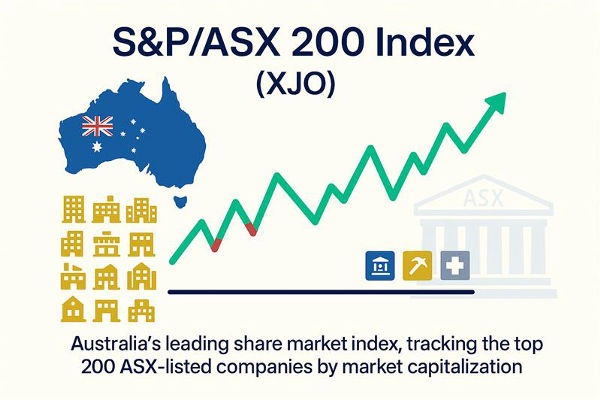

S& The P/ASX 200 Index is the benchmark institutional investable stock market index in Australia, consisting of the largest 200 stocks adjusted for market value. It is S& P DowJones published one of the Australian market indices (known as the S& P/ASX series indices), but is considered the main benchmark for the group.

Historical trends

S& The Importance of the P/ASX 200 Index

The reason for using floating market value adjustment is to have a tradable benchmark index that is suitable for large institutional asset management companies to use as a benchmark. Stocks with low trading volume are difficult to trade and are not suitable for inclusion in the benchmark index based on their total market value. Only frequently traded stocks are eligible for inclusion to ensure the liquidity of the index. Therefore, the index publishing trademark S&PDow Jones) will S& The P/ASX 200 is described as Australia's most outstanding benchmark index due to its representativeness, liquidity, and tradability.

The index was launched in April 2000 and undergoes quarterly rebalancing to ensure that the stocks included in the index meet the eligibility criteria. Although the index contains 200 stocks, it is mainly composed of large companies. As of June 2019, the top 10 stocks in the index accounted for over 44% of the total. Among these 10 stocks, 5 are banking stocks, while financial stocks account for slightly less than one-third of the index. The second largest industry is materials (resources), accounting for 19%. In July 2019, the previous P/E ratio of the index was 17.9 times, and the dividend yield was 4%.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.