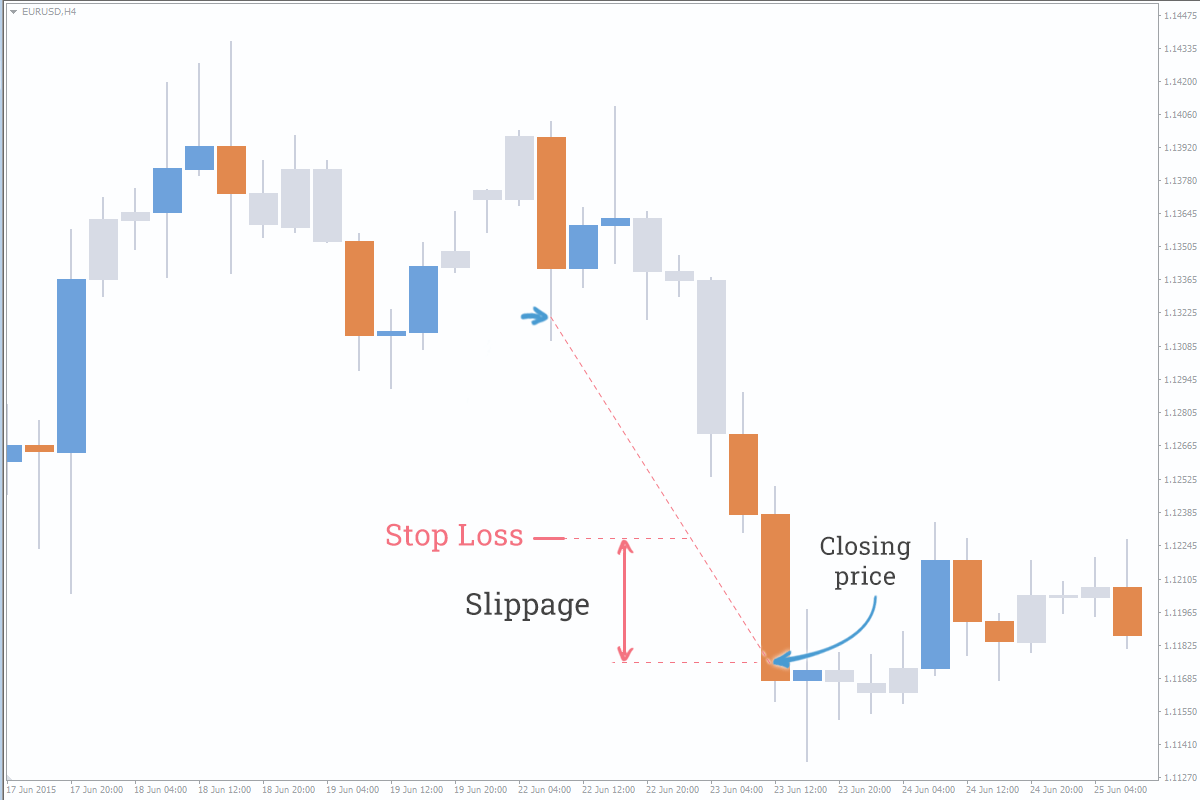

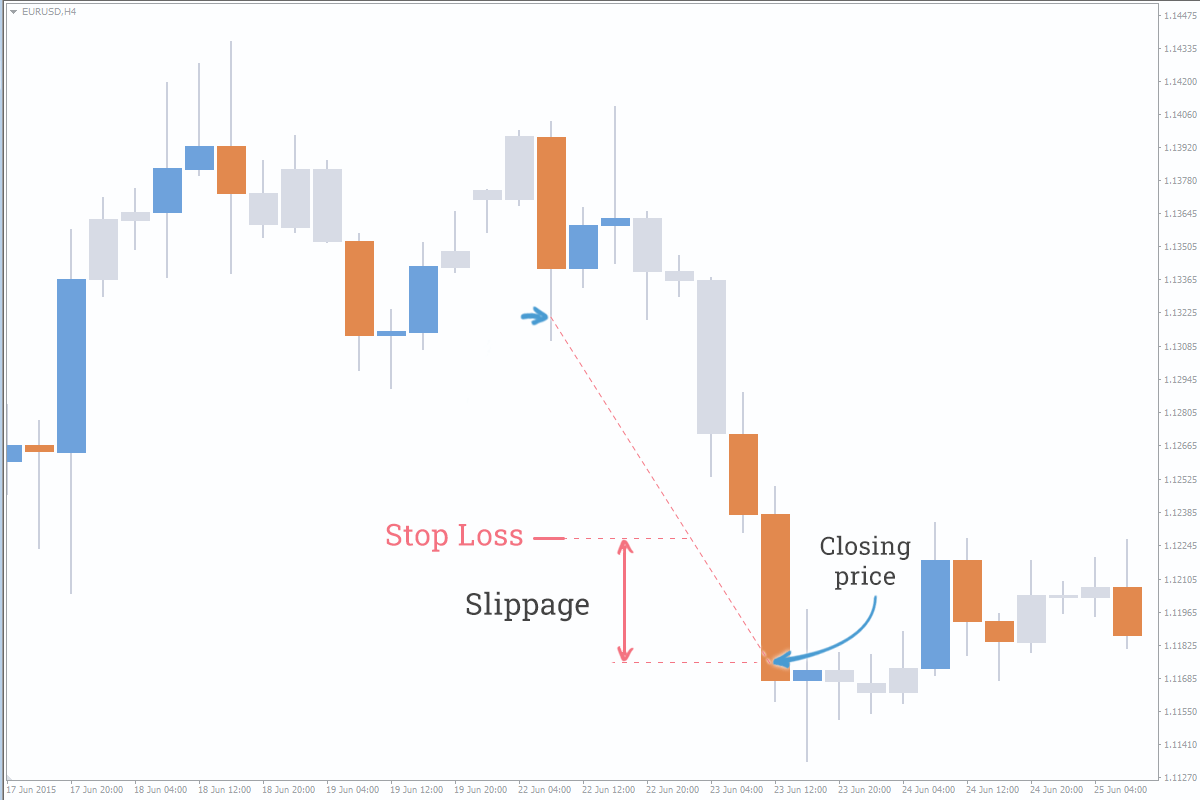

Every forex trader views major market fluctuations as lucrative opportunities. However, post-transaction, encountering slippage can lead to significant, unexpected losses—a frustrating scenario for any investor. How can traders effectively manage and mitigate slippage? Here's a comprehensive guide to help you navigate this challenge.

When it comes to slippage, it's inevitable to experience market price fluctuations when entering and exiting trades. Many traders perceive this as slippage, but it's actually an issue with bank quotes. The quote gaps may not align with the expectations of all traders, especially those using platforms with floating spreads. As long as orders are executed based on the actual market price, some slippage is understandable.

During major news events or important data releases, the forex market experiences significant volatility, increasing the likelihood of slippage. This has become a major concern for many traders. Have you ever noticed when your trade orders, stop losses, and limits are typically triggered throughout the day? Orders executed during high-risk news releases are more prone to experiencing slippage due to rapid market fluctuations and lower liquidity (as most financial institutions avoid closing positions during news releases). Check whether your orders were executed during these volatile periods or during the opening and closing times of each trading day when liquidity is relatively low. It's advisable to avoid these times to minimize the risk of encountering slippage in your trades.

Can the Sliding Point Be Controlled?

1. The sliding point of the price Limit Order is most commonly seen in the market price list and may appear at both entry and exit. To avoid bidirectional sliding points, traders also choose limit orders. Limit orders are only sold at designated prices or better. If a limit order is used and the optimal tradable price is still less than our limit price, the transaction will remain in a waiting mode and will not be triggered. Sometimes a limit order means losing potential profit opportunities, but it also allows you to avoid excessive investment in trading.

