Forex signal sources refer to information sources that provide Trading signals and suggestions. These signals and suggestions

are usually based on market analysis and technical indicators and are aimed at

helping traders make more informed trading decisions.

There are various sources of forex signals, including but not

limited to the following:

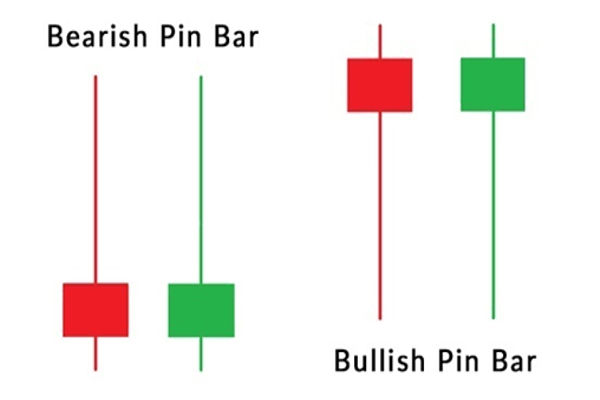

1. Technical Analyst

Technical analysts analyze market trends and provide corresponding trading

signals and suggestions by studying charts, price patterns, trend lines,

technical indicators, and other methods.

2. Fundamentals Analyst

Fundamental analysts focus on fundamental factors such as economic

indicators, political events, and monetary policy, analyze their impact on

exchange rates, and provide corresponding trading signals and suggestions.

3. Automated Trading system

Some forex signal sources are based on automated trading systems,

which automatically send buying and selling signals through preset trading

strategies and algorithms.

4. News organizations and media

News agencies and media typically provide news coverage, analysis, and

interpretation of the forex market, which can also serve as one of

the sources of forex signals.

5. Forex brokers

Some brokers provide forex signaling services,

providing trading advice and signals to customers.

The quality and reliability of forex signal sources vary. Traders

should carefully choose signal sources, evaluate the accuracy and effectiveness

of their signals, and make decisions based on their own trading strategies and

risk tolerance. At the same time, traders should also have a certain level of

market analysis and judgment ability and not completely rely on forex signal sources.

The charging method for forex signal sources varies depending on

the supplier and service type. The following are some common charging methods

for signal sources:

1. Subscription fees

Some forex signal sources provide subscription services, and

traders need to pay a certain fee to obtain the trading signals and suggestions

they provide. The amount of the subscription fee is usually priced based on the

quality and accuracy of the service.

2. Commission fees

Some trading signal sources are provided by forex brokers, who may charge commission fees. This means that when a trader executes

a transaction through the broker, they will pay a certain percentage of

commission.

3. Fixed expenses

Some forex signal sources may charge a fixed fee, and traders need

to pay the same amount regardless of the frequency of service usage. This

charging method is usually applicable to long-term or comprehensive

services.

4. Trading profit sharing

Some forex signal sources may collaborate with traders and share

trading profits. In this mode, traders share their profits obtained through

signal sources in accordance with the agreed proportion.

It should be noted that different signal sources may have

different charging methods and rates. When choosing forex signal

sources, traders should carefully understand the charging methods of different

signal sources and comprehensively consider their signal quality, service level,

and trading needs to make wise decisions. At the same time, attention should be

paid to avoiding the use of unreliable free signal sources, as their quality and

accuracy may be unreliable. It is best to choose reputable suppliers and conduct

thorough due diligence on the services they provide.