The COVID-19 in 2020 triggered a historic slump in oil demand. Although the global oil market is recovering, it may never return to the "normal". The reason for this is explained in the latest mid-term outlook of the International Energy Agency (IEA).

The rapid change of behavior caused by the COVID-19 pandemic and the stronger promotion of governments to achieve a low-carbon future have led to a sharp decline in the expectation of oil demand in the next six years. This forces oil producing countries and enterprises to make difficult decisions, as they are unwilling to allocate resources without development or increase new production capacity that will only be idle. Will oil demand peak earlier than expected? Or is the world heading towards a supply crisis? What impact will this have on the refining industry and trade flows?

Today, EBC Finance provides investors with a comprehensive outlook on global oil market supply and demand from 2021 to 2026, and explores some future challenges and uncertainties.

What is the "New Normal" of the oil market?

The global economy and oil market are recovering from the historic slump in demand caused by the COVID-19 pandemic in 2020. The large amount of excess inventory accumulated last year has been consumed, and in addition to strategic reserves, global oil inventories will return to pre pandemic levels in 2021. However, the oil market in the post pandemic era may never return to "normal" again.

The pandemic has forced people to quickly change their behavior, giving rise to new modes of working from home, reduced business and leisure air travel, and other behavioral changes. At the same time, more and more governments in countries are paying attention to the potential for sustainable recovery, hoping to help achieve a low-carbon future. The expectation of oil demand is therefore lowered. If the government implements strong policies and accelerates the transformation of clean energy, the peak oil demand may arrive earlier than previously expected.

These factors push oil producing countries and oil producing enterprises into a dilemma: they do not want to leave resources underground for extraction, nor do they want to build new production capacity that may be idle. But if this leads to insufficient investment, it may have an impact on geopolitics and exacerbate the risk of future supply shortages.

