Oil prices ticked higher in early trade on Thursday as investors weighed

impacts of the escalating conflict in the Middle East, against an amply-supplied

global market.

Israel has launched a ground operation across its northern border into

Lebanon targeting the Iran-backed militant group Hezbollah, opening a new and

dangerous phase in almost a year of war.

Iran was drawn into the conflict after it fired more than 180 ballistic

missiles at Israel in an escalation of hostilities, which have seeped out of

Israel and Palestine into Lebanon and further east.

But an unexpected build in US crude partly offset supply disruption concerns.

The EIA showed that rose by 3.9 million barrels last week, compared with

analysts' expectations for a drop of 1.3 million barrels.

OPEC has enough spare oil capacity to compensate for a full loss of Iranian

supply if Israel knocks out that country's facilities. Oil slumps 17% in the

previous quarter as economic data portend weak demand.

China's factory activity shrank for a fifth straight month and the services

sector slowed sharply in September, suggesting Beijing could grapple with its

2024 growth target even with stimulus blitz.

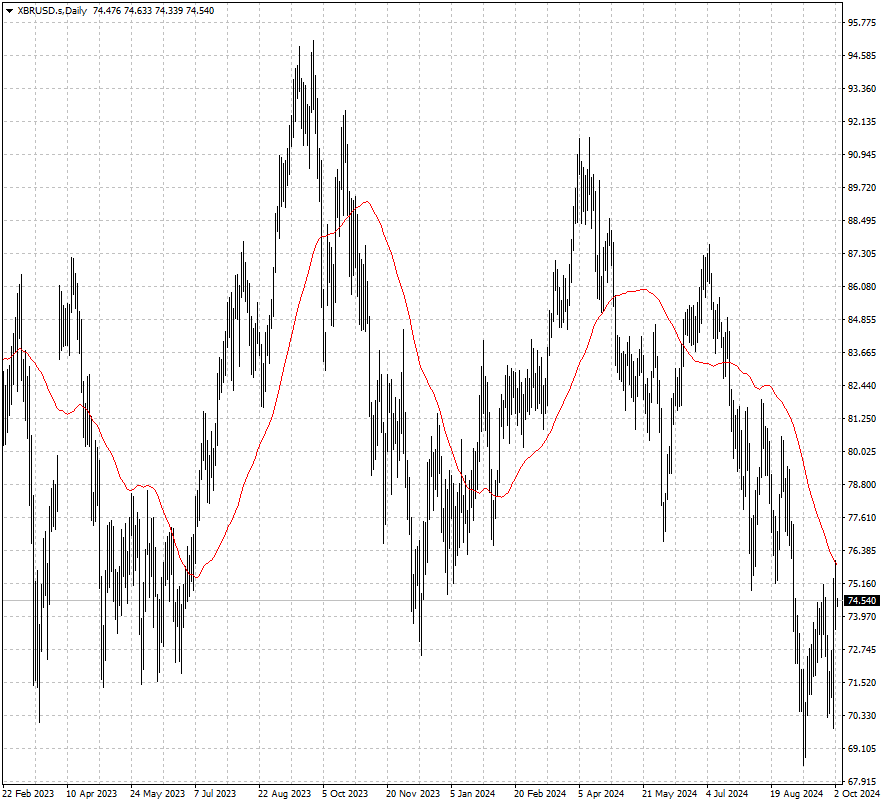

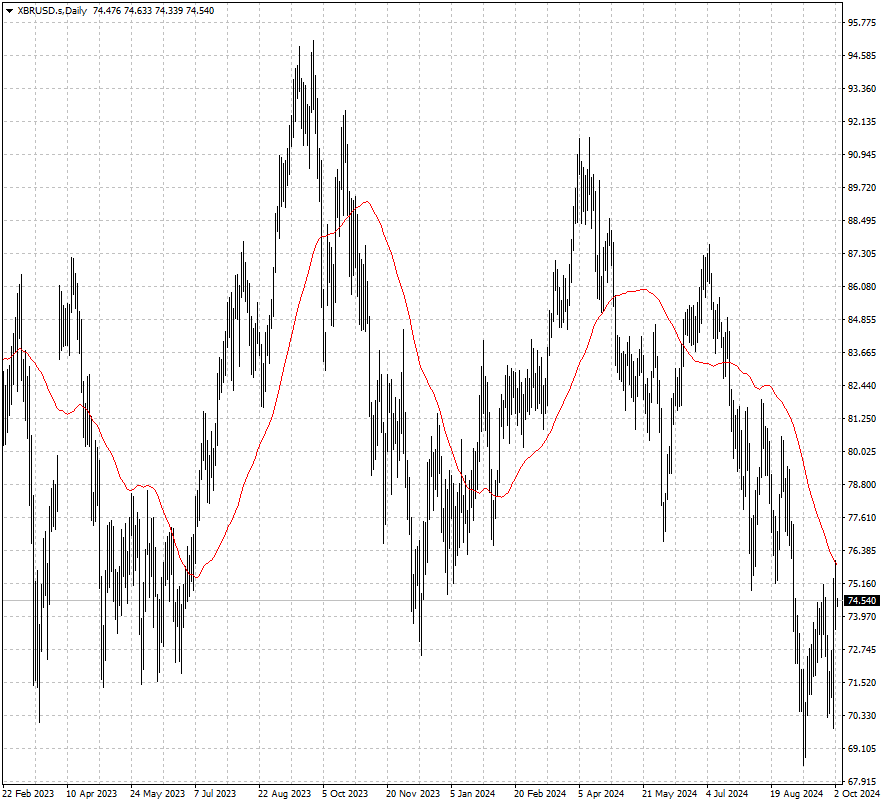

Brent Crude's gains were capped by 50 SMA. If the price fails to break above

the level, we maintain a bearish bias.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.