EBC Forex Snapshot

9 Oct 2023

Safe haven demand pushed the US dollar and Japanese yen higher on Monday as

Israel-Gaza conflict erupts into war. Risk sentiment was fragile amid rising

global bloodshed.

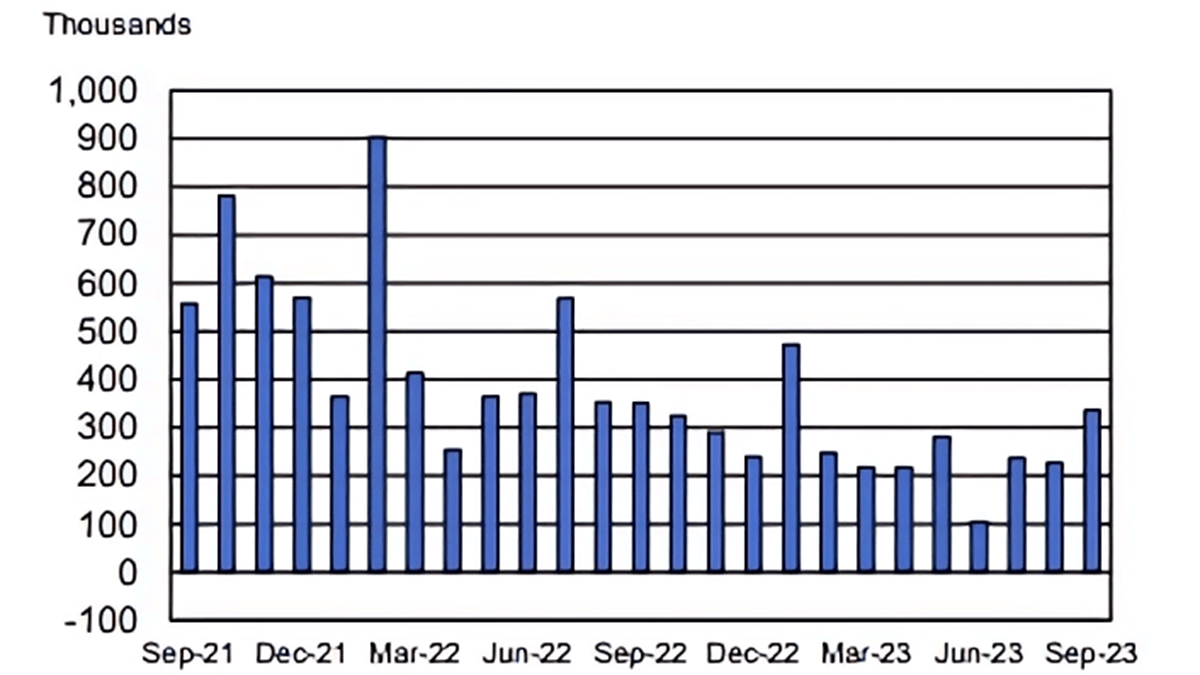

Market pricing shows a roughly 78% chance that the Fed will keep rates on

hold at its Nov’s policy meeting after a strong job report.

