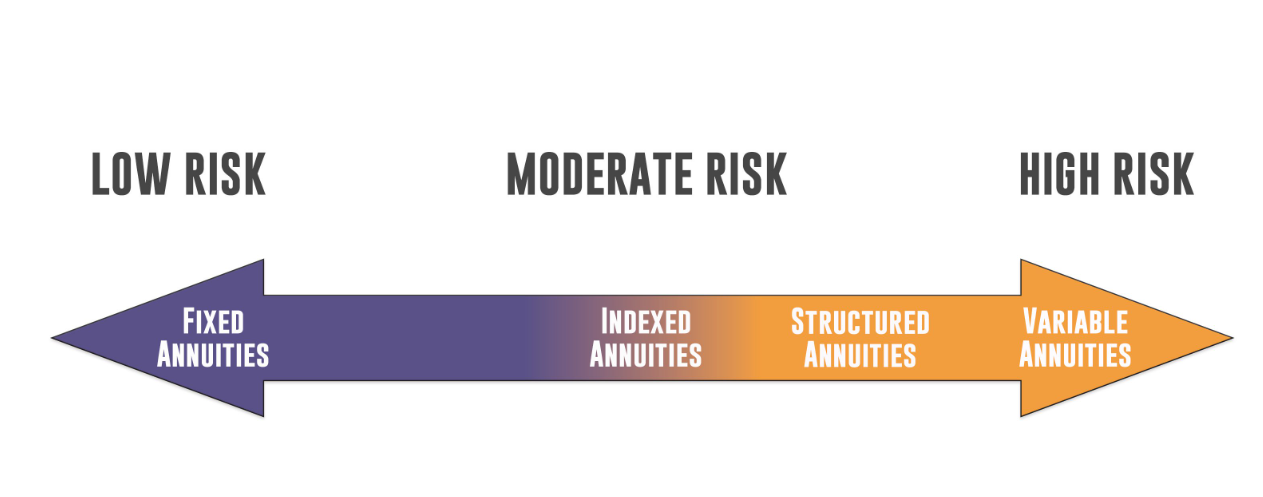

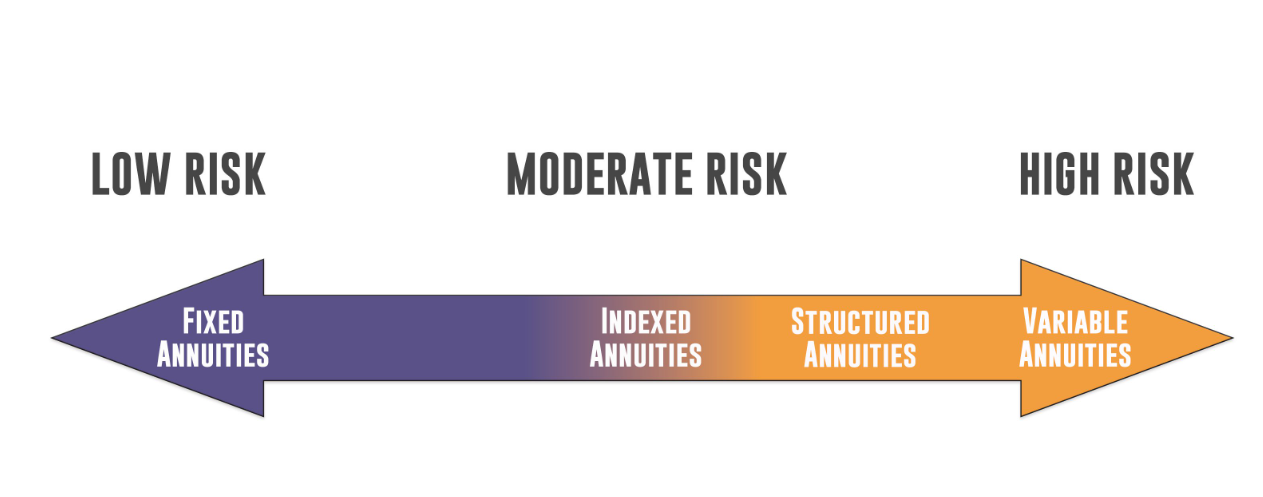

A fixed index annuity (FIA) is a financial product designed to provide both growth potential and protection. It's a popular choice for individuals looking to secure their retirement savings while still benefiting from market-linked returns. Unlike traditional annuities that offer a fixed interest rate, FIAs tie their earnings to a stock market index, such as the S&P 500. However, they do not involve direct stock investments, meaning your money is shielded from market downturns. This combination of safety and upside potential has made FIAs an attractive option for many investors.

How Interest is Credited in Fixed Index Annuities

The way FIAs generate returns is quite different from directly investing in the stock market. Rather than receiving the full gains of an index, annuity holders earn interest based on the index's performance, subject to certain limits. Insurance companies use different crediting methods to determine how much of the index's growth will be applied to the annuity.

One common method is the annual point-to-point approach, which measures the index's value at the start and end of a contract year. Another is the monthly sum method, where individual monthly changes are added together, factoring in both gains and losses. However, not all of the market's gains are passed on to the annuity holder. Insurance companies apply participation rates, caps, and spreads to control returns.

A participation rate determines how much of the index's growth you receive. If it's set at 80%, you'll only get 80% of the market's increase.

A cap rate limits the maximum return you can earn. If the cap is 6%, and the market gains 10%, you'll still only receive 6%.

A spread is a deduction that lowers your credited interest. For example, if the market gains 8% and the spread is 2%, your credited return would be 6%.

These mechanisms ensure the insurance company can offer guarantees while still making a profit, but they also mean FIA returns won't match full stock market performance.

Benefits and Drawbacks of Fixed Index Annuities

Fixed index annuities come with notable advantages, particularly for those who prioritise security. One of their strongest selling points is principal protection—even if the stock market crashes, your original investment remains intact. This makes FIAs a lower-risk alternative to investing in stocks directly. Another benefit is tax-deferred growth, meaning you won't owe taxes on earnings until you withdraw them, allowing your money to compound more efficiently. Some FIAs also offer optional income riders, providing a guaranteed stream of retirement income.

