What is foreign exchange commission?

We often hear the term 'foreign exchange commission' when conducting foreign exchange transactions, where traders have the opportunity to invest small amounts of money in the foreign exchange market and receive huge returns. However, in addition to making money in the foreign exchange market, traders also need to pay commissions. The commission in the foreign exchange market is the fee charged for trading operations, that is, the handling fee for buying and selling currency transactions.

Foreign exchange transaction commission refers to the transaction fees that investors need to pay when conducting foreign exchange transactions. The lower the commission for foreign exchange transactions, the lower the cost of conducting foreign exchange transactions.

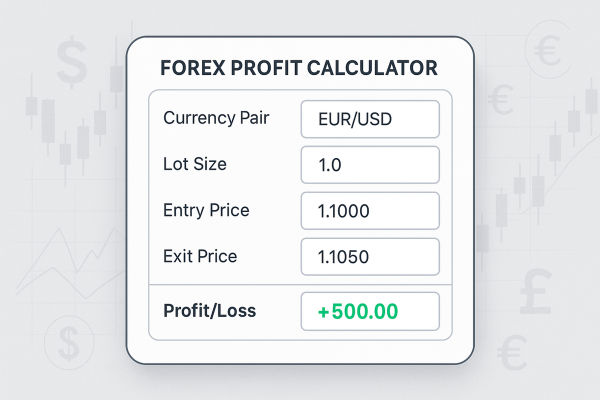

What is the commission for foreign exchange transactions? How to calculate it?

Foreign exchange rebates

Foreign exchange commission rebate is a committee of some investors who return to China. The committee is mainly composed of foreign exchange agents who introduce a concept to attract customers. However, there is the act of acting as an agent for the first investor and then adding commission to the foreign exchange commission rebate, which investors must recognize.

Foreign exchange commission rebates are usually additional fees paid by brokerage companies to investors, and direct market makers generally do not accept this commission. Due to the incomplete opening of foreign exchange margin trading in China, platform manufacturers recruit a group of Taiwan agents overseas to develop their business. Therefore, domestic gold and currency brokerage companies will charge a commission to maintain their operations. Some currency brokerage companies may say that there is no commission when promoting customer account opening, Moreover, the price difference is increasing, and commissions and price differences are actually important factors that constitute transaction costs. Together, the two are your true transaction costs.

Investors tend to want to minimize transaction costs when opening accounts, but Xiao Bian believes that it is also relatively independent. If foreign market makers are found to open accounts directly, the cost of the transaction committee will be reduced in the process of confirmation, but it is not important to provide online after-sales technical guidance for services. In case of difficulties, they need to help make an international call to contact relevant customer services. The process is very complicated, and the gold price will be relatively slow.

Regarding foreign exchange trading commissions, it should be noted that all foreign exchange trading platforms' commissions are not expressed in terms of commissions, but rather products from foreign exchange trading platforms that have just entered the Chinese market.

With the development of the foreign exchange market, all commissions and fees have disappeared, and foreign exchange platforms can only profit by collecting price differences. In other words, the price difference fee is the handling fee for foreign exchange transactions, also known as foreign exchange transaction commission.

The size of the Foreign Exchange Trading Commission is a differential. We can easily see that the commission for foreign exchange transactions is still very small.

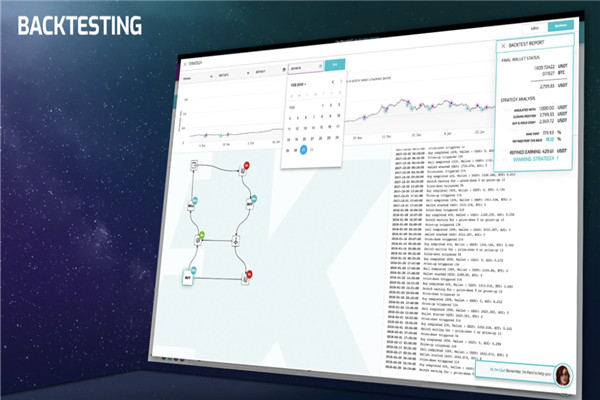

So how do you calculate the commission for foreign exchange transactions?

In fact, currently investors do not need to calculate commissions for foreign exchange transactions themselves. When investors engage in foreign exchange trading, all price differences can be clearly seen on the foreign exchange trading platform without the need for investors to calculate. The above is an introduction from the Foreign Exchange Administration Commission. The commission level is also an important factor for us to check whether the foreign exchange platform is safe. Investors should not overlook the role of the Foreign Exchange Commission.

The amount of commission usually depends on specific factors:

1. liquidity of currency pairs

Therefore, the transaction commission of mainstream currency pairs is much lower than that of less common currency pairs. Generally speaking, there is a significant difference in the commission amount between a traditional pair and an unusual pair.

2. The volume of transactions executed also matters

Compared to small transaction volumes, the commission for large transactions is much higher.

3. Foreign exchange market commission is influenced by market conditions

Experienced traders sell stocks during macroeconomic news releases - commissions increase. Insufficient intraday or year-on-year liquidity has also played a role, leading to an increase in commissions.

There are many types of foreign exchange commissions or spreads. The interest rate spread can be fixed, floating, standard, or targeted at small accounts. Fixed point difference is a fee charged under any market conditions. Floating price difference, charged 2 points when the market is stable; However, when there is an emergency in the market, it can rise to 40-50 points.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.