Japan’s current account balance logged the fifth straight month of surplus in

June as the trade balance swung to a surplus, government data showed on

Tuesday.

That marked an expansion of about 1 trillion yen from the same month last

year and compared with economists’ median forecast for a surplus of 1.4 trillion

yen in a Reuters poll.

Japan’s balance of trade for June unexpectedly swung to its first surplus

since July 2021, which should ease pressure on the economic recovery and on the

BOJ to tighten further.

Japanese authorities are unlikely to intervene in foreign exchange markets to

prop up the yen as the currency has already found some support and will head

much higher as U.S. interest rates peak, former finance official Eisuke

Sakakibara said.

The yen is poised to reach 130 against the dollar by the year end as the Fed

ends its aggressive monetary tightening and as Japan's economic outlook

brightens, he noted last week.

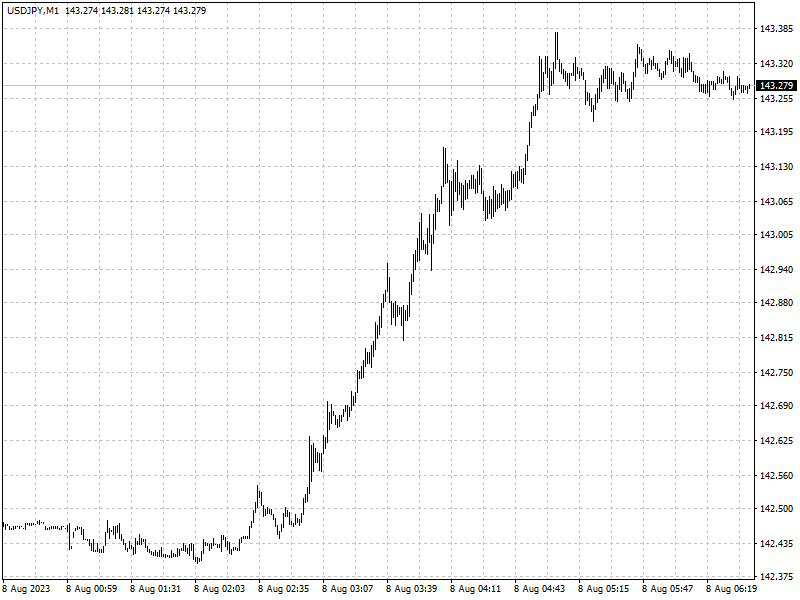

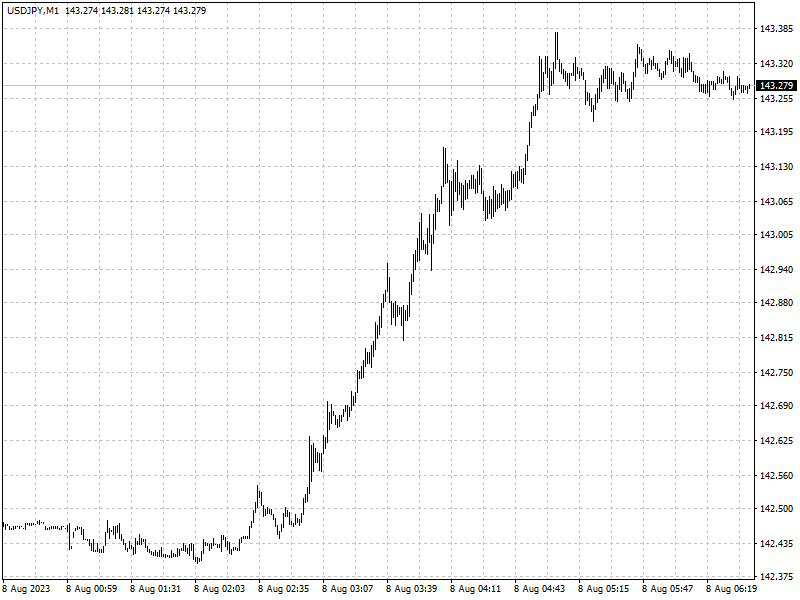

The yen has fallen 7.5% this year but steadied in the past week. It is

trading around 143 and will likely remain range-bound before the U.S. CPI

report.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.