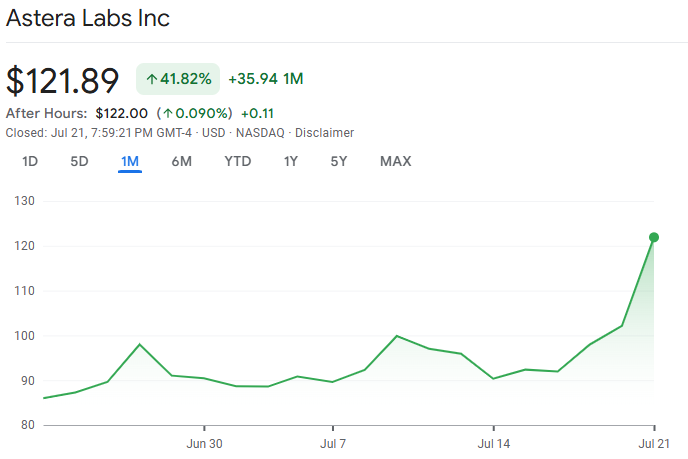

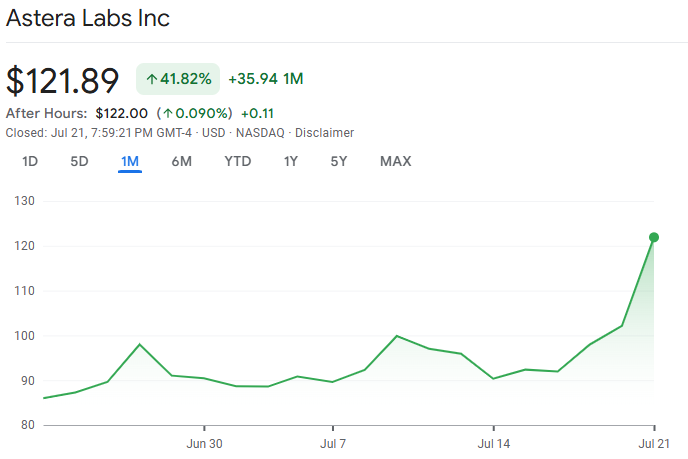

In mid-2025, Astera Labs (NASDAQ: ALAB) stunned investors with a 41% surge, reigniting interest in this AI‑connectivity play. Once an overlooked emerging tech stock, ALAB has now gained attention due to strong earnings, analyst upgrades, and the rapid growth of AI infrastructure.

However, with a valuation that raises eyebrows, the key question looms: is Astera Labs building a solid growth story, or riding a hype wave?

This analysis provides essential insights into current data, financials, growth drivers, associated risks, and strategic considerations for prospective investors.

What Sparked Alab Stock's Recent 41% Rally?

Several catalysts combined to lift ALAB's shares significantly in the past few weeks:

Blowout Q1 earnings and robust guidance: Astera reported Q1 revenue of $159.4 million, up 144% YoY, and issued Q2 revenue guidance between $170–175 million—a strong sequential growth signal.

New product rollout & strategic partnerships: The company announced expanded production capacity and a major collaboration likely tied to its AI interconnect tech, fueling confidence among investors.

Analyst upgrades: Multiple brokers, including Morgan Stanley, raised target prices and ratings, with technical Chart Patterns indicating further upside.

These factors converged to lift ALAB by over 41%, climbing from the $80s to the current $120+ territory.

Astera Labs History, Financial Snapshots & Growth Metrics

Astera Labs, founded in 2017, designs advanced semiconductor-based connectivity for AI and cloud infrastructure. Its product suite includes high-speed PCIe retimers, optical modules, and AI-oriented interconnect systems, most notably collaborating with Nvidia on NVLink Fusion for GPU clusters.

Following its IPO in March 2024, ALAB quickly increased its revenue from $80 million in 2022 to nearly $396 million in 2024, driven by demand for AI and data centres.

Q1 2025 revenue: $159.4 million (+144% YoY)

Non-GAAP EPS: $0.33, positive surprise

Net income (ttm): $41.4 million; gross margin ~75.8%, net margin ~8.4%

P/S ratio: ~41×; forward P/E ~89×; free‑cash‑flow multiples extremely high

Cash on hand: ~$5.61 per share; no debt on balance sheet

Astera is experiencing rapid growth, but it has a valuation typically reserved for established high-growth companies.

Alab Stock Valuation: Undervalued Upside or Overhyped?

Astera's valuation ratios remain stretched:

P/S ~41× vs S&P average ~3×.

Forward P/E ~89×, compared to broader sectors.

P/FCF ~185×, signalling expensive cash flow valuation.

Although justified by exceptional growth, historically, such high ratios have left the stock vulnerable to downside, especially if growth decelerates.

Analyst consensus: 15 ratings, average position "Strong Buy".

12‑month average target: $98.21, below current market price (~$121), indicating ~19% downside.

Broker views: Target's stock price has been boosted to $110, while Morgan Stanley has either initiated or upgraded their forecast, projecting a range between $80 and $120.

Although the overall sentiment is positive, some people are concerned about potential pricing pressure if the market undergoes a correction.

Key Risks to Consider

Several warning signs for prospective buyers:

Valuation squeeze: Any shortfall in growth or earnings could lead to significant declines.

Insider selling: In July, the CEO and executives sold millions in shares, which serves as a signal worth monitoring.

Execution dependency: Heavy reliance on AI infrastructure rollout and OEM adoption remains a critical dependency.

AI market volatility: A slowdown in AI capital expenditures could lead to a sudden decrease in demand.

Alab Stock Strategic Outlook: Buy, Hold, or Sell?

Buy

If you believe that the growth of AI-capex and data centre infrastructure will continue to accelerate, then for investors with a high risk tolerance, ALAB's current trading range may offer a strategic entry point before the Q2 earnings report on August 5.

Hold

If you're already invested and believe in the long-term thesis, consider holding while trimming positions around technical resistance (~$125–$130). Monitor insider behaviour and next-quarter guidance closely.

Sell

If you prioritise fundamentals and valuation discipline, the current price surpasses the average analyst targets. Considering an exit or partial reduction here could allow you to take profits while managing downside risks.

How to Balance Portfolio Opportunity with Discipline

Astera Labs offers a unique growth narrative in high-margin AI infrastructure, supported by solid financials and new technology partnerships. But the high valuation amplifies downside risk. Smart exposure balances conviction with caution:

Use stop-loss limits and scaled entries.

Monitor growth execution and insider/deal flow.

Remain alert to AI‑capex cycles and discretionary service spending.

As for portfolio strategies, experts recommend:

Growth-centric portfolios: Include this as a high-conviction investment in AI infrastructure, limiting it to 3–5% of your equity portfolio.

Momentum trades: Tactical entry on pullback, target short-term gains to manage risk.

Hedged exposure: Pair with semiconductor ETF exposure to diversify and reduce idiosyncratic risk.

Conclusion

In conclusion, whether Alab Stock is undervalued or overhyped depends on your perspective. On the undervalued side: If AI spending continues to accelerate and Astera maintains its performance, ALAB's valuation could become justified in the coming years.

Conversely, regarding overhyped: If growth slows down or market sentiment changes, the valuation could drop quickly, leading to a reversal of momentum.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.