The dollar held mostly steady on Thursday

2024-05-09 Summary:

Summary:

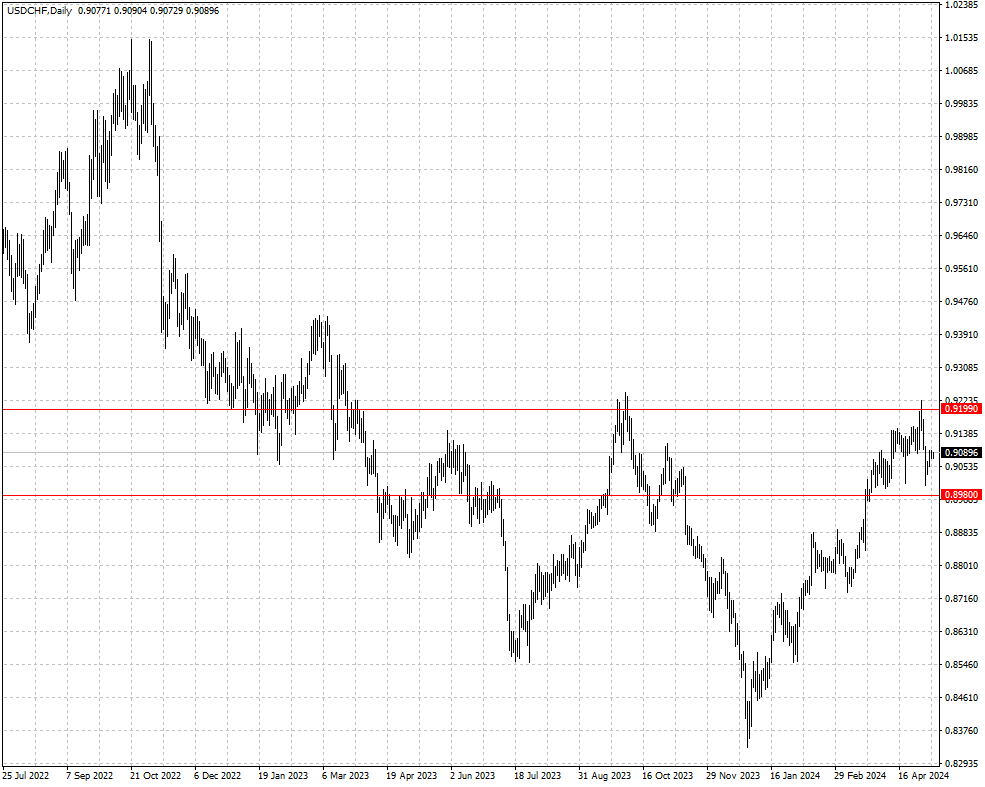

The dollar stayed stable ahead of next week's inflation data. The Swiss franc was strong at 0.9085, reflecting a labor market recovery.

EBC Forex Snapshot, 9 May 2024

The dollar held mostly steady on Thursday as traders kept their powder dry before next week's inflation data, while the Swiss franc traded on a strong note around 0.9085 due to signs of recovery in the labour market.

Switzerland's jobless rate was reported at 2.3% in April, the lowest rate since Dec 2023, the latest data showed on Tuesday. The consumer price index accelerated to 1.4% last month following the SNB's rate cut in March.

Weak US job growth have markets increasing bets for two rate cuts this year. Fed Bank of Boston President Susan Collins said overnight that the US economy needs to cool to return inflation back to target.

| Citi (as of 6 May) | HSBC (as of 9 May) | |||

| support | resistance | support | resistance | |

| EUR/USD | 1.0601 | 1.0885 | 1.0632 | 1.0835 |

| GBP/USD | 1.2300 | 1.2709 | 1.2317 | 1.2654 |

| USD/CHF | 0.8999 | 0.9244 | 0.8980 | 0.9199 |

| AUD/USD | 0.6443 | 0.6668 | 0.6410 | 0.6697 |

| USD/CAD | 1.3478 | 1.3846 | 1.3617 | 1.3813 |

| USD/JPY | 151.86 | 157.68 | 151.54 | 159.72 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The yen was trading around 156 on Monday

Investors await clues on US interest rates as the dollar holds steady. Fed officials are cautious despite weak inflation signals.

2024-05-20

Dollar's biggest 2.5-month fall vs. euro Friday

The dollar weakened versus the euro this week on signs of lower inflation and a softer US economy, raising Fed rate-cut expectations.

2024-05-17

US Dollar Slips to Multi-Month Lows on Thursday

US core inflation hits a 3-year low, causing the dollar to plummet; the Australian dollar also falls from a 4-month peak due to a weak jobs report.

2024-05-16