Unbalanced demand recovery path

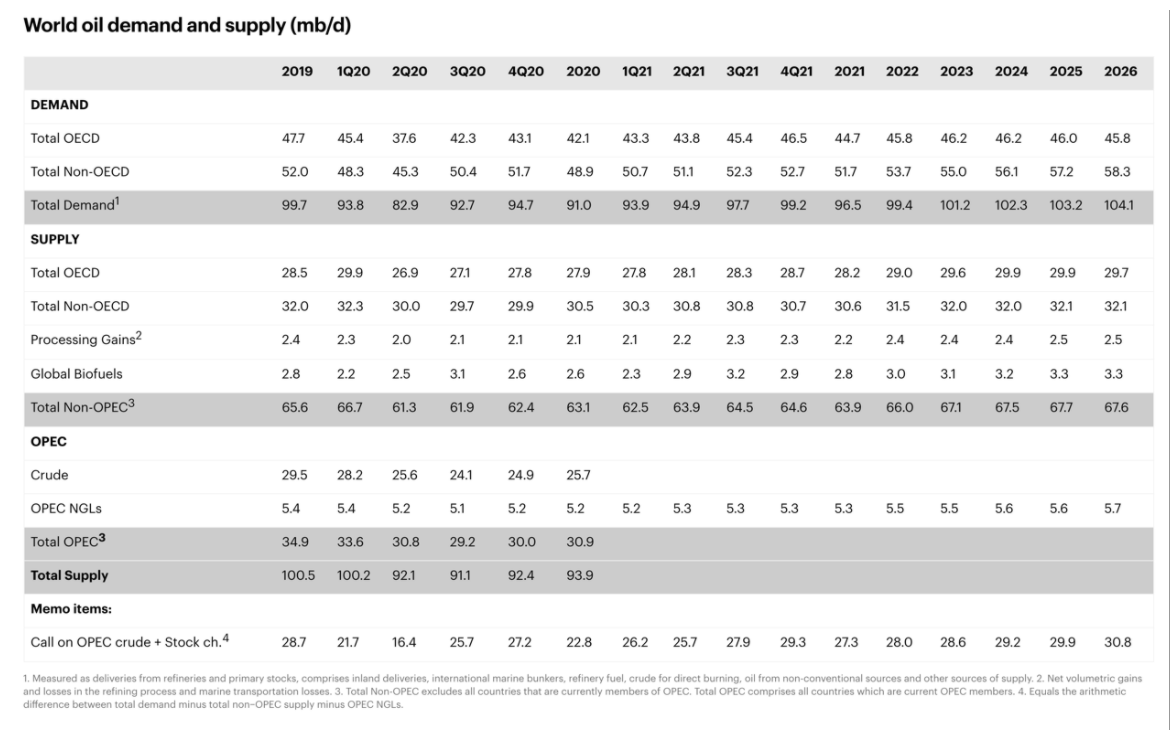

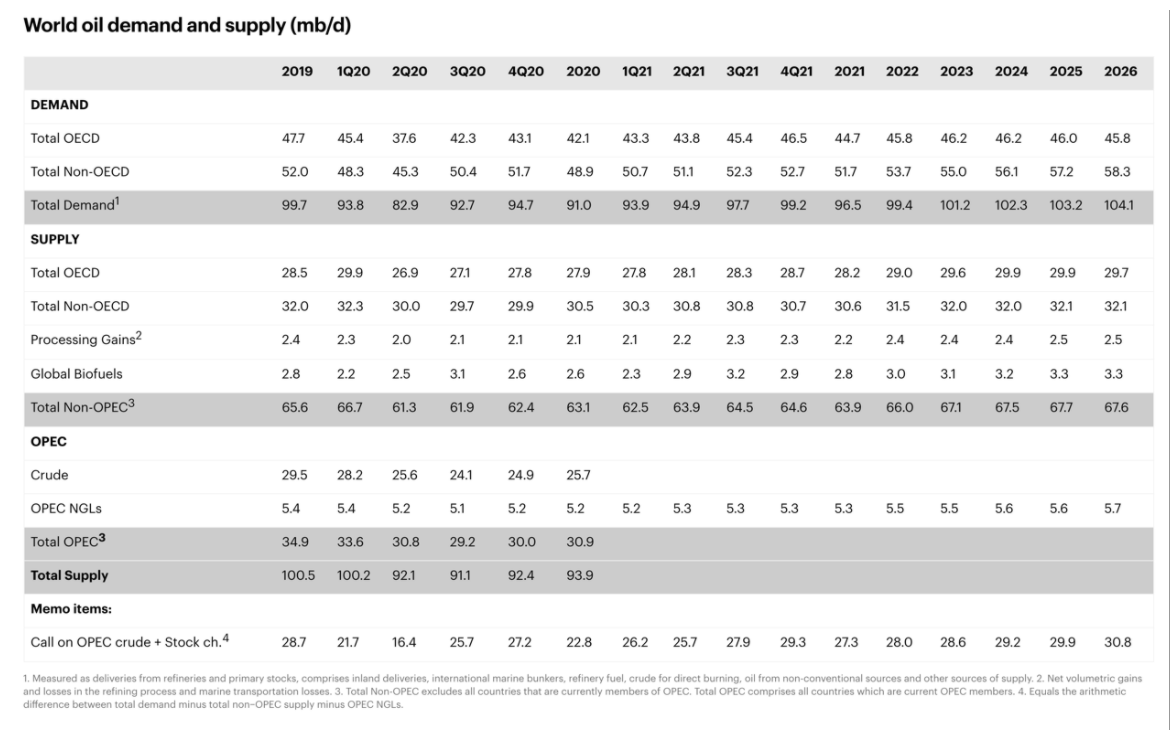

Global oil demand has not yet fully recovered from the impact of the COVID-19 epidemic, and there is little hope of returning to the development track before the epidemic. In 2020, oil demand was nearly 9 million barrels per day lower than in 2019, and the IEA predicts that it will not recover to 2019 levels before 2023. Without more rapid policy intervention and behavioral changes, long-term growth drivers will continue to drive up oil demand.

Therefore, by 2026, global oil consumption is expected to reach 104.1 million barrels per day. This will be 4.4 million barrels per day higher than the 2019 level.

Compared to 2019, the demand growth is expected to come entirely from emerging and developing economies, driven by an increase in population and income. Asian oil demand will continue to grow strongly, although the pace has slowed down compared to before the pandemic. In contrast, the demand of OECD members is not expected to return to pre pandemic levels.

Whether it is the speed or depth of recovery, it is likely to be uneven, not only reflected in geography, but also in different oil sectors and products. The demand for gasoline is likely not to recover to the level of 2019: the improvement in energy efficiency and the transition to electric vehicles have to some extent offset the strong growth of gasoline in the transportation sector of developing countries.

Aviation fuel is the most severely affected by the epidemic, and is expected to recover slowly, and will recover to the level of 2019 by 2024; However, the popularity of web conference may lead to permanent changes in the trend of business travel. During the forecast period, the petrochemical industry remains the pillar of growth. By 2026, ethane, liquefied petroleum gas, and naphtha will collectively account for 70% of the incremental demand for petroleum products.

Spending cuts lead to a slowdown in world oil supply growth

The historic collapse in oil demand in 2020 resulted in a record 9 million barrels per day reserve capacity buffer, sufficient to maintain sufficient supply in the global market for at least the next few years.

