Trend trading is a trading strategy based on market trends. It is based on

the core viewpoint that price trends are persistent; that is, once prices begin

to move in a certain direction, they are likely to continue moving in that

direction for a period of time. Therefore, the goal of trend trading is to

capture trends in price increases or decreases and utilize these trends to earn

profits.

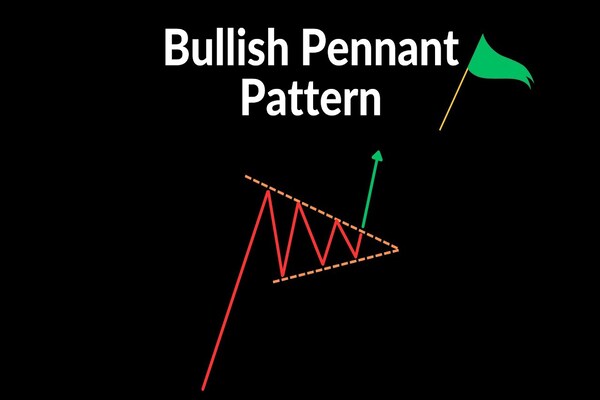

Trend traders determine the direction and strength of the market trend by

analyzing historical price data, Chart Patterns, technical indicators, etc. Once

the direction of the trend is determined, traders will enter the market and hold

positions in the hope that the trend can continue for a period of time, thereby

earning sufficient profits. Trend traders typically set stop loss orders to

limit potential losses and use a gradual stop gain strategy to protect

profitable positions.

Trend trading is widely used in various financial markets, including stock,

foreign exchange, commodity, and futures markets. It relies on technical

analysis methods and tools such as moving averages, trend lines, relative

strength indicators, etc. Although the idea of trend trading is relatively

simple, in practical applications, it is necessary to comprehensively consider

market risk and volatility and develop appropriate trading plans and risk

management strategies.

For traders, trends are a powerful profit driver, so if they want to make the

most money, they should pay attention to them. What retail traders do not

realize is that, for the same reason, trend trading profits are extremely high,

and trading against trends may cause a devastating blow to account funds.

When will Traders Trade Against the Trend?

1. Loss of account funds occurs not only when there is a loss but also when there is minimal or no profit.

2. Profits accrue slowly, while losses escalate swiftly.

3. In wider trading ranges, losses often outweigh any generated profits.

If you want to see your account funds diminish rapidly, simply trade against the trend.

It should be noted that the market does not always move according to the

trend, and sometimes there may be sideways or volatile markets, which may be a

challenge for trend traders. Therefore, trend trading is not always successful,

and traders need to possess good market analysis skills, risk control skills,

and psychological qualities.