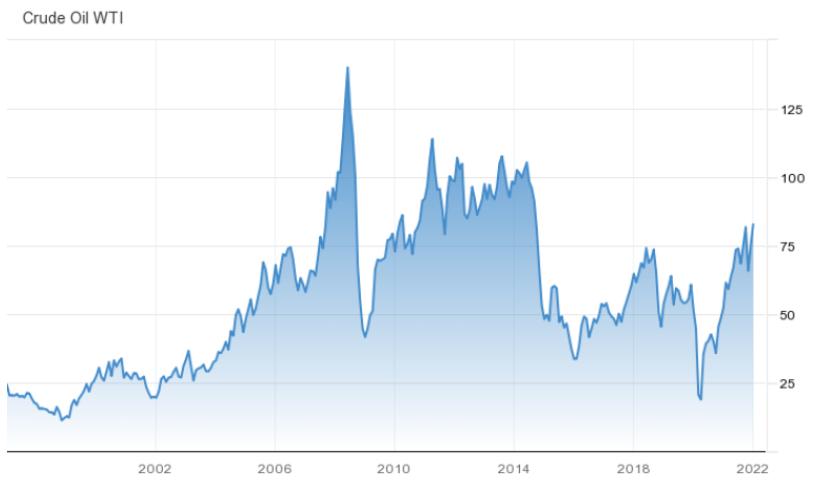

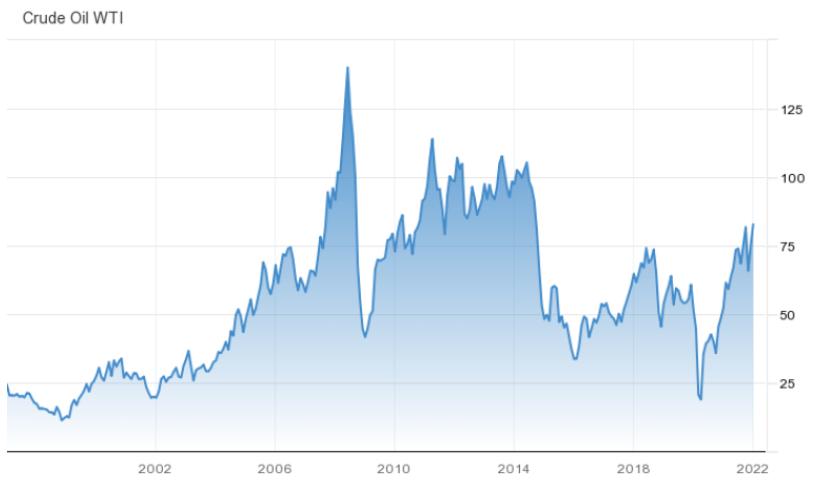

In the previous issue, we talked about the negative correlation between gold and the money market. In this issue, let's talk about another very important commodity, which many people call "black gold", which is Crude Oil. Unlike gold, human demand for crude oil is a necessity. Countries around the world need crude oil to drive their economic development, produce electricity, and other daily needs. The operation of cars and airplanes requires crude oil, and factories also require crude oil for productionTherefore, crude oil plays an indelible role in the long river of human history.

Market correlation between crude oil and USD/CAD

Canada is one of the world's largest crude oil producers, exporting 3 million barrels of crude oil and petroleum products to the United States every day. This has made the Canadian economy the largest crude oil supplier to the United States, while also making the canadian dollar a commodity currency. Due to the huge amount of crude oil exported by Canada, the position of the Canadian dollar in the world currency cannot be underestimated.

The following figure shows the import volume of crude oil from the United States:

The following figure shows the trend of the US dollar/Canadian dollar:

It is evident that the economic foundation and the import volume of US crude oil affect the price of the US dollar/Canadian dollar. Canada's economy is highly dependent on exports, with 85% of its goods and services exported to its southern neighbor, the United States of America (USA). Due to the trade between Canada and the United States, the US dollar/Canadian dollar is largely influenced by consumer sentiment towards oil prices.

If the demand for crude oil in the United States increases, manufacturers will need to import more crude oil to meet the rising demand. This will lead to an increase in oil prices, which in turn will lead to a decline in the US dollar/Canadian dollar. If demand in the United States decreases, manufacturers may relatively reduce imports, which may have a negative impact on demand for the Canadian dollar. It can be seen that there is a negative correlation between crude oil and the US dollar/Canadian dollar. According to statistical data, between 2000 and 2016, crude oil prices showed a 93% negative correlation with the US dollar/Canadian dollar. When oil prices rise, the US dollar/Canadian dollar falls. When oil prices fall, the US dollar/Canadian dollar rises.

