In the world of investing and trading, the term “paper hands” has become a popular way to describe those who sell their positions at the first sign of trouble.

But what does it really mean to have paper hands, how can you tell if you're one of these investors, and what can you do to develop a stronger, more resilient approach to the markets?

This guide will help you understand the concept, recognise the signs, and learn strategies to avoid the pitfalls of panic selling.

What Does “Paper Hands” Mean?

“Paper hands” refers to investors or traders who quickly abandon their positions when faced with market volatility or downturns. The phrase emerged from online trading communities, especially during periods of extreme market swings, such as the GameStop stock surge in 2021. Those with paper hands are often seen as risk-averse, lacking the psychological stability to withstand even minor losses or uncertainty.

In contrast, “diamond hands” describes investors who hold onto their assets through thick and thin, confident in their long-term strategy and able to weather market storms.

Signs You Might Have Paper Hands

Wondering if you fit the paper hands profile? Here are some common behaviours and signs:

Panic Selling: You sell your investments quickly at the first sign of a price drop or negative news, often out of fear rather than analysis.

Low Risk Tolerance: You feel uncomfortable with volatility and prefer to exit rather than risk further losses.

Emotional Decisions: Your trades are driven by anxiety, fear of loss, or Herd Mentality, rather than a well-defined plan.

Short-Term Focus: You struggle to hold positions for the long term, frequently switching assets or strategies.

Influenced by Social Media: You react to market hype or influencer opinions, selling when you see others doing the same.

Regret Missing Gains: After selling, you often see the price rebound and regret not holding on longer.

The Psychology Behind Paper Hands

Paper hands behaviour is rooted in psychology. Fear of loss, uncertainty, and the desire to avoid regret are powerful motivators. When markets turn red, it's natural to want to protect your capital. However, emotional reactions can lead to impulsive decisions that undermine long-term success. Social media and online communities can amplify these feelings, creating a herd mentality where panic selling spreads rapidly.

Many new investors fall into the paper hands category simply because they haven't yet experienced the natural ups and downs of markets. Understanding that volatility is part of investing is essential for building resilience.

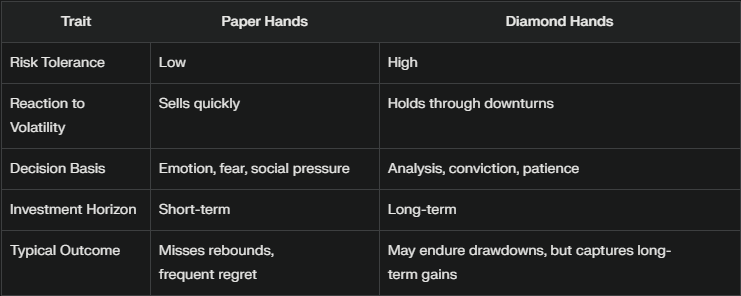

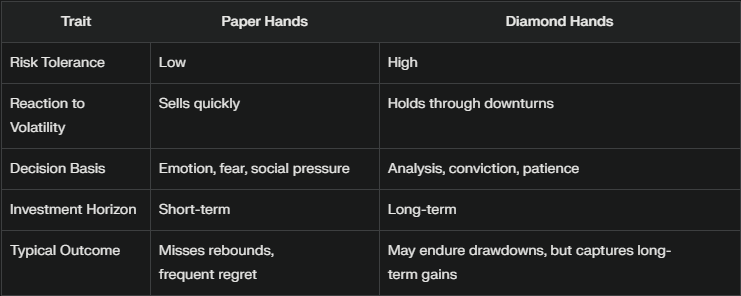

Paper Hands vs Diamond Hands

While diamond hands can sometimes hold too long and risk bigger losses, paper hands often miss out on recoveries and long-term growth by selling too soon.

The Impact of Paper Hands on Markets

When many investors with paper hands sell at once, it can trigger sharp price drops and increase overall market volatility. This “domino effect” can lead to further panic selling, making markets more unstable, especially in sectors like cryptocurrency or meme stocks where sentiment shifts rapidly.

How to Overcome Paper Hands Behaviour

If you recognise paper hands tendencies in yourself, here are practical steps to build stronger conviction:

Educate Yourself: Understand market cycles and the reasons behind price swings. Knowledge builds confidence.

Set a Long-Term Strategy: Define your investment goals and stick to them, rather than reacting to every dip.

Diversify Your Portfolio: Spread your investments across different assets to reduce the impact of any single downturn.

Use Risk Management Tools: Set stop-loss orders at rational levels, not out of panic, and avoid overexposing yourself to volatile assets.

Limit Market Noise: Don't obsess over daily price changes or let social media dictate your decisions.

Reflect on Past Trades: Learn from your experiences. Did panic selling help or hurt your results?

Seek Support: Engage with communities or mentors who encourage rational, long-term thinking rather than hype and fear.

Is It Ever Good to Have Paper Hands?

While paper hands is usually seen as a negative trait, there are situations where selling early can protect you from larger losses, especially in a sustained bear market or when fundamentals have changed. The key is to distinguish between a rational exit and an emotional reaction.

Conclusion

Being a paper hands investor means letting fear and short-term thinking dictate your trades, often at the expense of long-term gains. By recognising these tendencies and adopting strategies for discipline and resilience, you can transform your approach and become a more confident, successful investor.

Remember, every market has its ups and downs-those who stay the course with a clear plan are best positioned to reap the rewards.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.