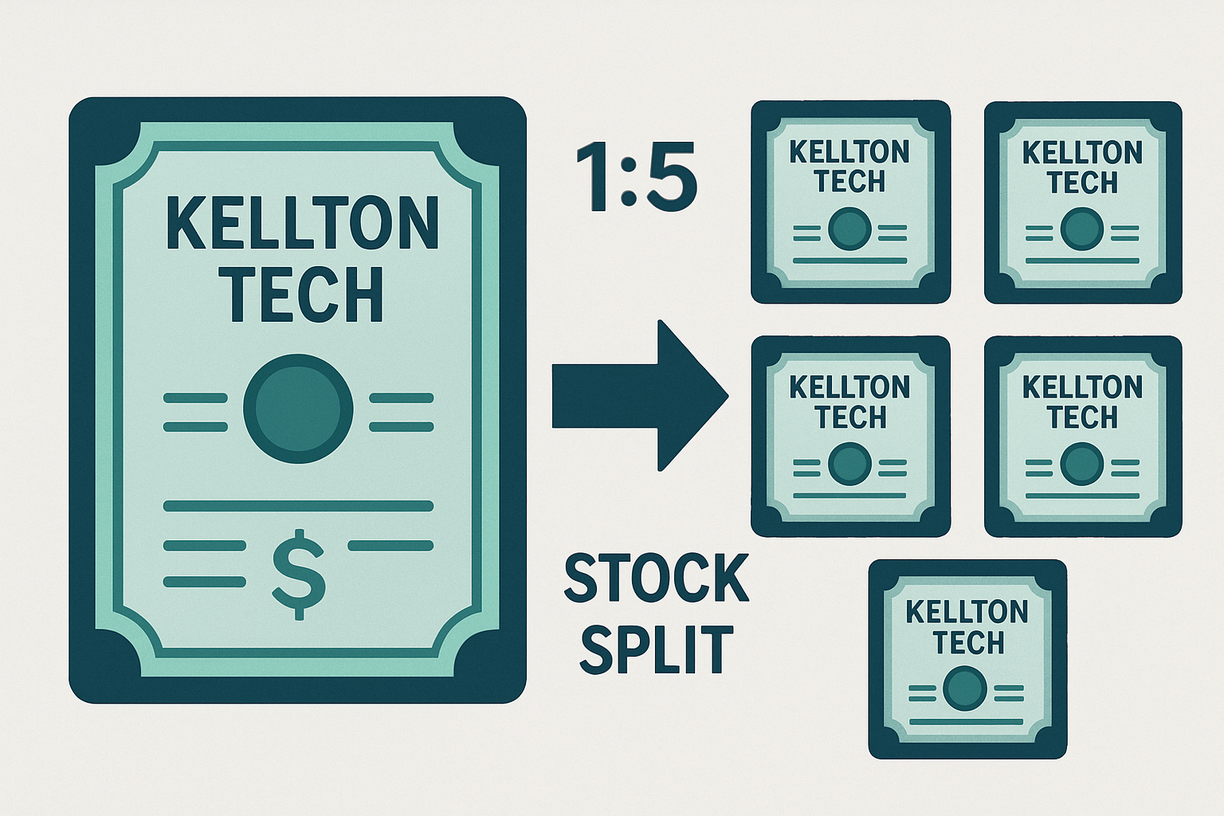

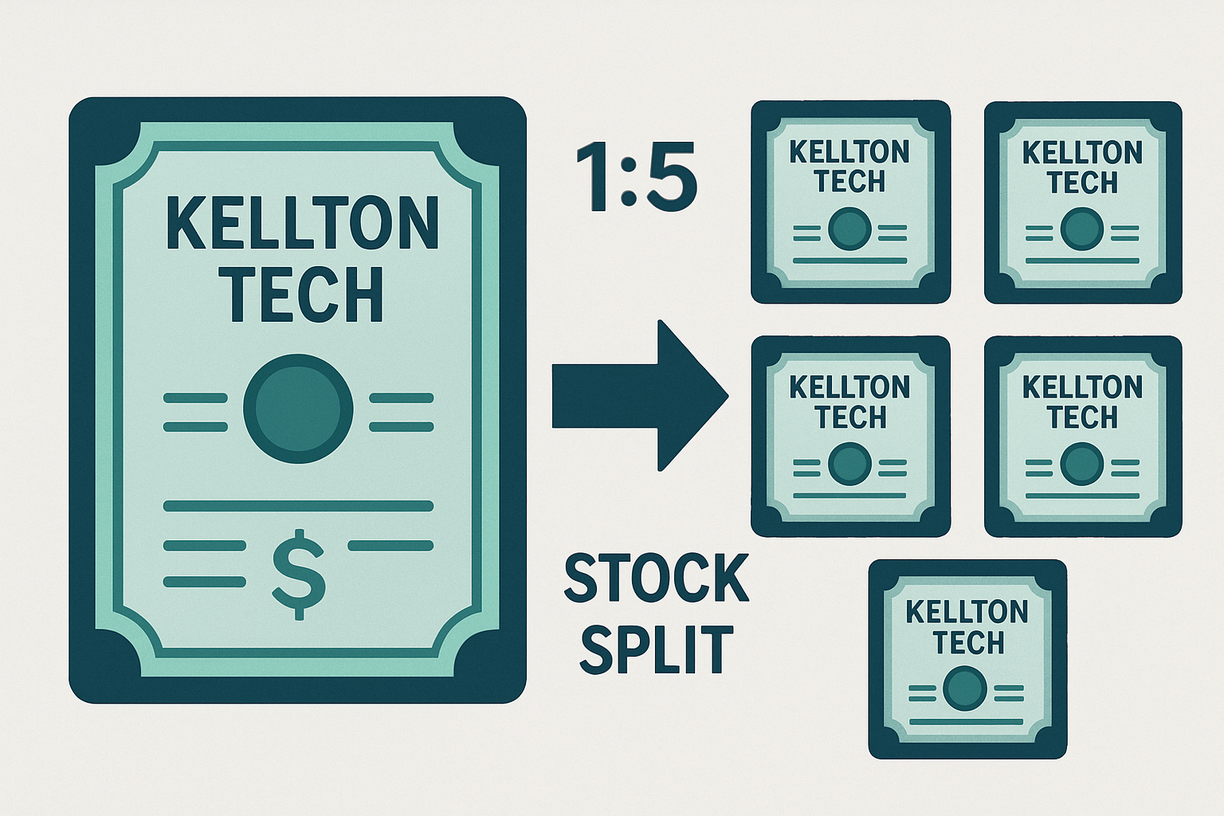

In July 2025, Kellton Tech Solutions Ltd., a small-cap IT services firm in India, announced its first stock split, granting investors 5 shares for every existing share (a 1:5 split, reducing the face value from ₹5 to ₹1).

The announcement and the record date set for July 25 triggered a rapid 6‑10% intraday gain. That begs the question: is this a genuine growth signal or a superficial move to boost market perception?

As of July 23, 2025, the stock trades in the ₹140–145 range, near its 52‑week high of ₹177.50. In this analysis, we'll explore the split's drivers, Kellton's fundamentals, market implications, and whether investors should interpret this as a growth inflexion or potential red flag.

What Is the 1:5 Kellton Tech Stock Split?

Kellton's board approved the split at a June 14 Extra‑Ordinary General Meeting, followed by shareholder approval on July 11. The ex‑date is July 25, 2025.

After the split, existing shareholders will receive five shares for every one share they hold, which keeps the market capitalisation unchanged while reducing the per-share face value and trading price.

The official rationale for the stock split is to enhance liquidity, affordability, and accessibility, which is particularly appealing to retail investors.

It is Kellton's first stock split since the 2:1 in March 2018. It arrives after a remarkable performance, with the stock increasing by over 500% in the last five years.

