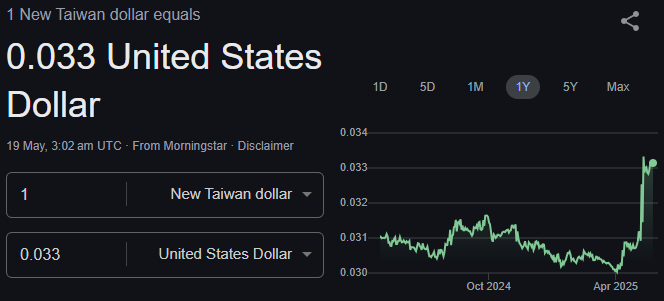

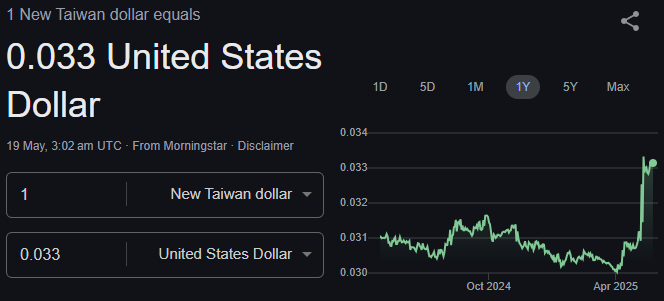

Trading the Taiwan dollar (TWD) against the US dollar (USD) offers unique opportunities and challenges for forex traders. The TWD to USD pair is influenced by regional economic trends, central bank policy, and global risk sentiment.

With volatility often driven by both local and international events, effective risk management is essential for any trader looking to succeed in this market. Here are actionable risk management tips to help you navigate TWD to USD trading in 2025.

Understanding TWD to USD Market Environment

Before placing trades, it's crucial to grasp what drives the TWD to USD pair. Taiwan's export-driven economy, its relationship with China, and the policy stance of the US Federal Reserve all play significant roles. Sudden shifts in trade policy, geopolitical tensions, or changes in US interest rates can trigger sharp moves, making risk control a top priority.