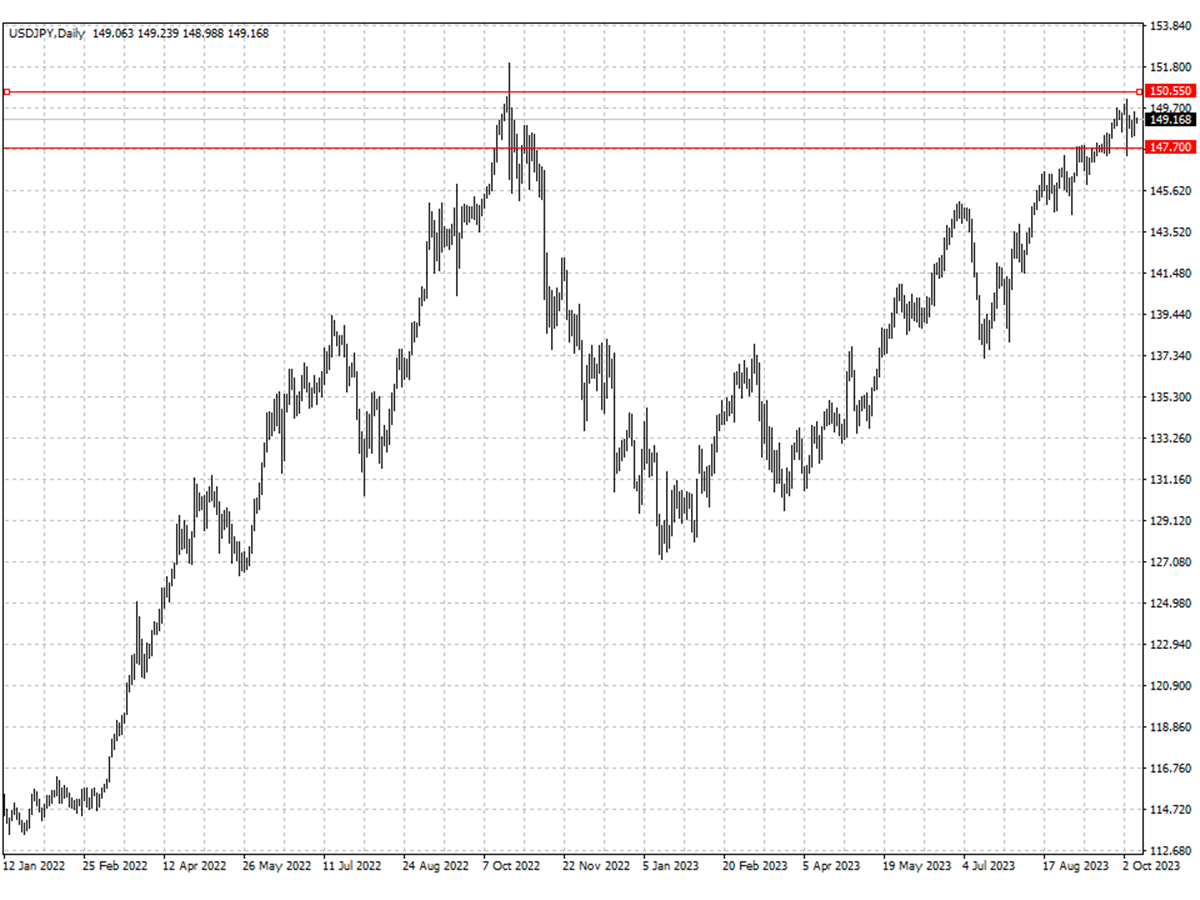

Japan will unlikely seek an intervention as recent falls reflect economic

fundamentals, former top currency diplomat Naoyuki Shinohara said.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 3 Oct) |

HSBC (as of 9 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0477 |

1.0834 |

1.0443 |

1.0732 |

| GBP/USD |

1.2011 |

1.2308 |

1.2042 |

1.2428 |

| USD/CHF |

0.8745 |

0.9338 |

0.8938 |

0.9252 |

| AUD/USD |

0.6300 |

0.6522 |

0.6274 |

0.6502 |

| USD/CAD |

1.3302 |

1.3695 |

1.3441 |

1.3833 |

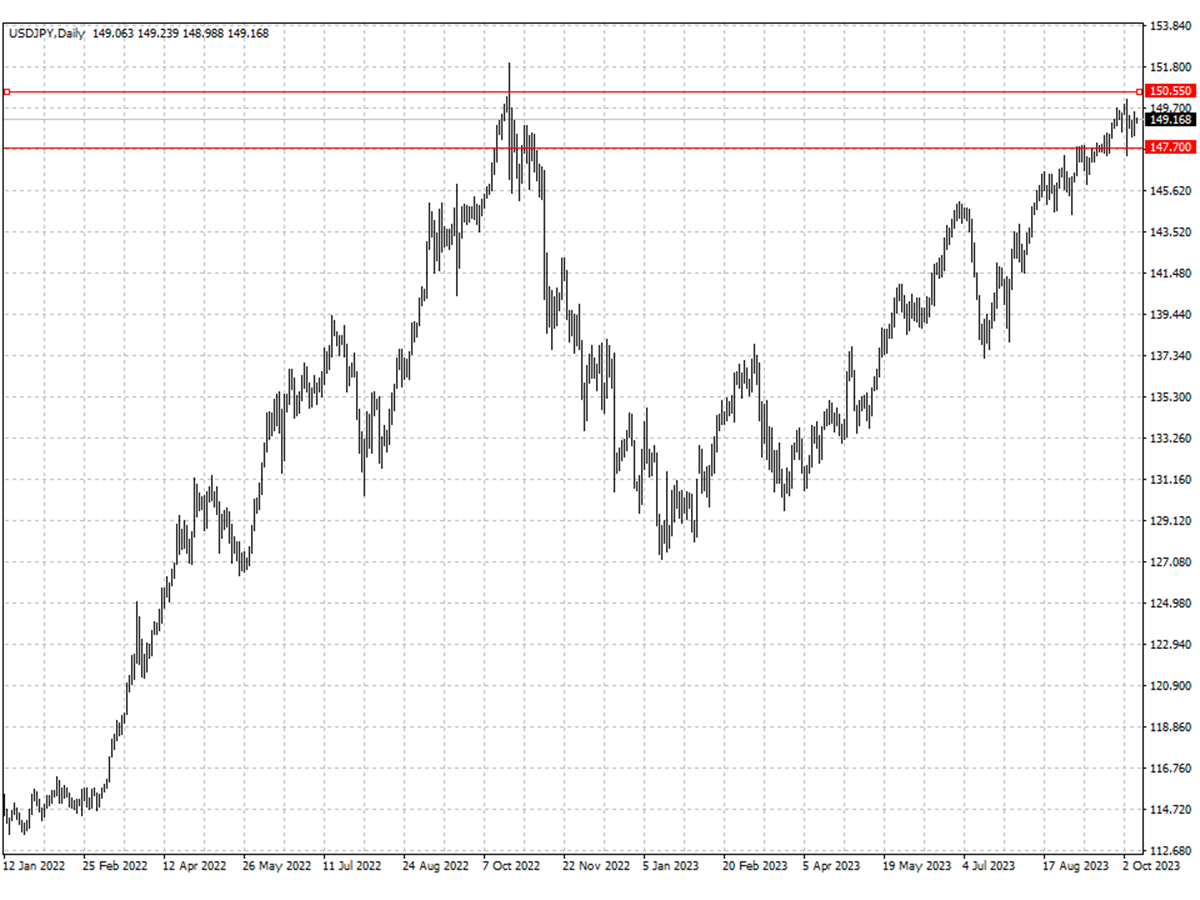

| USD/JPY |

144.54 |

150.15 |

147.70 |

150.55 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.