‘British disease’ chips away at sterling strengthens

2023-07-07 Summary:

Summary:

The U.K. has become the only country among the G7 wealthy nations where inflation is still rising, according to data from the OECD.U.K. consumer prices across all items rose to 7.9% in May when compared to the previous year, the OECD said, up slightly from 7.8% in April.

British disease

The U.K. has become the only country among the G7 wealthy nations where inflation is still rising, according to data from the OECD.

U.K. consumer prices across all items rose to 7.9% in May when compared to the previous year, the OECD said, up slightly from 7.8% in April.

Meanwhile, G7’s Inflation rate fell to 4.6% in May, down from 5.4% in April, reaching its lowest level since Sept 2021.

According to the OECD, the U.K. will post annual headline inflation of nearly 7% this year, the highest among all advanced economies.

That, before a critical election in 2024, poses a dire threat to Rishi Sunak who vowed to halve inflation by the end of the year.

Furthermore, the country’s growth has all but stalled and public debt has surpassed 100% of GDP for the first time since March 1961.

The U.K. hit double-digit inflation in the 1990s and was the only developed country with inflation significantly above target in the aftermath of the global financial crisis.

Last month, the BOE hiked interest rates by 50 bps, a larger increase than many expected. Its 13th consecutive rate hike has taken the rate to the highest level since 2008.

Stagflation risk

The kingdom is suffering from a textbook case of stagflation, and the symptoms are clear from the latest labour market trends.

The legacy of the pandemic has affected the supply of labour. Although the number of vacancies has fallen since last summer, it is still well above pre-pandemic levels.

In a recent CNBC-moderated panel at a monetary policy forum in Portugal, BOE’s governor Bailey noted that the U.K. labour force is unique in remaining below its pre-Covid levels.

‘I see this when I go around the country talking to firms. What they say to me very frequently is that their plan is to retain labour as much as they can, even in the event of a downturn, because they’ve been concerned and it’s been difficult to recruit labour.’’

Labour shortages makes it easier for workers to secure higher pay deals. Even so, private sector pay is not keeping pace with price rises, and the resulting squeeze on real incomes is a big factor behind the sluggish state of the economy.

However, Bailey denied that Brexit was the key component in the labour market tightness and sticky inflationary pressures, instead citing the country’s response to the Covid pandemic.

There is a silver lining: food inflation finally begins to cool. Prices rose 14.6 percent in June 2023, down from 15.4 percent in May, according to the British Retail Consortium.

‘If the current situation continues, food inflation should drop to single digits later this year.’ BRC Chief Executive Helen Dickinson told Reuters on 27 June.

Contrarian indicator

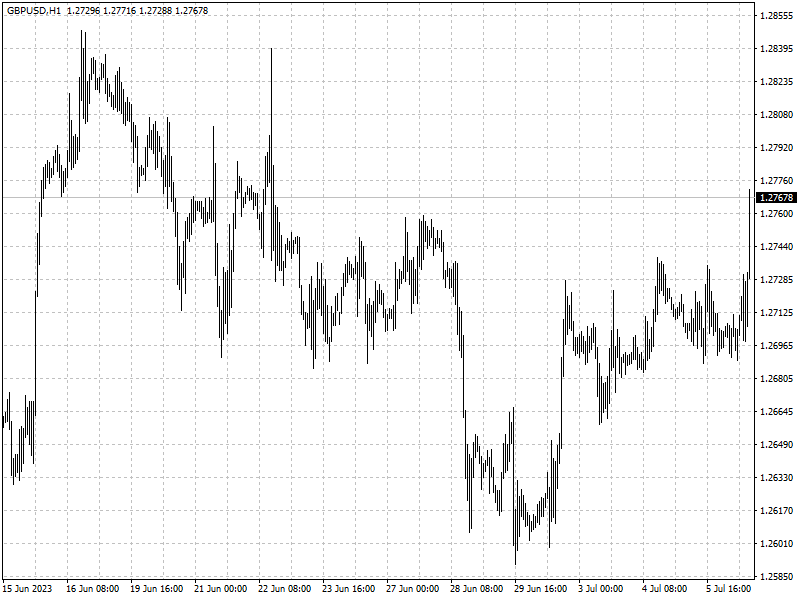

Speculators have boosted bullish wagers on the pound to the highest level for nine years despite recent signs that sterling’s strong rally this year is flagging.

Net long speculative positions on sterling to almost 52,000 contracts for the week ended Tuesday June 27, the highest level since July 2014, according to data from the CFTC.

The currency has fallen by nearly 1 percent since the BoE raised interest rates more than expected on June, upending the typical correlation between higher rates and stronger currencies.

The fact that the BoE is tightening because inflation has been persistently high is a negative for the pound given lacklustre growth, said Paul Robson, a currency strategist at NatWest.

Surging bullish sentiment points to greater risk for traders to be caught in a long squeeze if stagflation does materialise around the corner.

‘In theory we should see a bigger drop because there are more positions that could be scaled back,’ said Francesco Pesole, a currency strategist at ING. ‘We think sterling is quite vulnerable.’

Goldman Sachs is at odds with that view, saying that the pound should strengthen as real rates move higher.

With energy prices declining and the labour market still strong, real incomes are improving, and the BOE is no longer reluctant to raise rates, said the bank.

The yen was trading around 156 on Monday

Investors await clues on US interest rates as the dollar holds steady. Fed officials are cautious despite weak inflation signals.

2024-05-20

Dollar's biggest 2.5-month fall vs. euro Friday

The dollar weakened versus the euro this week on signs of lower inflation and a softer US economy, raising Fed rate-cut expectations.

2024-05-17

US Dollar Slips to Multi-Month Lows on Thursday

US core inflation hits a 3-year low, causing the dollar to plummet; the Australian dollar also falls from a 4-month peak due to a weak jobs report.

2024-05-16