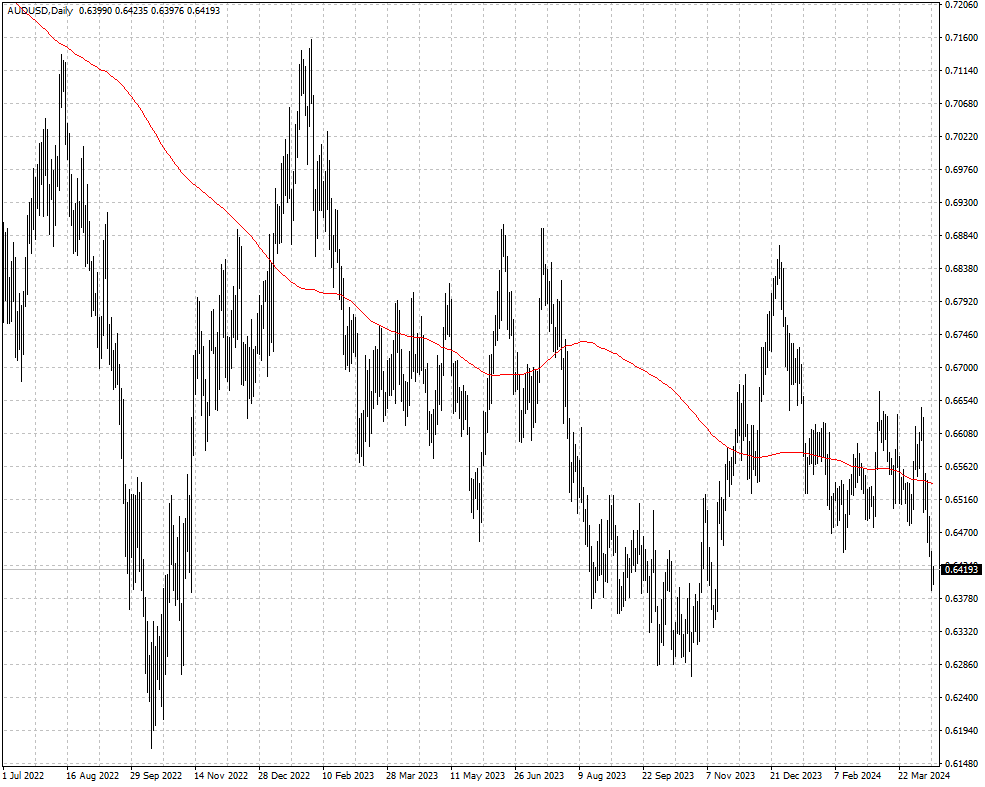

Australian dollar rebounds but concerns linger

2024-04-17 Summary:

Summary:

The Australian dollar has rebounded from a 5-month low against the US dollar. China's Q1 GDP is up 5.3% YoY, boosted by external demand.

The Australian dollar bounced back from a five-month low against the US dollar on Wednesday. China GDP grew 5.3% year-on-year in Q1, driven in part by external demand.

Last week, Morgan Stanley raised its 2024 real GDP forecast for China to 4.8%, from its previous expectation of 4.2%. But embattled real estate sector continued to show weakness.

The country’s property investments falling significantly in the last quarter, which is weighing on its iron ore import and hence the Australian economy which slowed to a crawl in Q4 2023.

Iron prices have staged a moderate rally this month after tumbling below the $100 threshold due to weak demand. Futures traded in Singapore was still down roughly 20% so far.

Falling steel production and emissions controls on highly polluting blast furnaces should shrink Chinese iron ore demand by 1% in 2024 and 2% in subsequent years, according to Capital Economics.

The World Steel Association projects robust global demand growth of 1.7%, while softer exports from India and production issues in Australia and elsewhere mean supply slippages could emerge.

The Australian dollar breached the 200 SMA and the support around 0.6450, bolstering the case of more pains ahead. The next level where buyers could return sits at 0.6330.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Chinese stocks continues to rise despite scepticism

China A50 was flat Friday, aiming for a fourth straight weekly gain. It hit a high since mid-September this week, after underperforming last year.

2024-05-10

Swedish krona remains besieged on dovish rate-setters

The Swedish Krona fell for the third straight day after Riksbank cut its key interest rate. More cuts may follow if price pressures stay mild.

2024-05-09

Macro shift puts commodity currencies back on track

The rapid post-epidemic recovery spurred a brief commodities bull market. High inflation expected for years will benefit the commodity market.

2024-05-09