The Fed is finally prepared to pivot towards monetary loosening in 2024. But

investors should not take for granted that the BOE will simply follow suit later

in Thursday.

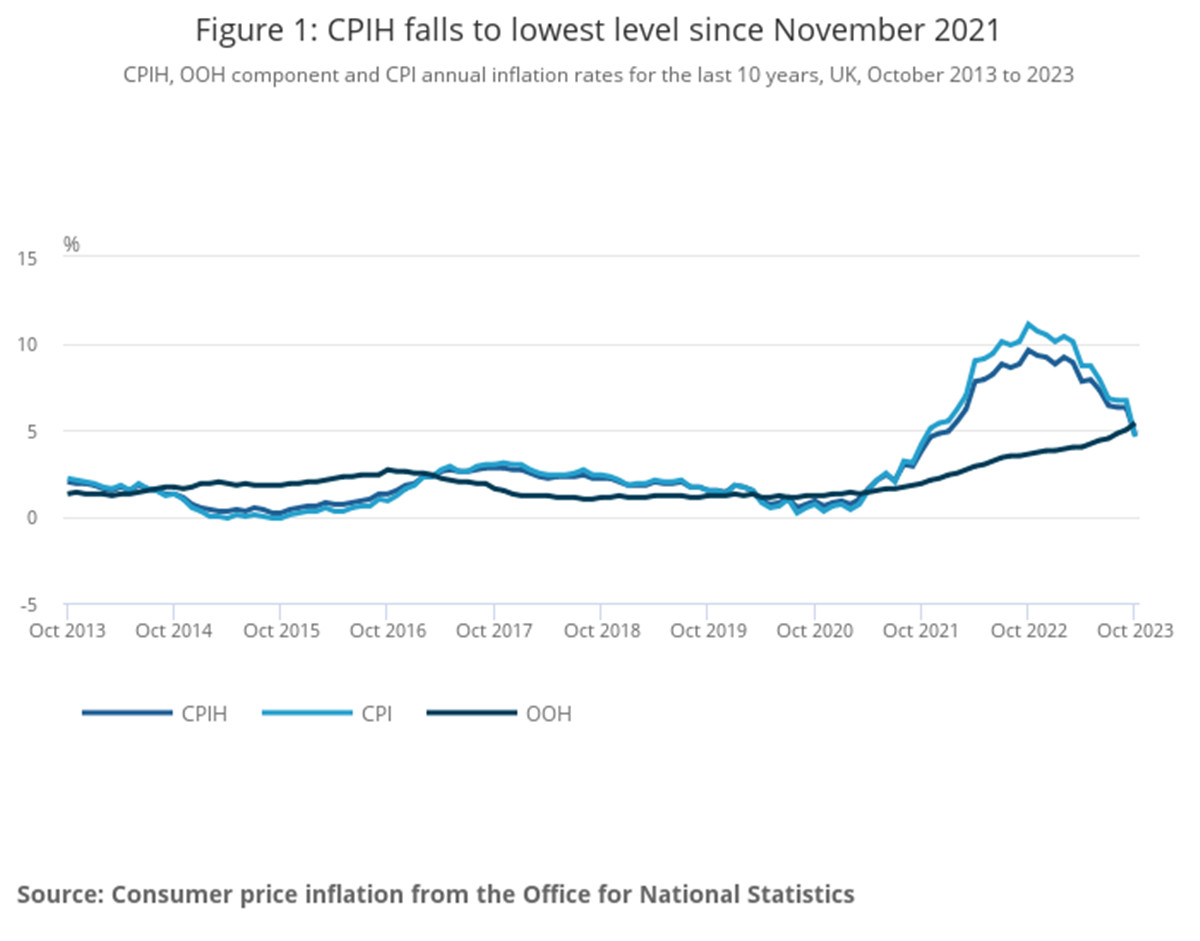

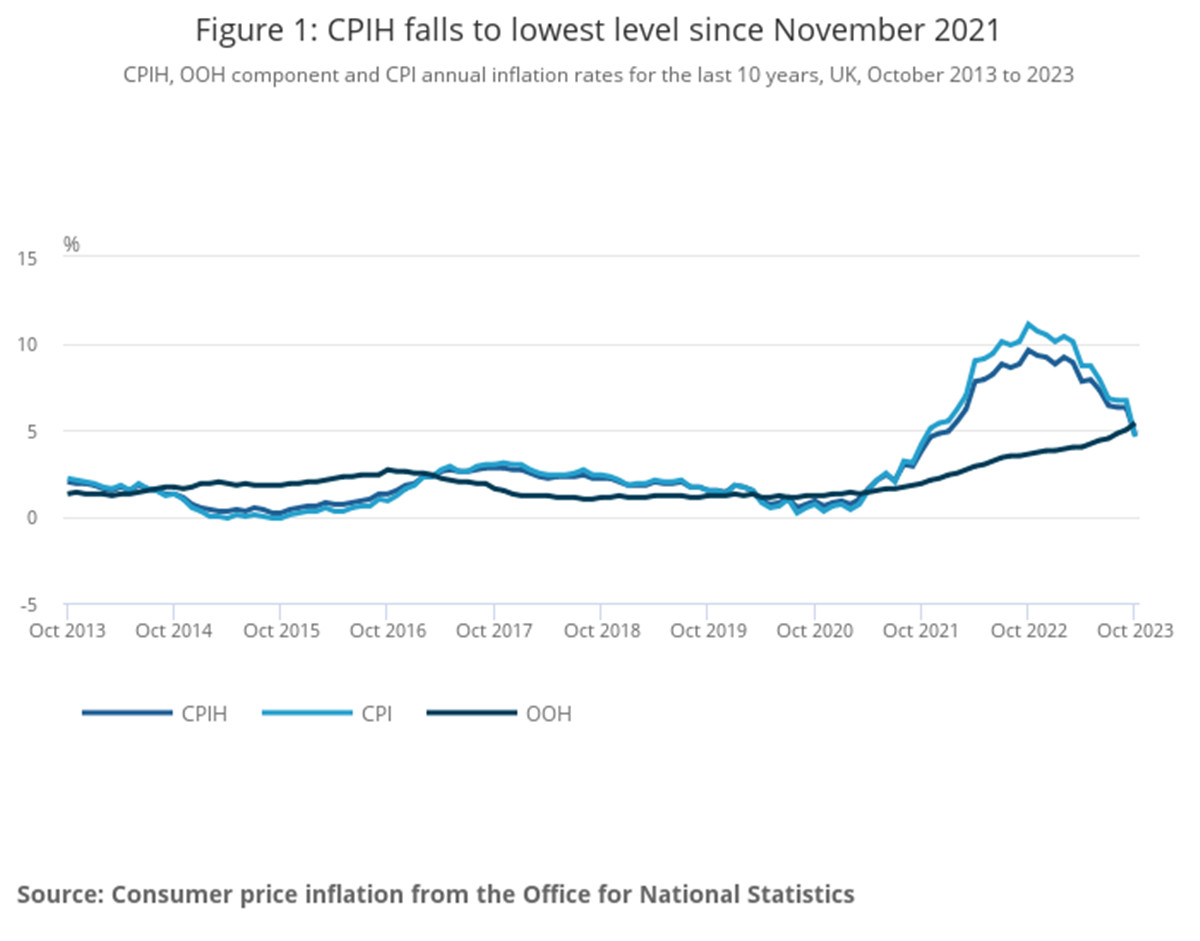

The UK has been reeling from worse inflation which could hamper interest rate

cuts next year. Bailey recently warned markets they were “underestimating”

inflation trajectory.

Economists polled in December by Consensus Economics, expect UK inflation to

still be 3.6% by March, higher than the 2.9% for the US and 2.4 % for the

eurozone. The BOE’s forecast is even less cheerful.

The county’s economy shrank unexpectedly by 0.3% in October as households and

businesses came under growing pressure amid the cost of living crisis.

While the BoE has cut its expectations for growth, policymakers are concerned

about the supply side of the economy. That means more signs of a recession may

not hasten rate cuts.

Voting pattern

UK economists warn the BOE is going to signal that borrowing costs must

remain elevated well into 2024. One key area of focus will be the voting pattern

of the MPC.

Three members of the committee voted for rate hikes last month, with the

remainder opting to leave it unchanged. A similar result would make investors

rethink the central banks’ resolve to stamp out inflation.

“We expect to see some pushback on this pricing, in the form of a hawkish

split and some stern words,” said Stefan Koopman, a senior macro strategist at

Rabobank.

Sanjay Raja, economist at Deutsche Bank, predicted the BoE would start

cutting rates only from the second quarter of next year.

There is speculation the BOE could consider including a rare and more

forceful push back against market expectations in its meeting minutes as it did

