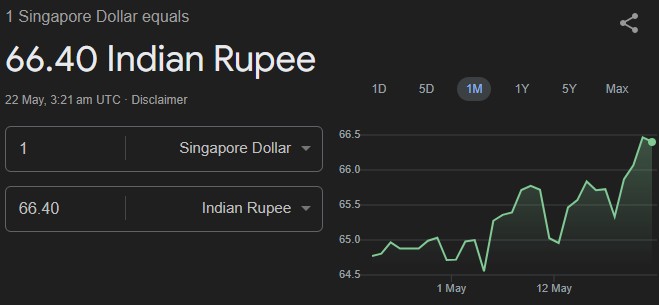

The Singapore dollar (SGD) to Indian rupee (INR) currency pair is influenced by more than just economic data and central bank policy. Trader sentiment and market psychology play a crucial role in shaping price movements, volatility, and trading opportunities.

Understanding how emotions, crowd behaviour, and sentiment indicators affect SGD to INR can give traders a valuable edge in today's fast-moving FX market.

Why Sentiment Matters in SGD to INR Trading

Sentiment analysis is the study of how traders feel about a currency pair—whether they are bullish, bearish, or undecided. In the SGD to INR market, sentiment can shift rapidly in response to news, economic releases, or geopolitical developments. When most traders are optimistic about the Singapore dollar, for example, buying pressure can push SGD/INR higher, sometimes beyond what fundamentals alone would justify.

Market psychology refers to the collective emotions and biases that drive trading decisions. Fear, greed, optimism, and panic can all trigger sharp moves, especially in emerging market pairs like SGD to INR, where liquidity can fluctuate and local news can have an outsized impact.

Key Sentiment Indicators for SGD to INR

1. Commitment of Traders (COT) Reports

While COT reports are more widely used for major currencies, they can still offer clues about institutional positioning in Asian FX markets. A surge in net long positions on SGD or net shorts on INR may signal a shift in sentiment that could influence the pair.

2. Retail Positioning Data

Some trading platforms publish data showing the percentage of traders long or short on SGD/INR. Heavy one-sided positioning can sometimes precede a reversal, as crowded trades are vulnerable to sudden changes in sentiment.

3. News and Social Media Analysis

Modern sentiment analysis often includes monitoring financial news headlines, social media chatter, and analyst commentary. Sudden spikes in positive or negative news about Singapore's economy, India's monetary policy, or regional events can quickly shift trader sentiment.

4. Volatility and Volume

Sharp increases in trading volume or volatility often reflect heightened emotional trading. For SGD to INR, this might occur around Reserve Bank of India (RBI) or Monetary Authority of Singapore (MAS) announcements, or in response to unexpected economic data.

How Market Psychology Drives SGD to INR Moves

Herd Behaviour

When a majority of traders move in the same direction, it can create momentum trades. For instance, if strong Singapore GDP data is released, traders may rush to buy SGD, pushing the rate higher. However, when sentiment becomes too one-sided, it can set the stage for a sharp correction as traders take profits or reverse positions.

Overreaction and Mean Reversion

FX markets often overreact to news, with prices swinging more than justified by fundamentals. This creates opportunities for contrarian traders who recognise when SGD to INR has moved too far, too fast, and is likely to revert to a more sustainable level.

Fear and Greed

Periods of high uncertainty—such as elections, geopolitical tensions, or surprise economic shocks—can trigger fear-driven selling or panic buying. Conversely, overconfidence during strong trends can lead to excessive risk-taking and sudden reversals.

Practical Tips for Using Sentiment in SGD to INR Trading

Monitor sentiment indicators: Use retail positioning, news sentiment, and volume data to gauge the mood of the market.

Watch for extremes: Extreme bullishness or bearishness often signals a potential turning point.

Combine with technical and fundamental analysis: Sentiment is most powerful when used alongside Chart Patterns and macroeconomic trends.

Stay disciplined: Avoid getting swept up by crowd emotions. Stick to your Trading plan and use stop-losses to manage risk.

Real-World Example: Sentiment Shift in Action

Suppose the MAS unexpectedly raises interest rates to combat inflation. News headlines turn bullish on SGD, and retail data shows a surge in long positions. The SGD to INR rate climbs rapidly.

However, as sentiment becomes overwhelmingly positive, technical indicators show overbought conditions. Soon, profit-taking and a shift in sentiment trigger a pullback, illustrating how market psychology can drive and reverse trends.

Final Thoughts

Understanding sentiment analysis and market psychology can help traders anticipate moves, manage risk, and spot opportunities in the SGD to INR pair. By staying aware of crowd behaviour, monitoring sentiment indicators, and remaining disciplined, traders can gain an edge in this dynamic FX market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.