However, there are downsides to consider. While FIAs provide growth potential, returns are often lower than stock market investments due to participation rates, caps, and spreads. Fees can also be a factor, especially if the annuity includes additional features like income guarantees. Another potential drawback is surrender charges—if you withdraw your money before the contract period ends (often 7-10 years), you may face steep penalties. This lack of liquidity can be a concern for those who may need access to their funds sooner.

Current Trends and Market Performance

Fixed index annuities have become increasingly popular, particularly as economic uncertainty pushes investors toward safer retirement options. In recent years, FIA sales have surged, driven by concerns over stock market volatility and interest rate fluctuations. Many retirees and near-retirees are turning to FIAs as a middle ground between risk and stability, seeking moderate returns without exposing their savings to major market downturns.

Another factor driving demand is the decline of traditional pensions. As more workers become responsible for funding their own retirements, products like FIAs offer an appealing alternative by providing a level of guaranteed income. Additionally, insurance providers have been expanding their FIA offerings, introducing more flexible terms and enhanced income options to attract a wider range of investors.

Key Considerations Before Investing in Fixed Index Annuities

Before committing to a fixed index annuity, it's essential to evaluate your financial goals and risk tolerance. If you're looking for market-linked growth without the risk of losing your principal, an FIA could be a suitable choice. However, it's important to understand that you won't receive the full market returns, and liquidity can be limited due to contract restrictions and surrender charges.

Reading the fine print is crucial. Be sure to review the participation rate, cap, and fees before signing a contract. Some FIAs also include complex terms that may not be immediately clear, so consulting a financial advisor can help you determine whether an FIA fits within your broader retirement strategy.

While fixed index annuities aren't for everyone, they offer a compelling mix of security and growth potential, making them a popular option for those seeking predictability and peace of mind in their long-term financial planning.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.