Top Risk Management Tips for TWD to USD Trading

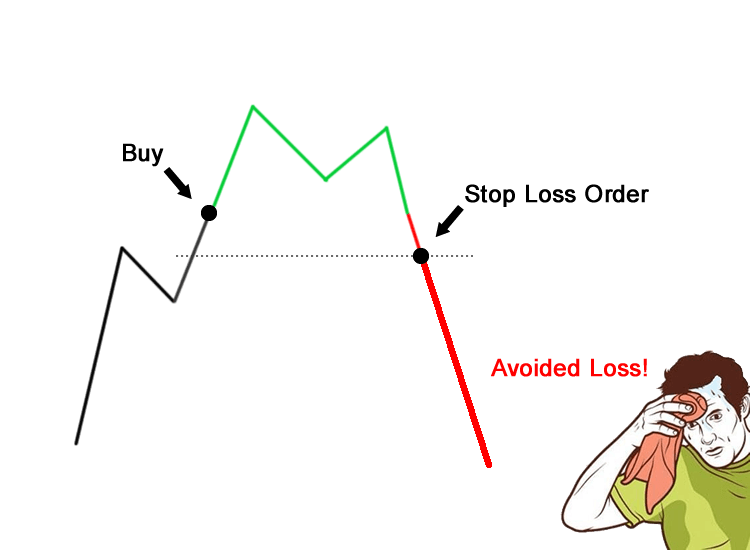

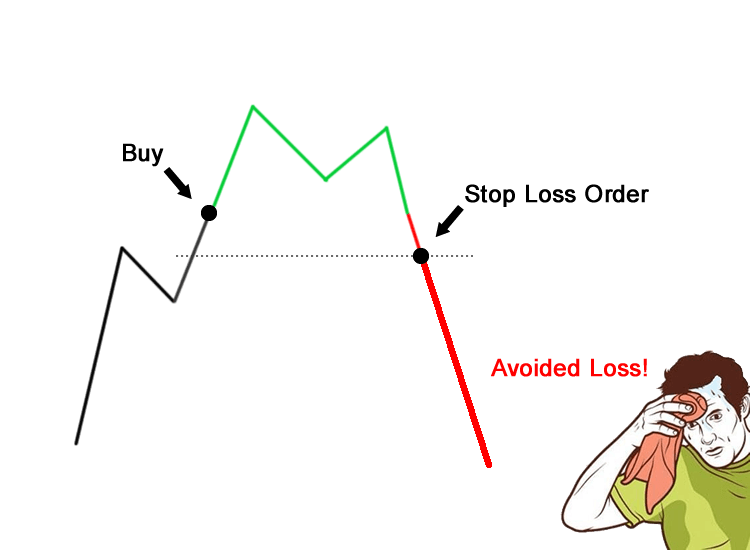

1. Set a Clear Stop-Loss for Every Trade

Never enter a TWD to USD position without a predetermined stop-loss. This is your safety net, capping potential losses if the market moves against you. Place your stop-loss at a technical level that invalidates your trade idea, not just at a random distance from entry.

2. Use Position Sizing Wisely

Adjust your trade size based on your account balance and risk tolerance. Many experienced traders risk no more than 1–2% of their capital on a single trade. For TWD to USD, which can experience sudden spikes, smaller position sizes can help you weather volatility without blowing up your account.

3. Monitor Economic Calendars and News

Keep an eye on economic releases from both Taiwan and the US, such as GDP, inflation, and central bank announcements. Unexpected news can cause rapid price swings. Avoid holding large positions through major events unless you have a clear strategy for managing the risk.

4. Diversify Your Trades

Don't put all your capital into TWD to USD. Diversifying across different currency pairs or asset classes can help reduce the impact of a single adverse move. If your trading portfolio is heavily weighted towards Asian currencies, consider balancing with other regions.

5. Be Aware of Liquidity and Trading Hours

The TWD to USD pair is most liquid during Asian trading hours and when US markets overlap. Outside these times, spreads may widen and slippage can increase. Plan your entries and exits during peak liquidity to minimise execution risk.

6. Adapt to Volatility

TWD to USD can experience periods of high volatility, particularly around central bank meetings or geopolitical developments. During these times, consider tightening your stop-loss, reducing position size, or even stepping back from the market until conditions stabilise.

7. Keep Emotions in Check

Emotional trading is one of the biggest risks in forex. Stick to your Trading plan, avoid revenge trading after a loss, and don't let greed or fear dictate your decisions. Consistency and discipline are your best defences against emotional mistakes.

8. Review and Adjust Your Risk Management Regularly

The forex market is always evolving. Review your trades, analyse what worked and what didn't, and adjust your risk management rules as needed. Continuous improvement is key to long-term success.

Special Considerations for TWD to USD Traders

Central Bank Intervention: The Central Bank of the Republic of China (Taiwan) may intervene to stabilise the TWD. Be alert to official statements or sudden, unexplained moves.

Geopolitical Risk: Tensions in the Taiwan Strait or broader Asia-Pacific region can cause sharp, unpredictable swings in TWD to USD. Always factor in geopolitical headlines.

US Dollar Strength: The USD's role as a global reserve currency means moves in TWD to USD can be influenced by broader dollar trends, not just Taiwan-specific news.

Example: Risk Management in Action

Suppose you identify a bullish setup in TWD to USD at 0.0315, with resistance at 0.0320 and support at 0.0310. You set your stop-loss at 0.0310, risking 0.0005 per unit. If you want to risk $100 and each pip is worth $10, you should trade 2 units (since 0.0005 x $10 x 2 = $10 risk per pip move, $100 total risk for a 10-pip stop).

This approach ensures your risk is controlled and your position size matches your tolerance, regardless of market outcome.

Final Thoughts

Effective risk management is the foundation of successful TWD to USD trading. By setting clear stop, sizing positions sensibly, monitoring news, and keeping emotions in check, traders can protect their capital and thrive in a dynamic forex environment. Regularly review your approach and stay informed to maintain your edge in the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.