If you're trading currencies, or just curious about the eurozone, understanding Portugal’s currency is essential. Portugal’s adoption of the euro has shaped everything from daily spending to international trade.

Here are five fast insights every investor, or trader should know about the currency Portugal uses.

5 Insights About Portugal's Currency

1. What Currency Does Portugal Use

Portugal uses the euro, with the currency code EUR and the symbol €, as its official currency. The euro replaced the Portuguese escudo in 1999 as part of the country's entry into the eurozone, and physical euro notes and coins entered circulation in 2002.

Today, all prices in shops, restaurants, and services across Portugal are listed in euros, and this is the only currency accepted for everyday transactions.

Key facts:

2. Euro Banknotes and Coins in Portugal

When you visit Portugal, you'll encounter a range of euro banknotes and coins. Banknotes are uniform across all eurozone countries and include denominations of €5, €10, €20, €50, €100, €200, and €500. However, €200 and €500 notes are rarely used in everyday transactions, and many small shops may not accept them.

Euro coins come in 1, 2, 5, 10, 20, and 50 cent pieces, as well as €1 and €2 coins. All euro coins and notes are valid throughout the eurozone, so you may see coins minted in other countries while in Portugal.

Tip: For daily purchases, carry smaller denominations, as large notes can be hard to break in local shops or markets.

3. History: From Escudo to Euro

Before the euro, Portugal's currency was the escudo. The switch to the euro began in 1999, with the escudo phased out entirely by February 2002. Portugal's early adoption of the euro was part of a broader European effort to create a single, stable currency, making travel and trade easier across the continent.

The euro is now the second-most traded currency in the world, providing Portugal with access to a large, stable market and removing the risks of fluctuating exchange rates within the eurozone.

4. Currency Exchange and Spending in Portugal

If you're travelling to Portugal, you'll need euros for all purchases. Foreign currencies like the US dollar, British pound, or Malaysian ringgit are not accepted in shops or restaurants. It's best to exchange your money before you arrive or use a travel money card that supports euros.

5. Currency Tips for Traders

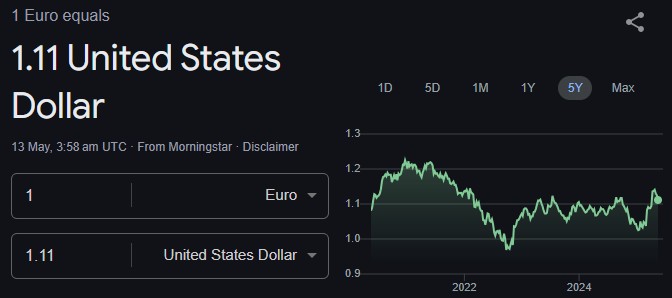

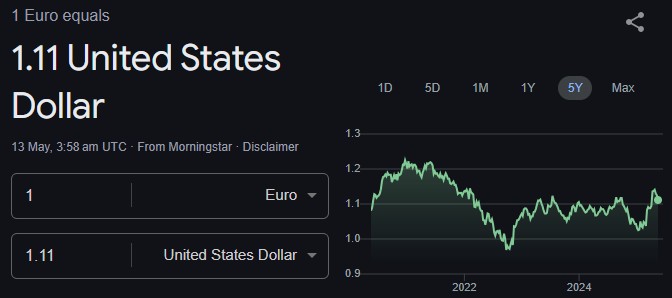

Exchange rates: The EUR/USD and EUR/GBP are among the most traded currency pairs globally, so rates can fluctuate based on economic news, central bank decisions, and global events.

Decimal notation: In Portugal, a comma is used for decimals (e.g., €1,50 instead of €1.50), and a dot for thousands (e.g., €10.000 for ten thousand euros).

No dual pricing: Portugal only accepts euros, so always check prices and receipts carefully.

Banking: The Bank of Portugal issues and oversees the euro in Portugal.

For traders: The euro's value against other currencies can be affected by European Central Bank policy, economic data from the eurozone, and global financial trends. Portugal's use of the euro means its currency is directly linked to these broader movements.

Conclusion

Portugal uses the euro (EUR, €) as its sole official currency, with a straightforward system of coins and banknotes familiar across the eurozone. Whether you're a trader, or business owner, understanding how the euro works in Portugal will help you navigate payments, exchanges, and market trends with confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.