Central banks play a pivotal role in shaping global financial markets, and their policy stances—described as "hawkish" or "dovish"—can move currencies, equities, and bonds in dramatic ways.

For traders and investors, understanding how to interpret these signals is essential for anticipating market reactions and making informed decisions. This guide explains the meaning of hawkish vs dovish, how to spot these signals, and why they matter for your trading strategy.

Hawkish vs Dovish: Key Difference

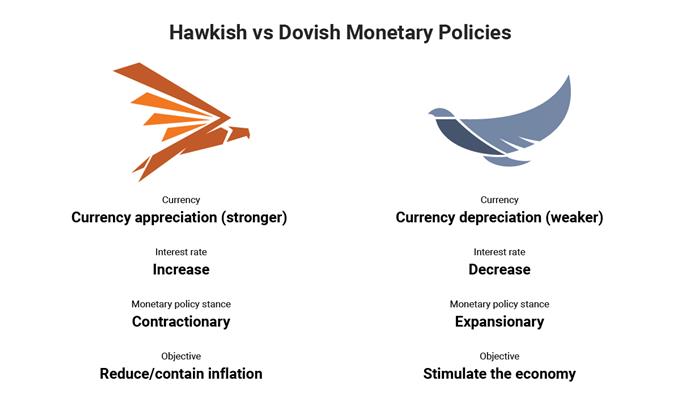

A hawkish central bank focuses on controlling inflation, often by raising interest rates and tightening monetary policy. Hawks are more concerned about the dangers of rising prices and are willing to slow economic growth if it means keeping inflation in check.

A dovish central bank, on the other hand, prioritises stimulating economic growth and supporting employment, even if it means tolerating higher inflation. Doves favour lower interest rates and expansionary policies to encourage borrowing, investment, and spending.

Why Do Central Banks Shift Between Hawkish and Dovish?

Central banks adjust their stance in response to changing economic conditions. When inflation is rising rapidly, a hawkish approach helps cool the economy and stabilise prices. When growth is weak or unemployment is high, a dovish approach supports recovery by making credit cheaper and more accessible.

How to Spot Hawkish and Dovish Signals

Central banks communicate their stance through policy statements, press conferences, meeting minutes, and speeches. Here's what to look for:

Hawkish Signals

Language about inflation risks: References to "persistent inflation" or "price stability concerns."

Hints at rate hikes: Phrases like "further tightening may be required" or "policy normalisation."

Reducing balance sheets: Plans to shrink asset holdings or end quantitative easing.

Emphasis on strong economic data: Highlighting robust growth or low unemployment.

Dovish Signals

Focus on growth and jobs: Concern for "sluggish economic activity" or "about market slack."

Hints at rate cuts: Talk of "accommodative policy" or "supporting the recovery."

Expanding balance sheets: Announcing asset purchases or new stimulus programmes.

Downplaying inflation: Describing inflation as "transitory" or "below target."

Real-World Examples

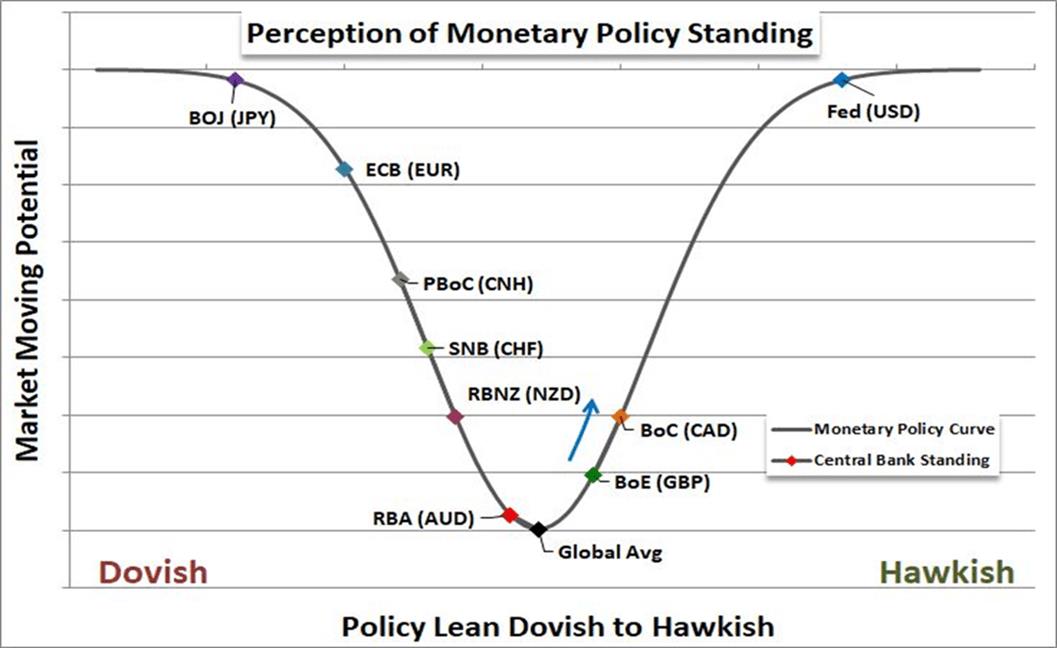

Hawkish Example: In 2022 and 2023, the US Federal Reserve and European Central Bank raised interest rates aggressively to combat soaring inflation, signalling a strong hawkish stance.

Dovish Example: During economic slowdowns, such as the COVID-19 pandemic, many central banks slashed rates and launched stimulus measures to support growth, reflecting a dovish approach.

How Hawkish vs Dovish Signals Affect Markets

Currencies: Hawkish signals typically strengthen a currency, as higher rates attract foreign capital. Dovish signals often weaken a currency due to lower yields.

Equities: Hawkish moves can pressure stocks by raising borrowing costs and slowing growth, while dovish moves often boost equities by making credit cheaper.

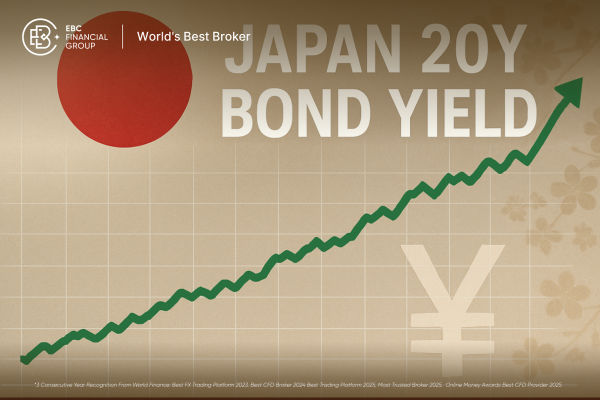

Bonds: Hawkish policy can lead to higher bond yields and falling prices; dovish policy usually lowers yields and raises bond prices.

Tips for Reading Central Bank Signals

Watch for key phrases: Central banks often use carefully chosen language to prepare markets for policy shifts.

Compare statements: Changes in tone or emphasis from previous meetings can signal a shift in stance.

Monitor economic data: Inflation, employment, and GDP reports influence central bank decisions and the likelihood of hawkish or dovish moves.

React, don't predict: Let the central bank's actual signals guide your trading decisions, rather than trying to guess in advance.

Final Thoughts

Understanding the difference between hawkish and dovish central bank signals is crucial for anyone trading currencies, stocks, or bonds. By learning to read policy statements and economic cues, you can anticipate market reactions and position yourself for potential opportunities—or avoid unnecessary risks.

Stay alert to central bank communications, keep an eye on the data, and you'll be better equipped to navigate the ever-changing financial landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.