2. The market scope command allows you to set an acceptable price range (in basis points) for reaching a trade. If your trade cannot be reached at the price within the selected range, the trade will be cancelled and the position will not be opened. Therefore, such commands limit the scale of the sliding points you may face. The wider the range you set, the greater the likelihood of a trade. From this perspective, there is no best way to avoid sliding points, so it is particularly important for us to choose a trading platform with stable servers and strong liquidity. Under normal circumstances, the greater the liquidity that platform providers connect with, the less likely they are to experience slippage points. The more advanced the server technology of platform providers, the further they can avoid slippage points caused by network latency.

If you encounter a slippage on an online trading platform, you can take the following measures:

1. Confirm if the sliding point exceeds the normal range: When the market fluctuates violently or has low liquidity, the sliding point is very normal. Therefore, it is necessary to first confirm whether the sliding point has exceeded the normal range.

2. Contact the broker: If you think the slip point is unreasonable or too large, you can solve the problem by contacting the broker. Please provide detailed information about the order and slip points to help them understand the situation.

3. Seek third-party mediation: If the problem cannot be resolved by contacting the broker, consider seeking third-party mediation. Some regulatory agencies provide dispute resolution services, and you can seek help from them.

4. Reduce risk: To reduce the impact of slip points on your trading, you can consider using tools such as stop loss orders and limit orders to manage risk. In addition, it is also possible to try to avoid trading during periods of intense market volatility or low liquidity.

EBC Platform Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.