Fitch downgrade rings alarm bells for the dollar

2023-08-09 Summary:

Summary:

Last week Fitch Ratings downgraded billions of dollars worth of public finance credits that are linked to the rating company’s landmark decision to strip US government debt of its AAA status.

White House raged

Last week Fitch Ratings downgraded billions of dollars worth of public finance credits that are linked to the rating company’s landmark decision to strip US government debt of its AAA status.

The rating agency cited its outlook that the country’s finances will likely deteriorate over the next three years given tax cuts, new spending initiatives, economic shocks and repeated political gridlock.

The White House reacted with anger, sending out a release citing pundits calling the decision “off-base”, “absurd” and “widely & correctly ridiculed”.

U.S. Treasury Secretary Janet Yellen called it "entirely unwarranted" because it ignored improvements in governance metrics during the Biden administration and the country's economic strength.

The surprising downgrade came two months after the country narrowly averted default amid political wrangling over the federal borrowing limit.

A wide swathe of assets fell later in the day but the knee-jerk reaction failed to gain more traction. Similarly, S&P’s rating cut in 2011 triggered a selloff in risk assets.

Fitch also expects a recession, putting it at odds with the Fed and a growing proportion of analysts who predict the central bank will succeed in taming inflation and engineer a soft landing.

Market players stay clam

Jamie Dimon, the chief executive of JPMorgan Chase, said Fitch’s downgrade shouldn’t be too concerning about how investors view the country’s ability to pay its debt.

‘It doesn't really matter that much. The markets decide. It's not the rating agencies,’ he said, adding that the U.S. is home to the ‘best economy the world ever seen.’

Big holders of US Treasury Securities aren't going to rush to shed their holdings just because of the downgrade, according to Goldman Sachs.

‘Because Treasury securities are such an important asset class, most investment mandates and regulatory regimes refer to them specifically, rather than AAA-rated government debt.’

‘The vast majority of economists and market analysts looking at this are likely to be equally perplexed by the reasons cited and the timing,’ El-Erian wrote in a post on Twitter. ‘This announcement is much more likely to be dismissed than have a lasting disruptive impact on the U.S. economy and markets.’

‘Treasuries still provide the broad risk off hedge during periods of stress, which ironically, the downgrade may morph into,’ said Marvin Loh, global macro strategist at State Street Corp. ‘When we look at 2011, credit and stocks initially were the most volatile following the S&P downgrade.’

Economists joined a cohort of financial institutions in criticizing Fitch Ratings’ decision. Former Treasury Secretary Larry Summers said while there are reasons for concern about the long-run trajectory of the US deficit, the country’s ability to service its debts wasn’t in doubt.

Insoluble debt problem

The U.S. debt burden will reach 118% of GDP by 2025 — more than 2.5 times higher than the ‘AAA’ median of 39%, according to Fitch, which projects the debt-to-GDP ratio will rise even further in the longer-term.

The federal deficit hit $1.39 trillion for the first nine months of the current fiscal year, up some 170% from the same period the year before, partly due to rising interest rates with the cost of servicing government debt rising by 25% to an 11-year high of $652 billion.

The U.S. Treasury last week boosted its borrowing forecast for the current quarter to $1 trillion, well above the $733 billion it had predicted in May. The country’s fiscal deficit has been growing for years, with little progress over multiple presidential administrations.

UBS said the underlying conditions that led to Fitch’s decision are worse than debt ceiling issue that underlays S&P’s similar move more than a decade ago, citing ‘very large budget deficits.’

The CBO calculates that in the first seven months of the 2023 fiscal year, underlying government revenues are down 10 per cent with spending up 12 per cent. This leaves the federal budget deficit more than three times larger than in the same months of the 2022 fiscal year.

