Available margin refers to the balance of funds available for trading in your

exchange account. When trading derivatives such as futures, foreign exchange,

and stocks, investors need to pay a certain amount of margin as a trading

security to ensure that they can fulfill their contractual obligations and bear

risks.

Available margin refers to the funds in the account that can be used for new

or additional positions in addition to the frozen margin. When you open or add a

position, the system will automatically deduct the corresponding deposit amount

from your available deposit. Similarly, when you close or reduce your position,

the system will also return the released margin to your available margin, making

it available.

The available margin does not include frozen margin, so if you already hold

some positions, you need to deduct the required margin amount for these

positions in order to obtain the current available margin balance. At the same

time, in order to avoid being forced to close positions, it is recommended that

you always maintain sufficient available margin balances when trading.

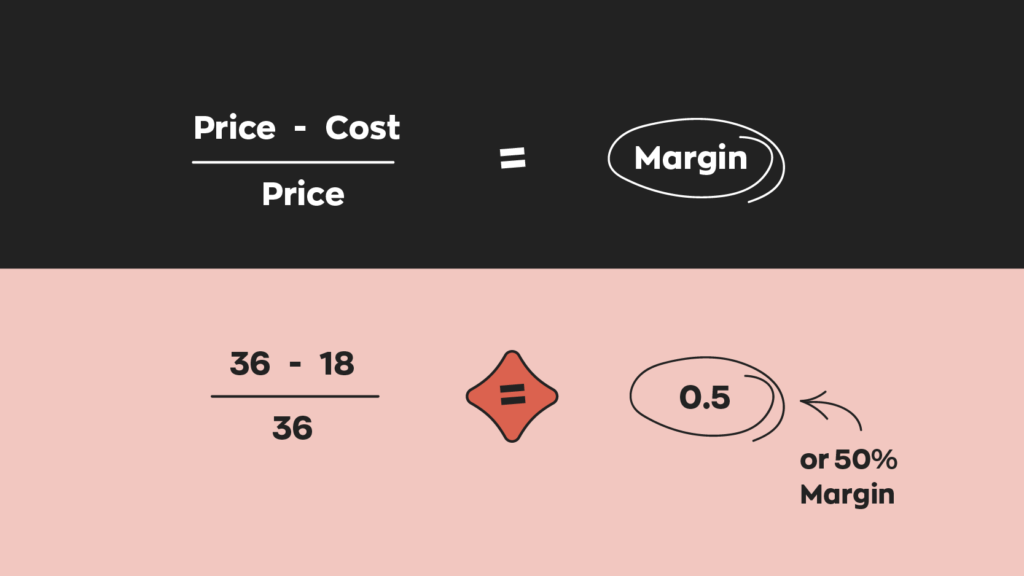

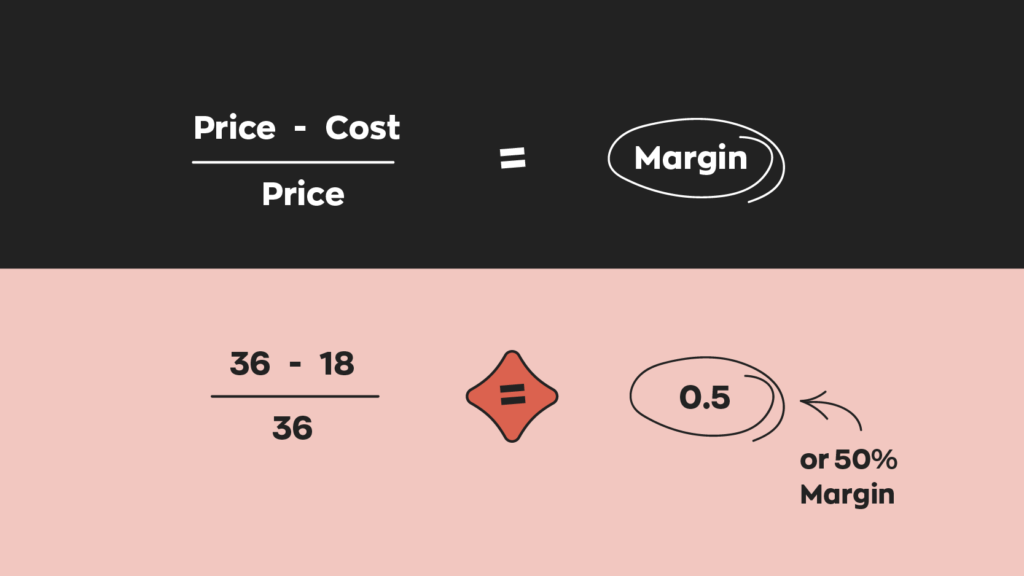

The available margin calculation method is as follows:

Available margin=total account funds; margin required for contracts already

held; margin required for contract orders

Among them,

Total account funds refer to the total balance of your exchange account.

The required margin for contracts that have already been opened refers to the

amount of margin required for contracts that you have already opened.

The required deposit for a contract with a listed order refers to the amount

of deposit required for the contract that you are currently waiting to

complete.

For example, if your total account funds are $10000, the required margin for

open contracts is $2000, and the required margin for open contracts is $500,

then your available margin is $7500 (10000 2000 500 = 7500).

When your available margin falls below the minimum margin requirement set by

the exchange, you will be unable to trade or will be forced to close your

position. Therefore, when conducting transactions, it is recommended that you

maintain sufficient available margin to cope with market fluctuations and

trading risks.