Runoff election

Erdoğan faced his toughest campaign since 2002 as the vote could go to a

second round for the first time since Turkey switched to an executive presidency

in 2017.

Turkey’s leader Recep Tayyip Erdoğan and rival Kemal Kılıçdaroğlu were locked

in a tight battle for the presidency on Monday morning as the election count

suggested rising odds of an unprecedented second round.

Both candidates have claimed to be ahead in Sunday’s race but neither side

appeared to be in line to clinch the majority required. Erdoğan secured just

under 50 per cent of the vote, compared with 45 per cent for Kılıçdaroğlu.

according to Anadolu.

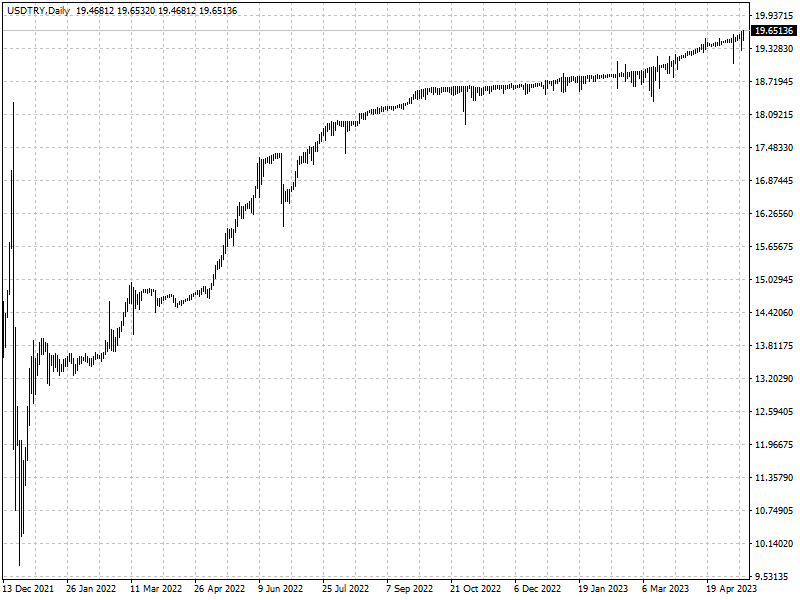

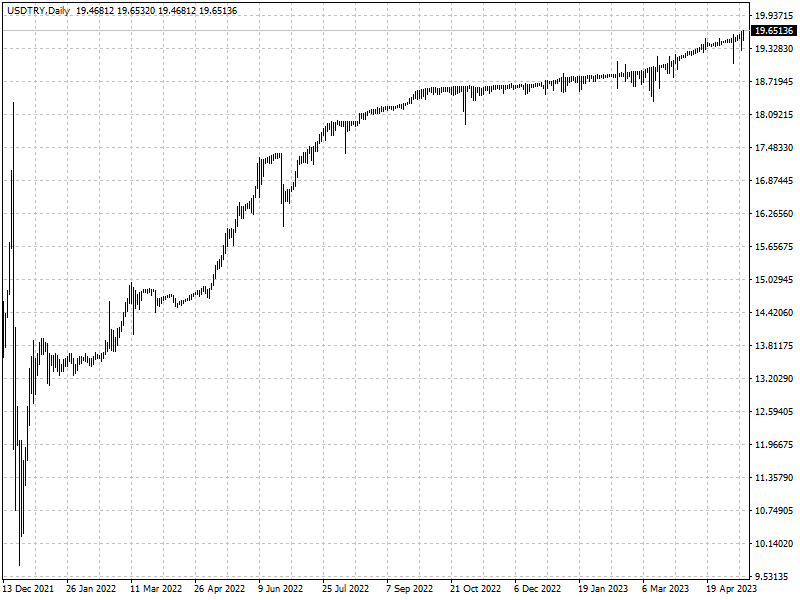

The lira slipped to a fresh two-month low of 19.70 as the race for presidency

appeared headed for a runoff. The vote will decide not only the foreign policy

of the country, but also its economic future.

Erdoğan framed himself as the only politician who could secure a prosperous

future for Turkey while Kılıçdaroğlu has vowed to revive Turkey’s ailing

economy.

Unorthodox mantra

The currency has lost almost 95% of its value over the last decade. Turkey’s

monetary policy prioritizes the pursuit of growth and export competition rather

than assuaging inflation.

Erdogan endorses the unconventional view that raising interest rates

increases inflation, rather than taming it. The president’s refusal to raise

rates played an instrumental role in the lira’s historic plummet.

He has publicly proclaimed that interest is ‘the mother and father of all

evil’ and linked the high interest rates necessary with the usury forbidden in

Islamic scripture.

The Turkish central bank’s independence has been eroded as Erdogan dismissed

several governors who failed to heed his pressure.

After enjoying nearly two decades of relatively stable economic growth,

Turkey has seen its economy come apart at the seams.

In order to fuel economic expansion, Turkey accepted high levels of foreign

currency-denominated debt. However, low currency reserves relative to that debt

made Turkey’s economy vulnerable to exchange-rate shocks.

Independent economists suggest that Turkey could slide into a

“devaluation-hyperinflation scenario” akin to Argentina or Venezuela.

More volatility

‘Should Erdogan win, which is our base case assumption, USD/TRY could move to

23.00,’ Wells Fargo’s Emerging Markets Economist and FX Strategist Brendan

McKenna wrote in an e-mail.

‘The lira is heavily overvalued as a result of intervention efforts, and

depending which way the election ends up going, the currency could move sharply

in either direction,’ he said.

JPMorgan forecast the lira could soften to levels of 24-25 to the dollar.

Goldman Sachs said in a note in recent days that its calculations showed the

market was pricing the lira to weaken by 50% in the next twelve months,

including a sharp devaluation post-election.

‘Ultimately the lack of confidence in investment will mean that the Turkish

Lira will probably be among the worst performing currencies in the world for

some time,’ noted Mike Harris, the founder of Cribstone Strategic Macro.

The lira’s strength would be short-lived even if the opposition emerges

victorious, according to a report by Commerzbank.

However, Wells Fargo’s McKenna anticipates a more optimistic long-term

outlook for the currency in a regime change scenario.