In this context, it is not surprising that upstream investment and expansion plans have slowed down. In 2020, the expenses of operators decreased by one-third compared to the budget at the beginning of the year (a decrease of 30% compared to 2019). In 2021, the total upstream investment is expected to increase only slightly.

The sharp decrease in expenditure and project delays have constrained global supply growth, and it is currently expected that world oil production capacity will increase by 5 million barrels per day by 2026. Unless stronger policy measures are taken, global oil production will need to increase by 10.2 million barrels per day by 2026 to meet the expected demand rebound.

Half of the above increase is expected to be provided by Middle Eastern oil production companies, mainly from existing shutdown capacity. If Iran continues to face sanctions, saudi arabia, Iraq, the United Arab Emirates, and Kuwait may need to utilize their remaining production capacity to produce oil at record or near record highs in order to maintain the balance of the world oil market.

This marks a dramatic shift in the reality of the United States leading global supply growth in recent years. In the current policy environment, as investment, activity levels increase, and prices rise, US production growth will recover. However, the hope of growth returning to its recent high is slim. For the tight oil industry, the business model has significantly shifted to strictly control expenditure, generate Free cash flow, deleverage and provide cash returns for investors, and the development prospects have been constrained.

For most of the medium term, the global market remains in a state of sufficient supply. However, in the absence of new upstream investment, the reserve capacity buffer will slowly shrink. By 2026, the global effective reserve capacity (excluding Iran) may decrease to 2.4 million barrels per day, the lowest level since 2016. -

The Refinery Industry in the Third Round of Capacity Rationalization Adjustment

As the upstream industry's capacity buffer may shrink, the refining industry is struggling with overcapacity. The demand shock, large-scale expansion and the expectation of long-term structural decline of demand brought by the COVID-19 have formed the surplus that can only be eliminated through large-scale shutdown.

Currently, the third wave of refinery capacity rationalization adjustments worldwide is underway. Currently, a global shutdown of 3.6 million barrels per day has been announced, but to restore utilization to over 80%, a total of at least 6 million barrels per day need to be shut down.

The business east of Suez is expected to cover all the incremental refining activities from 2020 to 2026 compared to 2019. Therefore, by 2026, Asian Crude Oil imports are expected to surge to nearly 27 million barrels per day, requiring record levels of Middle Eastern crude oil exports and Atlantic Basin production to fill the gap. The focus of finished product trade will also shift to Asia, leading to an increase in the region's dependence on oil imports to 82% by 2026. -

Increasing policy efforts can reduce demand early on

To achieve the grand goal of net zero emissions in the middle of this century, it is necessary to increase efforts to transform towards a clean energy future. This will require more specific government policies and legislative measures, as well as significant behavioral changes.

Further improvements in fuel efficiency are needed, including increasing remote work and reducing business travel, significantly increasing the market share of electric vehicles, developing new policies to curb oil consumption in the power sector, and expanding recycling and reuse. The above measures will reduce oil consumption by up to 5.6 million barrels per day by 2026, which means that oil demand will never return to pre pandemic levels.

Considering current industry plans, government policies, and existing energy transformation measures, global oil demand is expected to increase by 3.5 million barrels per day between 2019 and 2025. To achieve the sustainable development scenario outlined in the World Energy Outlook, oil demand must decrease by 3 million barrels per day over the same period (the sustainable development scenario outlines the path to achieving the climate goals of the Paris Agreement and other sustainable energy goals). If we want to achieve global net zero emissions before 2050, we must significantly reduce oil demand.

Industry Impact

In order to accelerate the transition to a sustainable future, the government quickly formulated plans; This creates a high degree of uncertainty and is a test for the oil industry. Even during rapid transformation, investing in the upstream sector is crucial, as it will still take years for global transportation to shift from internal combustion engines to electric vehicles and other low-carbon alternatives. The aviation, shipping, petrochemical and other industries will continue to rely on oil for a period of time.

Regardless of the path taken for transformation, the oil and gas industry will play an important role, and various energy enterprises will also be affected. The top priority is to minimize emissions from core operations, especially methane emissions. The oil and gas industry can also make significant contributions to decarbonization in some of the most difficult sectors to address emission issues, including the development of carbon capture, utilization, and storage, low hydrocarbons, biofuels, and offshore wind energy. Some oil and gas companies have already begun to expand their commitments in the aforementioned areas.

Effective and orderly transformation will be crucial for achieving international climate goals and preventing severe supply disruptions and destabilizing price fluctuations.