Gold prices have seen dramatic moves in May 2025, with shifting global trade dynamics, currency strength, and investor sentiment all playing a role.

Whether you're an investor, trader, or simply tracking the market, understanding the latest headlines and the forces moving gold is crucial for making informed decisions. Here's a roundup of the top gold news and market movers this month.

Gold Price Headlines: May 2025

1) Gold Drops Sharply on US-China Tariff Deal

On 12 May, gold prices fell more than 2% as the United States and China announced a temporary deal to reduce tariffs, easing months of trade tensions. Spot gold dropped by 2.6% to $3,237.04 per ounce, while US gold futures declined by 3%.

The agreement saw the US lower tariffs on Chinese goods from 145% to 30%, with China reciprocating by reducing tariffs on US imports from 125% to 10%. This shift boosted global risk sentiment and led investors to move out of safe-haven assets like gold.

2) Dollar Strength and Stock Rally Pressure Gold

The US dollar reached a one-month high following the tariff announcement, making gold more expensive for non-US buyers and further pressuring prices. Global stock markets also rallied, reflecting renewed optimism and a “risk-on” environment that typically weighs on gold demand.

3) Technical Levels and Market Sentiment

Gold's recent decline has seen it breach key technical support levels. On 9 May, prices fell below $3,300, with analysts highlighting the importance of the 21-day Simple Moving Average at $3,307 as a near-term support.

The 14-day Relative Strength Index (RSI) remains above the midline at 55, suggesting some potential for a rebound, but the Stochastics Oscillator at 44 points to a period of consolidation. For bullish momentum to return, gold would need to reclaim the $3,400 level and break above the recent two-week high at $3,435.

4) Market Forecasts: Is the Rally Over?

After a record-breaking surge that saw gold top $3,500 per ounce in April, analysts now expect further declines in May. Technical experts point to an overbought market that has entered a correction phase, with the strengthening US dollar acting as a catalyst for the drop.

The consensus is that gold prices are likely to remain under pressure in the near term, especially if optimism around global trade continues.

What's Moving the Gold Market in May 2025?

1. Global Trade Developments

The US-China tariff deal has been the single biggest driver of gold's recent moves. Easing trade tensions typically reduce demand for safe-haven assets, causing gold prices to fall as investors shift funds into equities and riskier assets.

2. US Dollar Strength

A stronger dollar generally leads to lower gold prices, as gold becomes more expensive for buyers using other currencies. The dollar's rally this month has been a key factor in gold's decline.

3. Central Bank Policies

Central banks in the US, UK, China, and several European countries have kept rates steady or made modest cuts, supporting a mixed outlook for gold. While no immediate US rate cuts are expected, any surprise moves could quickly alter gold's trajectory.

4. Technical Trading and Profit-Taking

After a parabolic rise in early 2025, gold became technically overbought. The recent correction has triggered profit-taking among investors, adding to downward pressure.

5. Geopolitical and Economic Uncertainty

While trade tensions have eased, ongoing concerns about global growth, inflation, and regional conflicts continue to provide a floor for gold prices. Any flare-up in geopolitical risk could quickly reverse the current trend and drive safe-haven demand back up.

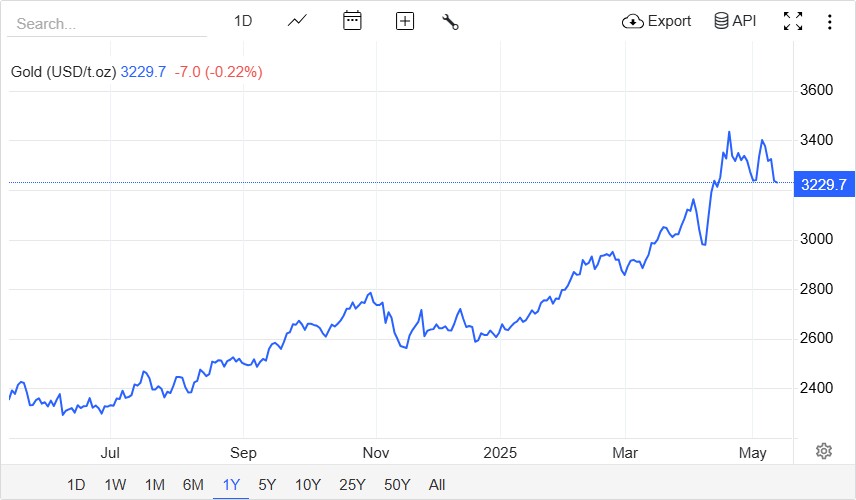

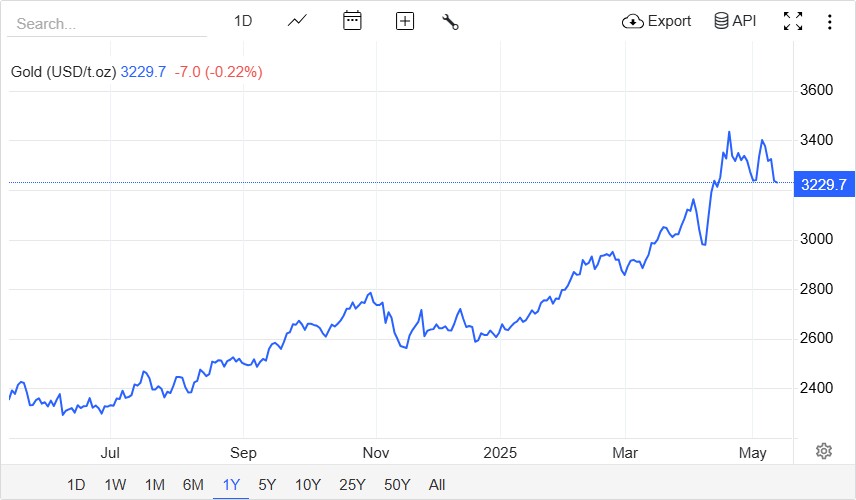

Recent Gold Price Performance

Peak (April 2025): $3,500.05 per ounce

Current (12 May 2025): $3,237.04 per ounce

Recent Support: $3,300 per ounce

Key Resistance: $3,400–$3,435 per ounce

Despite the pullback, gold remains up more than 60% since early 2024, reflecting the metal's strong performance amid previous market turmoil.

Expert Outlook for Gold

Most analysts expect gold to remain volatile in the coming weeks. If optimism around trade deals persists and the dollar stays strong, further declines are likely.

However, if new risks emerge or central banks shift policy unexpectedly, gold could rebound quickly. The long-term trend remains upward, but the short-term correction may not be over yet.

Final Thoughts

Gold's dramatic moves in May 2025 have been driven by easing US-China trade tensions, a stronger dollar, and technical corrections after a historic rally. While prices have pulled back from record highs, the market remains sensitive to global headlines and policy shifts.

For investors and traders, staying alert to these market movers is essential for navigating the gold market in the weeks ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.