Forex buying price: also known as "quoted price" or "askPrice "is the price that the buyer needs to pay to purchase the benchmark currency, which is the value of the quoted currency. Taking the euro/US dollar as an example, if the current quotation for the currency transaction pair is 1.2000, a payment of 1.2000 US dollars is required to purchase 1 euro.

Forex selling price: also known as "bid price" or "bidPrice" refers to the price obtained by the seller from selling the benchmark currency, which is the value of the benchmark currency. Taking the euro/US dollar as an example, if the current quotation for the currency transaction pair is 1.2000, 1 euro can be sold at a price of 1.2000 US dollars.

The difference between forex buying and selling prices

The transaction method is different: if a foreign currency is purchased at a bank, the bank will give a corresponding selling price, which is the price that the buyer needs to accept. If the bank uses foreign currency to exchange for local currency, the bank's buying price applies. The difference between the buying price and selling price is the bank's profit.

Exchange rates are different: the price at which gold is sold is determined from the bank's perspective, not from the customer's perspective; In addition, the above prices are all in foreign currency and are not calculated based on local currency purchase or sale prices. The difference between the buying and selling prices is compensation for bank risk, usually 1% -5%.

What are the examples of buying and selling prices?

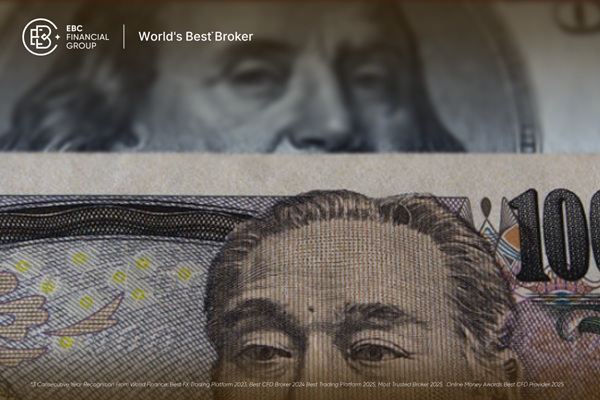

If the ratio of US dollars to Japanese yen is 115.25/115.35, then this means that one customer sells US dollars to the bank at an exchange rate of 115.25 to purchase Japanese yen (the bank purchases US dollars), while another customer sells Japanese yen to the bank at an exchange rate of 115.35 to purchase US dollars.

If the customer wants to convert 100 US dollars into Japanese yen, they can convert it into 11525 Japanese yen (i.e. 100 * 115.25) at the exchange rate of 115.25; Alternatively, if you want to exchange Japanese yen for US dollars, 10000 Japanese yen is equivalent to 86.69 US dollars (i.e. 10000/115.35).

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.