back in Nov 2022.

“Much like in November 2022, when the MPC saw market pricing running ahead of

itself, the committee may feel emboldened to push back explicitly on market

pricing,” said Raja.

money markets are pricing in 80 bps of easing in 2024, up from 50 just after

their last decision six weeks ago. On the other hand, they see about 130 bps by

the ECB and 100 by the Fed.

Craze for pound

Expectations for the pound to strengthen are gathering momentum as the BOE

could prove more hawkish than major peers.

Overall investors flipped to net bullish sterling positions for the first

time since September during the week to 5 Dec, according to the CFTC.

Data from Citigroup showed that asset managers had ramped up sterling

purchases since the start of November. The bank said “sterling buying flows over

the past month were [the] biggest since July 2023.”

John Velis, foreign exchange and macro strategist at BNY Mellon, said

overseas holdings of sterling have returned to “close to normal” long-term

averages having been “meaningfully underweight for most of the year until just a

few weeks ago”.

Goldman Sachs revised its forecast upward for the currency, seeing it

strengthen to 1.30 against the dollar in six months from an expectation of 1.20

previously. It also predicts the euro will weaken to 0.82 against the pound in

the next six months.

According to GS, markets have moved toward pricing a soft landing that also

incorporates some rate relief, which should be good for cyclical and

rates-sensitive currencies like sterling.

Economists polled by Bloomberg forecast that sterling will be $1.29 at the

end of next year. Fidelity International predicts it will strengthen to the

$1.40 level next year.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.