Financial Performance Snapshot

Q4 FY25 Highlights (March 2025 Quarter)

Revenue: ₹287 crore (+15.5% YoY, +2.9% QoQ)

EBITDA: ₹30 crore, margin of 10.5%

Net Profit: ₹19 crore (down from ₹23.9 crore YoY)

Nine new clients added in the quarter

FY25 Annual Results

Revenue: ₹1,098 crore (+11.7% YoY)

PAT: ₹80 crore (+23.4% YoY)

52‑week stock returns: +54% from low, +577–742% over five years

These figures demonstrate strong growth and improving margins, though there is slight profit softness in Q4.

Immediate Market Reaction

Following the record date announcement, Kellton gained 6‑7%, trading around ₹143–145 on July 16–17, compared to the ₹131 prior close. Analysts identified technical support near ₹135 and resistance around ₹144, suggesting upside to ₹156 post-split.

This swift move suggests retail-driven excitement, but it also raises questions about whether this rally is sustained or purely mechanical.

Kellton Tech Stock Split Rationale: Growth Catalyst or Caveat?

Coinciding with the split, Kellton plans to raise ₹69.3 crore (~$8.5 million) via preferential warrants (55 lakh units at ₹126 each), convertible into equity. It could bolster cash inflows for organic growth or strategic acquisitions, but may also cause dilution for existing shareholders if exercised extensively.

Positive Drivers

Liquidity Boost: A lower per-share price post-split may attract retail investors and improve daily volume.

Psychological Enhancements: Splits can increase perceptions of growth even without underlying changes—an unintended short-term sentiment boost.

Aligns with a Multibagger Image: With strong returns already, a split reinforces momentum and may extend the rally.

Possible Red Flags

No Value Created: Stock splits don't affect fundamentals; market cap remains constant.

Retail Speculation Risk: Retail-driven rallies often reverse after a split once mechanical buying subsides.

Timing Suspicion: When a fundamental lull coincides with a split, it may signal marketing over underlying strength.

If Kellton uses split momentum to raise funds or drive engagement without parallel operations, caution is warranted.

Technical View & Valuation

Stock Chart Analysis

Technical indicators suggest solid support around ₹135, with resistance identified near ₹144–145. The stock, after the 5-for-1 split, may stabilise in the ₹28–30 range when adjusted.

There was a significant increase in trading volume following the news of the split, indicating strong interest from retail investors. However, the sustainability of this interest will depend on solid underlying fundamentals.

Valuation Context

Currently, Kellton is trading at a forward P/E ratio of approximately 15x, which is lower than the mid-teens average of the IT sector (around 28x). Key financial metrics include:

Despite the relatively lower multiples, high growth expectations may support premium valuations if execution remains strong.

Should Investors Buy, Hold or Sell After Kellton Tech Stock Split Announcement?

Buy If:

A believer in Kellton's digital‑AI roadmap, acquisition strategy, and proven growth, particularly if willing to tolerate post-split volatility and participate in small‑cap upside.

Hold If:

You already hold stock; consider trimming small portions after the stock split to secure profits while maintaining upside from growth execution. Monitor Q1 performance closely.

Sell If:

You prefer fundamentals over sentiment-driven rallies, or are wary of potential dilution and retail‑led volatility.

What Investors Should Monitor?

Near Term

Post-split adjusted volume and trading patterns

Q1 FY26 results to see if momentum holds

Execution on warrant conversion and capital deployment

Medium Term

Revenue/margin trajectory over the next two quarters

Acquisitions or partnerships enhancing capabilities

Broader tech market sentiment and sector rotation

As for the red flags to watch, investors must keep an eye on

Sharp retracement after split hype

Warrant conversion diluting EPS if used for general funding

Q1 miss on revenue or margin targets

A downturn in discretionary IT spending could stall growth

Any of these could trigger a 10–20% drop from post-split highs.

Conclusion

In conclusion, Kellton Tech's 1:5 stock split and associated fundraising mark a significant moment in its growth journey. There's real potential: a digitally focused IT player, growing internationally, with improving margins and strategic clarity.

For those who are risk-tolerant and optimistic about niche digital transformation opportunities, you can consider a portfolio allocation of 3–5%. If you prefer investing based on fundamentals, it may be wise to reduce your holdings or monitor the stock after the split and warrant execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.