The euro eased on Wednesday after the German parliament elected conservative

leader Friedrich Merz as chancellor. But he was the first chancellor candidate

since World War II to fail to win election in the first round.

The Chancellor vowed reforms and new investments as the country's centrist

parties signed a coalition agreement and announced additional members of the

cabinet.

The ECB made yet another 25-bp interest rate cut at April's meeting as tariff

turmoil along with a prolonged war in Ukraine has created widespread uncertainty

and spurred fears about growth outlook.

The euro zone economy grew by a stronger-than-expected 0.4% in Q1, flash data

from Eurostat showed. A plunge in energy prices in the current quarter may help

cool inflation further.

Germany rose 0.2% over the same period and French GDP added 0.1% across the

three-month stretch. Southern European and smaller economies outperformed, with

Italy's output growing by 0.3%.

The EU is preparing for the possible end of a 90-day tariff truce, after

which these levies could rise to 20% on 8 July. Its trade chief said the bloc

will not be pressured into an unfair trade deal with the US.

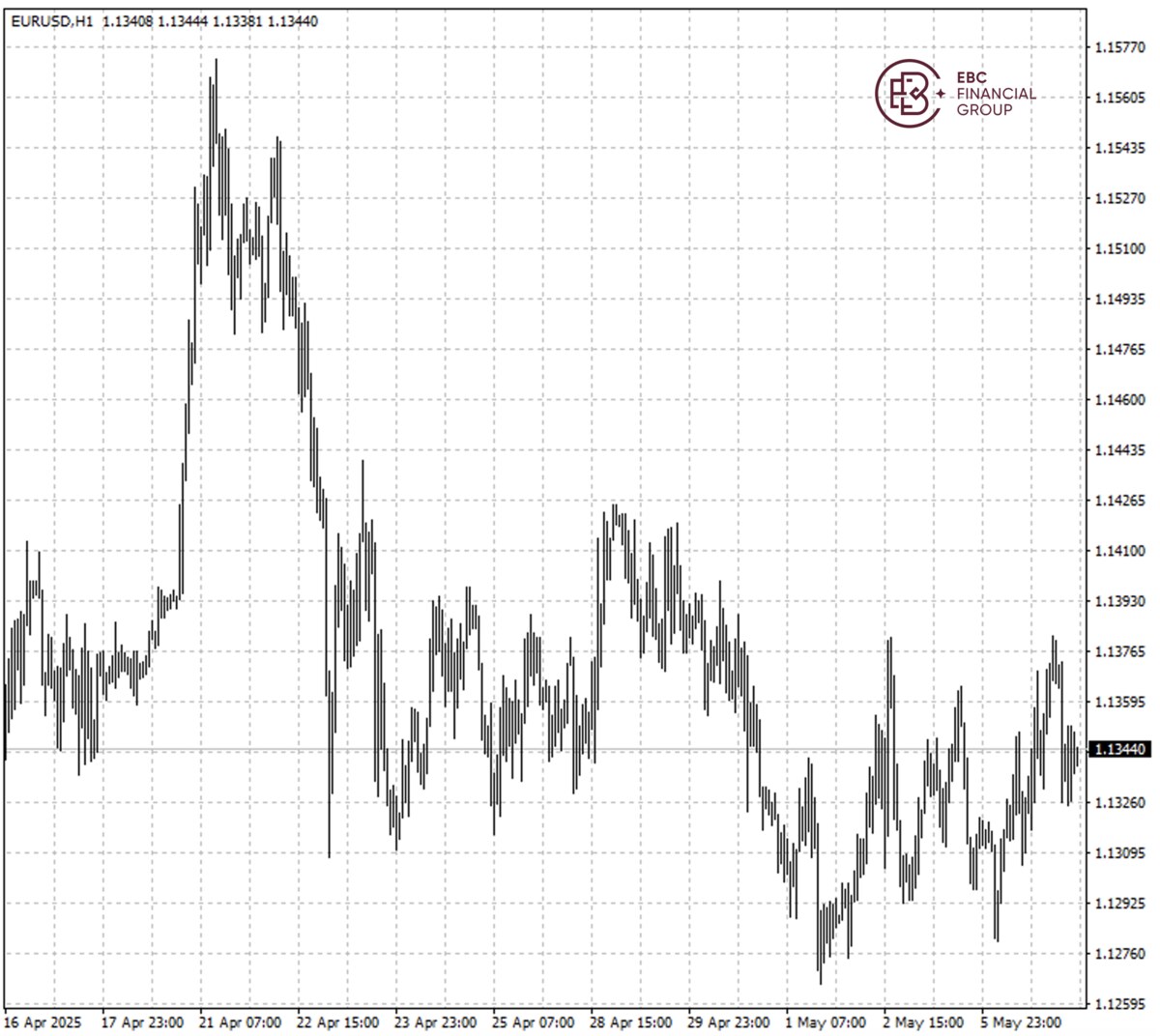

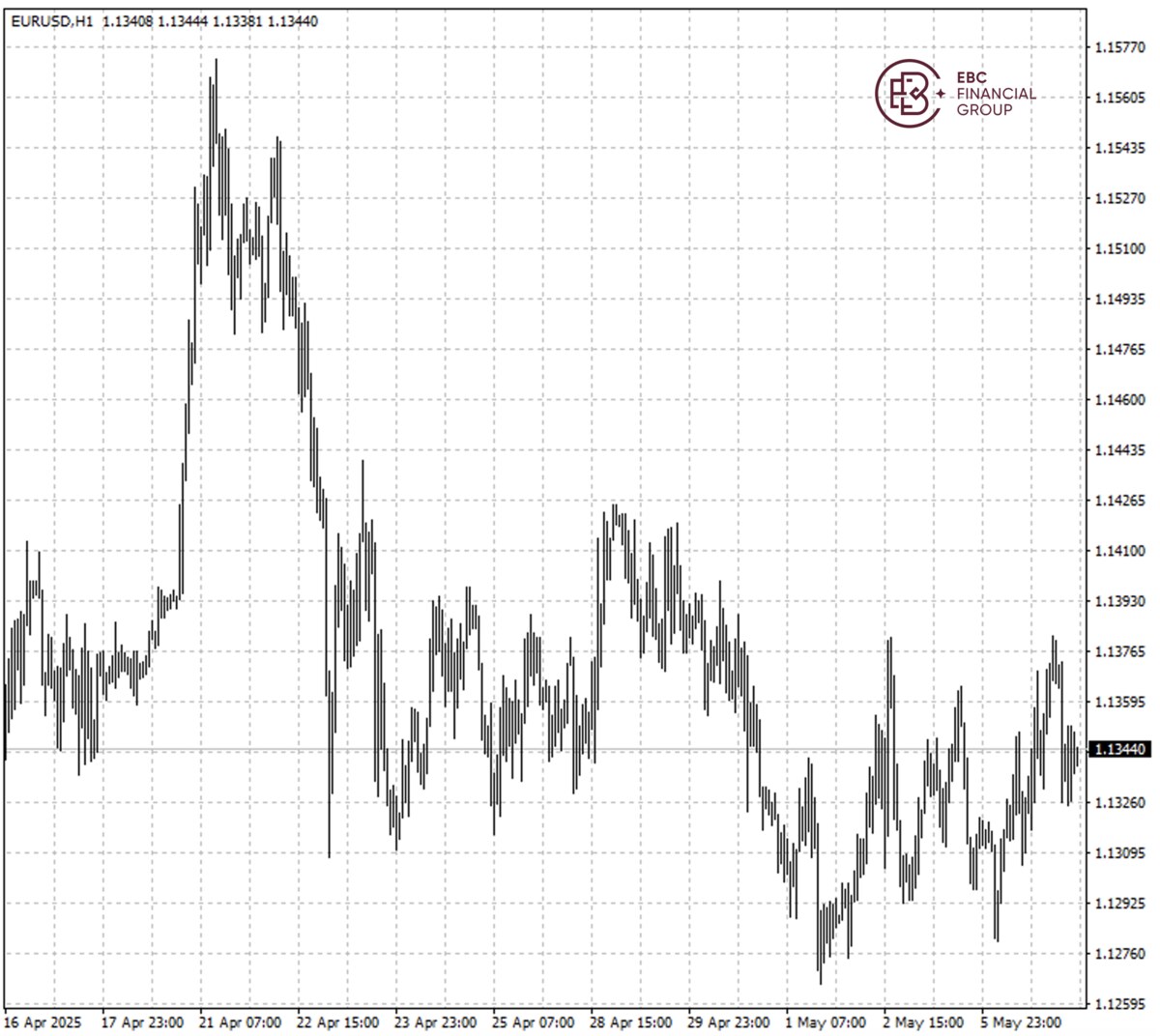

The single currency faces downside risks given double top pattern. The

initial support is seen around 1.1290, a break below which could expose

1.1280.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.