Bullion held firm on Wednesday on the back of tense Russia-Ukraine

negotiations. Ukraine President Zelenskiy said no peace deal could be made

behind his back.

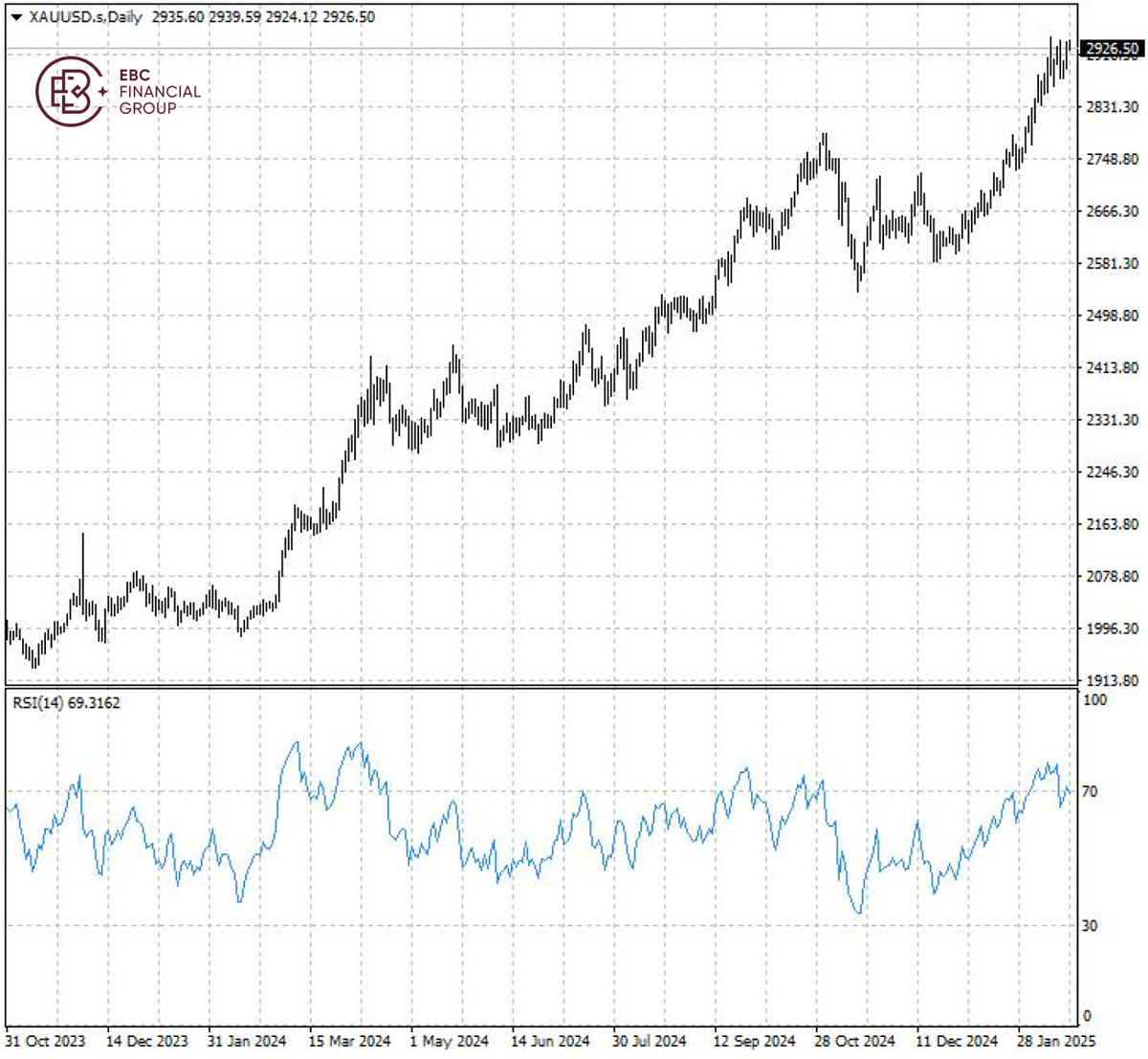

Goldman Sachs raised its year-end gold target to $3,100 an ounce on

central-bank buying and inflows into bullion-backed ETFs, highlighting Wall

Street's enthusiasm for the metal.

Should uncertainty over economic policy persist, including on tariffs,

bullion could hit $3,300 an ounce on higher speculative positioning, according

to the bank.

