analyze the market, they usually use the

closing price as the basis for calculation.

How to Look at the Opening Price

On monthly, weekly, and daily charts, the opening price is a continuation of

the market trend of the previous Unit of time. Combining a high opening price, a

low opening price, and a flat opening price with the operating trend of the

market In an upward trend, a high opening price is a prerequisite for forming an

upward short gap, and often an upward short gap on the weekly chart is the

beginning of a bull market characteristic. There are often three gaps in the

daily gap: the breakthrough gap, the relay gap, and the exhaustion gap, all of

which provide a basis for determining the future direction of market operation.

Similarly, in a downward trend, opening at a low opening price is a prerequisite

for forming a short downward gap. Often, a downward short gap on the weekly

chart is the beginning of a bear market characteristic, and such a gap should be

watched vigilantly when it appears at a high level.

How to Look at the Closing Price

The closing price is the result of the battle between the long and short

sides of the Unit of time. The combination of the closing price and the running

trend will make the market more clear. In an upward trend, the closing price is

above the 5, 10, 20, and 30-day Moving Average systems, indicating that the

market is in an upward trend and in a strong operation. In the early stages of

this operating trend, boldly intervening in the market will increase the hope of

appreciation.

On the contrary, if the closing price is below the 5-day, 10-day, 20-day, and

30-day moving average systems, it indicates that the market is in a downward

trend and in weak operation.