The dollar edged broadly lower on Thursday

2024-02-22 Summary:

Summary:

The dollar dips as traders await business surveys to assess major economies. The Fed rate cut odds for May at around 30%.

EBC Forex Snapshot, 22 Feb 2024

The dollar edged broadly lower on Thursday as traders awaited a slew of business activity surveys to gauge the health of major economies. Traders are currently pricing in just about a 30% chance of Fed’s rate cuts in May.

Most Fed officials cautioned against cutting rates too quickly at their last policy meeting as they continue to look for convincing evidence that inflation is returning to their 2% target, the latest minutes showed.

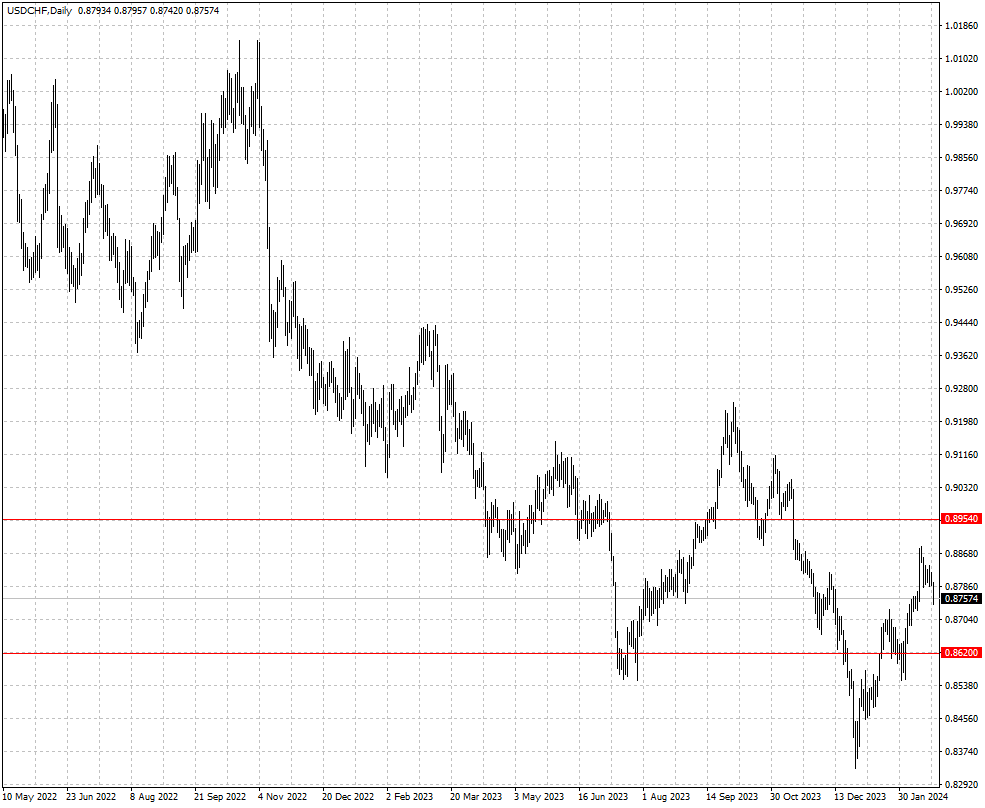

The Swiss franc strengthened to its high within more than a week. The annual inflation fell further to 1.3% in Switzerland last month, paving the way for earlier cuts by the SNB.

| Citi (as of 5 Feb) | HSBC (as of 20 Feb) | |||

| support | resistance | support | resistance | |

| EUR/USD | 1.0724 | 1.1139 | 1.0681 | 1.0885 |

| GBP/USD | 1.2487 | 1.2827 | 1.2481 | 1.2738 |

| USD/CHF | 0.8333 | 0.8728 | 0.8620 | 0.8954 |

| AUD/USD | 0.6500 | 0.6900 | 0.6449 | 0.6618 |

| USD/CAD | 1.3379 | 1.3552 | 1.3372 | 1.3595 |

| USD/JPY | 146.09 | 148.80 | 147.03 | 152.03 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The yen was trading around 156 on Monday

Investors await clues on US interest rates as the dollar holds steady. Fed officials are cautious despite weak inflation signals.

2024-05-20

Dollar's biggest 2.5-month fall vs. euro Friday

The dollar weakened versus the euro this week on signs of lower inflation and a softer US economy, raising Fed rate-cut expectations.

2024-05-17

US Dollar Slips to Multi-Month Lows on Thursday

US core inflation hits a 3-year low, causing the dollar to plummet; the Australian dollar also falls from a 4-month peak due to a weak jobs report.

2024-05-16