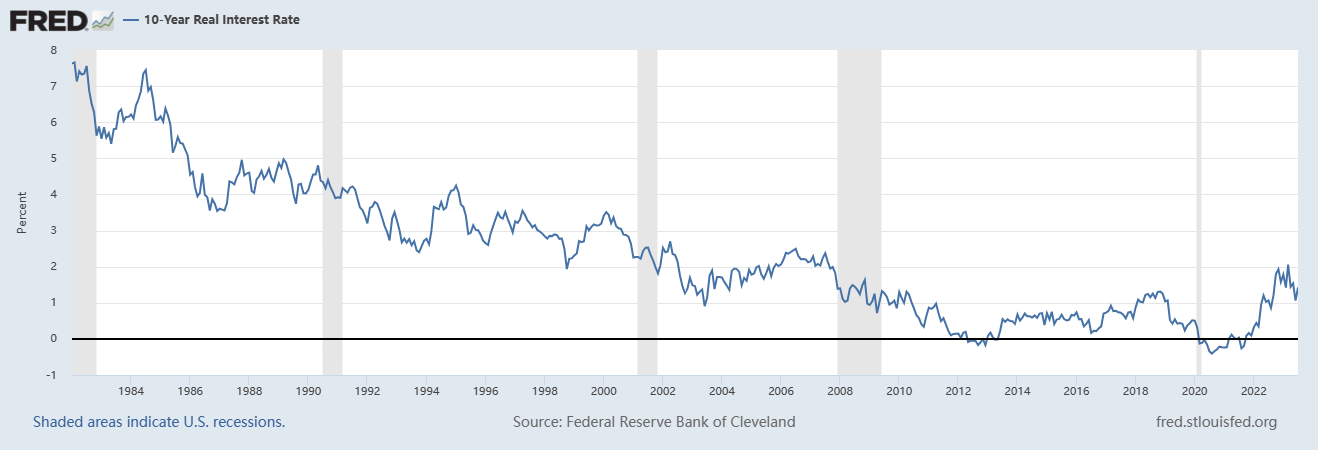

For JPMorgan Chase’s Alexander Wise and Jan Loeys, the ultimate question is where inflation-adjusted rates eventually go as they maintain a forecast that the real U.S. 10-year yield will reach 2.5% over the coming decade.

Billionaire investor Bill Ackman said he is betting against 30-year U.S. Treasurys as a hedge against the impact of long-term rates on stocks.

He argued that if U.S. inflation is 3% in the long term instead of 2%, 30-year Treasury yields could hit 5.5% and it can happen soon.

Interest-only experiment

Economies with the highest credit rating at S&P Global Ratings, Fitch and Moody’s Investors Service include Germany, Denmark, Netherlands, Sweden and Norway. That means investors have a limited pool of AAA-rated sovereign debt to choose from.

While the Treasury securities are still seen as indispensable in a risk-neutral portfolio, the glut of supply will likely weigh on investors’ appetite for the traditional haven on fears that yields could continue to move higher.

The dollar’s share of allocated foreign exchange reserves in 2022 Q4 was 58.4%, according to the IMF. The consistent drop in dollar shares over years have sparked controversy about the dollar’s losing its global dominance.

Most official dollar reserves are invested in Treasury securities, so the dim prospect for the assets may nudge reserve mangers towards other dollar-denominated securities or even a further diversification from the dollar.

The dollar’s narrowing rate advantage over the euro and the BOJ’s potential policy tweak could give another meaningful impetus to de-dollarization process if U.S. inflation remains higher than that in Europe and Japan for a prolonged period.

China, the U.S.’ second-largest creditor, reduced its holdings of U.S. Treasury bonds in May to the lowest level in 13 years, as foreign investors sold for the first time in 4 months.

Still it is not a close call. Tuesday’s $42 billion sale of three-year notes produced a lower-than-expected yield, a sign that demand was stronger than anticipated.

Borrowing without limit steers the U.S. into unchartered territory precariously. Ultimately, it will prove to be calamitous to carry on the interest-only experiment.

The yen was trading around 156 on Monday

Investors await clues on US interest rates as the dollar holds steady. Fed officials are cautious despite weak inflation signals.

2024-05-20

Dollar's biggest 2.5-month fall vs. euro Friday

The dollar weakened versus the euro this week on signs of lower inflation and a softer US economy, raising Fed rate-cut expectations.

2024-05-17

US Dollar Slips to Multi-Month Lows on Thursday

US core inflation hits a 3-year low, causing the dollar to plummet; the Australian dollar also falls from a 4-month peak due to a weak jobs report.

2024-05-16