Citigroup said earlier this month that it expects prices to hit $3,000 an

ounce within three months, with geopolitical tensions and trade wars stoked by

Trump boosting demand for haven assets.

There are structural shifts that are creating a bullish backdrop for the

precious metal. Central bank buying has been the biggest driver of the market

instead of Chinese and Indian consumer demand.

While the central bank buying is hardly predictable, investment flows may

help underpin the ongoing rally. Gold ETFs added $3 billion in January, led by

Europe that is mired in geopolitical malaise.

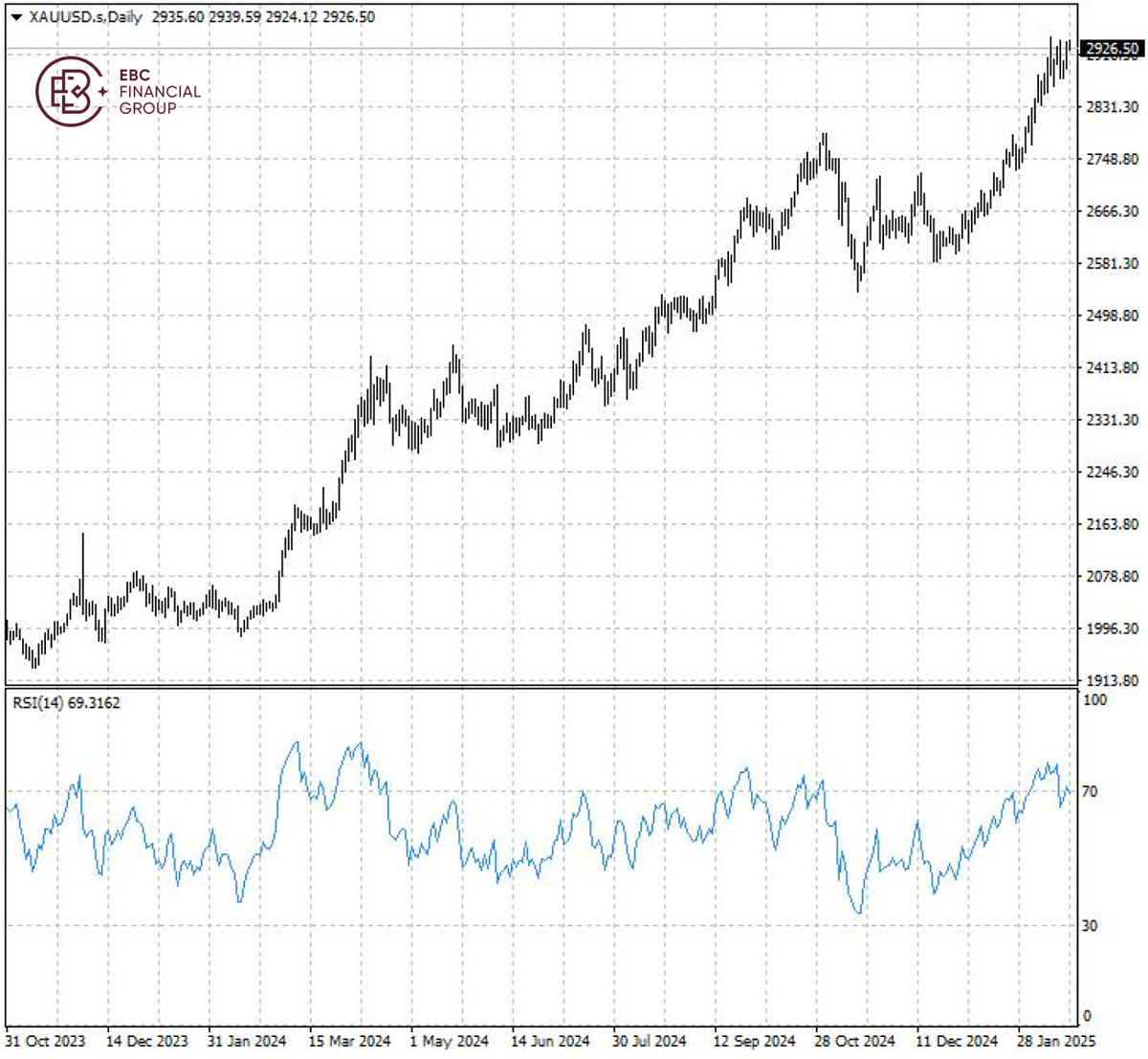

Gold has returned to the overbought territory amid sigs of a triple top

pattern, so it will likely head back to $2,900.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.