Changes in the relationship between crude oil and the US dollar

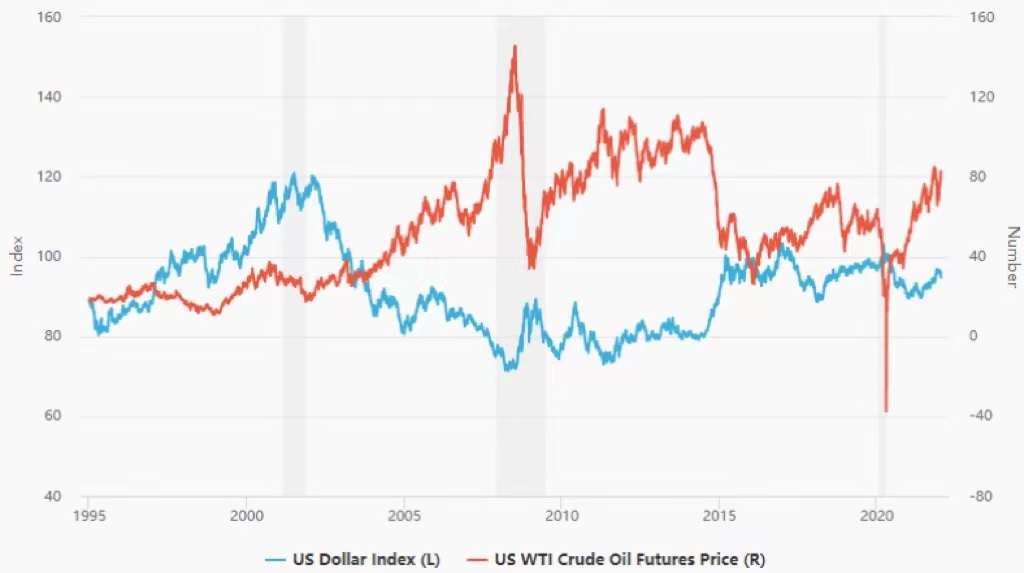

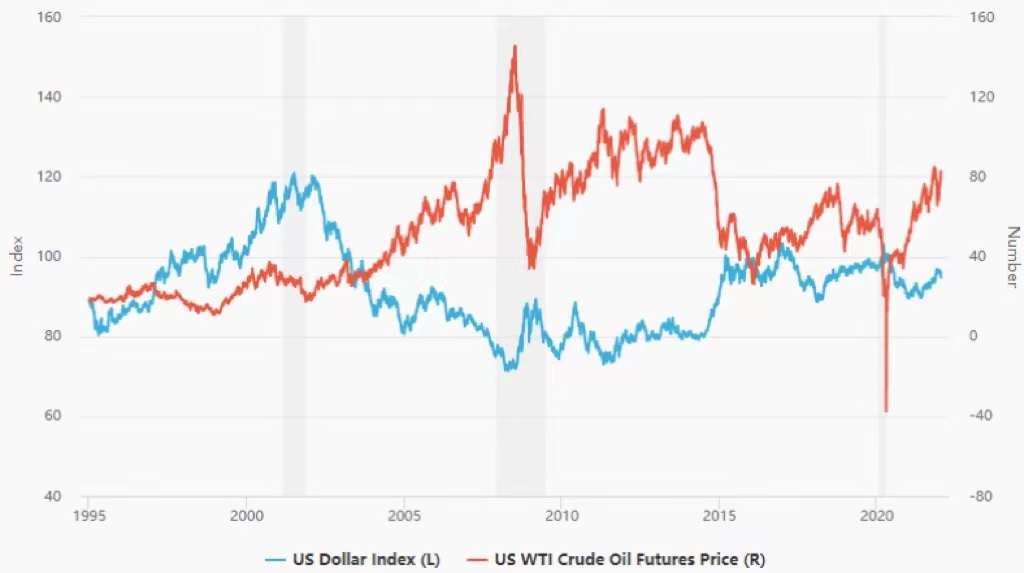

From a historical perspective, inter market analysis has shown a negative correlation between crude oil prices and the US dollar. This is due to two main factors, namely:

Crude oil is priced based on US dollars;

Throughout history, the United States has been a net importer of crude oil.

If we combine the trend of US crude oil imports with the US dollar, we can see the following figure:

As shown in the figure, the first point of the above analysis is the main reason, as the US dollar and crude oil have a strong correlation. When the US dollar appreciates, the amount of US dollars required to purchase a barrel of crude oil will be even less. When the US dollar weakens, people will need more US dollars to buy a barrel of crude oil. The second factor has a relatively small impact. From a historical perspective, the United States has always been a net importer of crude oil, as the US economy is the world's largest economy and requires a large amount of crude oil to drive the development of the entire country. This has led to an increase in the US trade deficit and an increase in oil prices.

It was not until 2011 that the United States became a net exporter of refined petroleum products. According to the Energy Information and Administration (EIA), the United States' own production can meet 90% of total domestic demand. The new refining technology has broken the pattern of the crude oil market, causing the United States to increase its crude oil exports and reduce imports. This means that the rise in oil prices no longer leads to an increase in the US trade deficit, which is conducive to the development of the US economy. But the US dollar and Canadian dollar are not the only factors that affect oil prices. Factors such as the tense geopolitical situation in the world and the turbulent stock market can all lead to fluctuations in oil prices.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.