Important Notice: EBC to launch Tiered Crypto Leverage TML starts 23 Oct

2025-10-21

Summary:

Summary:

EBC will launch Tiered Margin Levels (TML) for crypto on Oct 23, 2025 (GMT+3), for all MT4/MT5 Live servers to improve risk control and trading transparency.

Thank you for your continued trust and support in EBC.

As part of our commitment to maintaining a robust and transparent trading

environment amid evolving regulatory standards and heightened market volatility

in crypto market, EBC is pleased to announce the upcoming launch of a Tiered

Margin Levels (TML) for Crypto products, effective from Thursday, 23 October

2025, starting at 00:00 (platform time GMT+3).

The new TML of crypto products will apply to all MT4/MT5 Live servers. Please

review the details below carefully and ensure your positions are managed

accordingly ahead of the update.

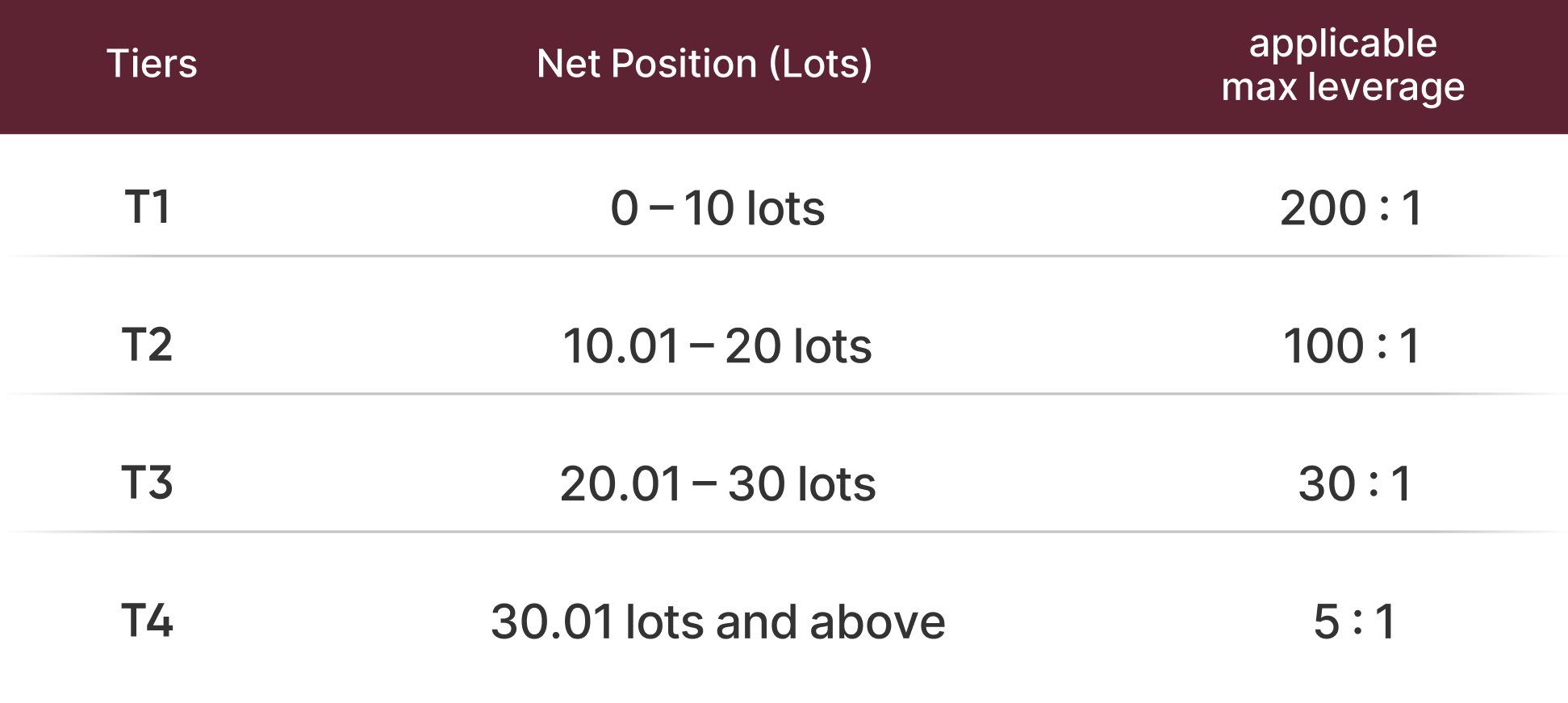

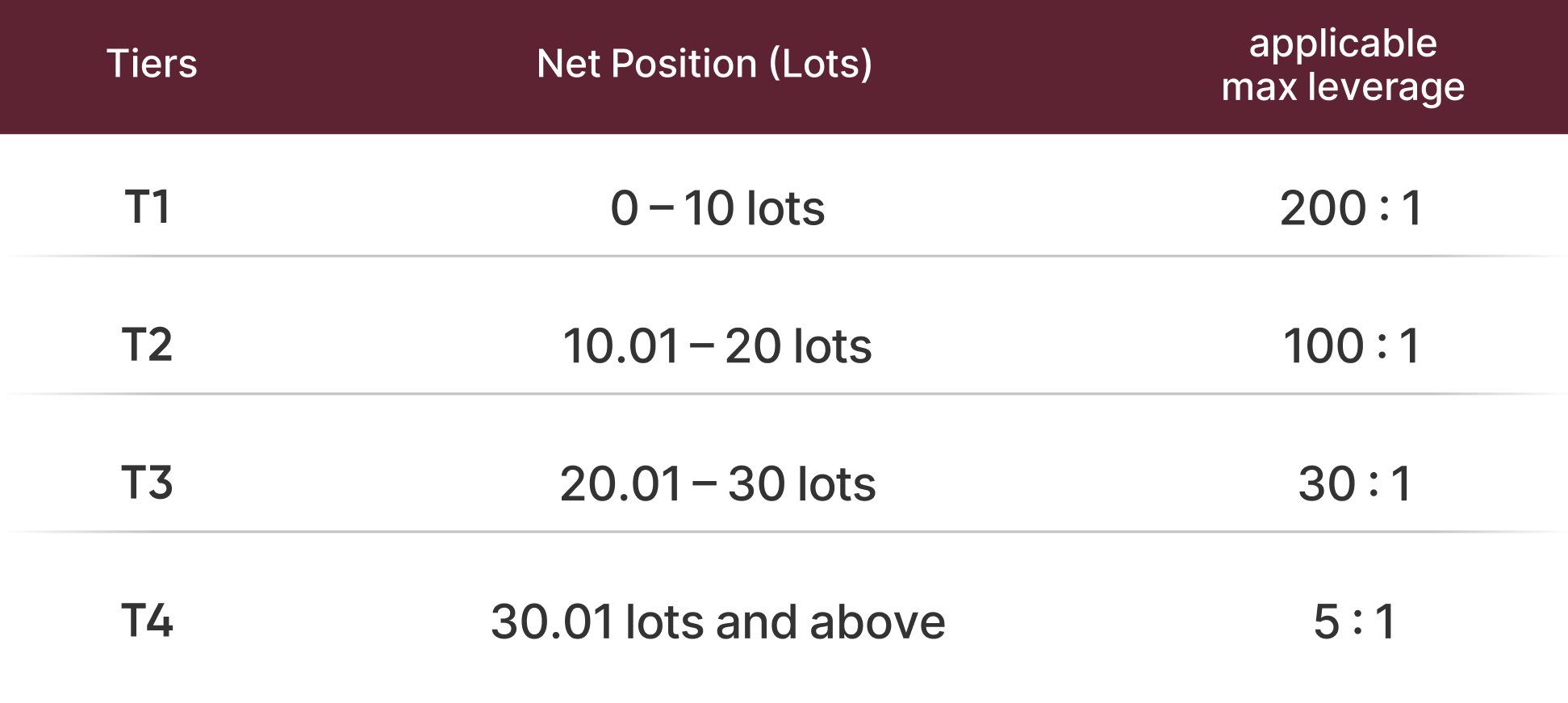

Updated Tiered Margin Structure for Crypto products

Illustrative Example

Under the TML, the margin for your net crypto positions will be calculated

separately for each tier according to the applicable leverage ratio, and then

aggregated to determine total margin requirement. For example, assuming a BTCUSD

position of 25 lots with an entry price of $100,000, your margin would be

calculated as follows:

Tier 1: 10 lots × $100,000 ÷ 200 leverage = $5,000

Tier 2: 10 lots × $100,000 ÷ 100 leverage = $10,000

Tier 3: 5 lots × $100,000 ÷ 30 leverage = $16,666.67

Total Required Margin = $5,000 + $10,000 + $16,666.67 = $31,666.67

Important Notes:

Existing cryptocurrency positions will not be affected by this update.

Any subsequent action on existing positions (such as adding, reducing, or

partially closing) will trigger recalculation of margin requirements based on

the new tiered structure.

Please ensure sufficient funds and appropriate position sizing before the

effective date to accommodate the updated leverage settings and avoid

unnecessary margin pressure.

We encourage you to review your positions and risk management strategies

following the implementation to ensure alignment with the new margin

framework.

Should you have any questions or require further clarification, please do not

hesitate to contact our Client Services Team — we will be here to assist.